U.S. index futures show slight variation in Monday’s pre-market,

reflecting investor caution ahead of corporate earnings reports.

Expectations for earnings to drive new records are tempered by

uncertainties surrounding elections, Fed decisions, and

geopolitical issues.

As of 05:08 AM, Dow Jones futures (DOWI:DJI) fell 24 points, or

0.06%, while S&P 500 futures rose 0.11%, and Nasdaq-100 futures

advanced 0.17%. The 10-year Treasury yield stood at 4.096%.

In commodities, oil prices fell, nearly erasing last week’s

gains due to China’s inflation decline and lack of clarity on

economic stimulus. Uncertainty raised concerns over oil demand in

the world’s largest importer.

West Texas Intermediate crude for November dropped 2.46% to

$73.70 per barrel, while Brent for December fell 2.39% to $77.15

per barrel.

Western and Chinese investors responded differently to Beijing’s

new stimulus measures. Western investors were disappointed by the

lack of specific figures, while Chinese investors saw government

determination to revive the economy. Divergent movements in

commodity prices, such as copper (CCOM:COPPER) rising 0.3%, reflect

these differing perceptions.

On the U.S. economic agenda today, the spotlight is on Federal

Reserve Governor Christopher Waller’s speech, scheduled for 3

PM.

Asia-Pacific markets closed mixed after Beijing’s stimulus

announcement. China’s CSI 300 rose 1.9%, while Hong Kong’s Hang

Seng dropped 0.9% in the final hour of trading. Australia’s

S&P/ASX 200 gained 0.47%, and South Korea’s Kospi rose over 1%.

Japan’s market was closed.

Goldman Sachs raised China’s 2024 GDP forecast to 4.9%, citing

the government’s recent stimulus measures, which it says reflect

increased focus on boosting the economy.

China’s consumer inflation rose 0.4% in September, slowing from

0.6% in August. Producer price deflation worsened, falling 2.8%,

intensifying from 1.8% the previous month. This increased pressure

on the Chinese government to implement more stimulus measures.

The anticipated Chinese financial stimulus announcement was

vague on details, frustrating investors who had expected more

concrete information. Although the finance minister promised

economic support, specifics on amounts and timelines were absent.

Measures include increased debt issuance, subsidies for low-income

families, support for the real estate market, and recapitalization

of state-owned banks. However, the lack of details could prolong

uncertainty until the next legislative meeting.

Additionally, China urged the European Union not to engage in

separate negotiations over the pricing of Chinese electric vehicles

sold in the EU, warning that it could harm confidence in bilateral

tariff negotiations. Beijing fears such talks could derail broader

trade discussions after Brussels rejected a proposal for a minimum

price to avoid tariffs.

In Japan, Prime Minister Shigeru Ishiba stated he would not

interfere with monetary policy, emphasizing the Bank of Japan’s

(BOJ) independence in pursuing price stability. He highlighted that

consumption is crucial for exiting deflation and advocated for

higher real wages to strengthen the economy.

In Singapore, the central bank left its monetary policy

unchanged as expected. Economic growth accelerated in the third

quarter, with GDP rising 2.1% compared to the previous quarter,

beating expectations. The economy grew 4.1%, and the manufacturing

sector rebounded, expanding 7.5% year-on-year. However, analysts

predict policy easing in 2025 due to external risks. The Monetary

Authority of Singapore will continue monitoring the exchange rate

to control inflation and adjust policy if necessary.

In India, sovereign bonds included in the JPMorgan emerging

markets index saw their first weekly outflow since inclusion, with

foreign investors selling $200 million (16.8 billion rupees). The

selloff was driven by uncertainty over Fed rate cuts and high oil

prices, but the impact remains modest. Avenue

Supermarts, owner of Dmart, shares fell 9.5%, their

biggest drop since 2019, after net profit missed expectations and

concerns grew about competition from online grocers.

In New Zealand, consumer spending fell 0.7% in the third quarter

after a 2.8% drop in the previous quarter, suggesting the economy

may be in recession. The services sector remained in contraction in

September, with the index marking 45.7, reinforcing the Reserve

Bank of New Zealand’s decision to cut rates. Despite a slight sales

increase, new orders stagnated, and employment hit its lowest level

since February 2022.

In Australia, TPG Telecom (ASX:TPG) shares fell

3.9% after agreeing to sell its fiber assets and fixed-line

business to Vocus Group (ASX:VOC) for $3.5 billion

(A$5.25 billion). Vocus will provide fixed-line network services to

TPG as part of the deal. The transaction is expected to close in

the second half of 2025.

China will release its September trade data today, with

expectations of 6% growth in exports and 0.9% growth in imports.

Later this week, China will release third-quarter GDP, industrial

production growth, retail sales, and unemployment rate.

European markets are trading mixed, while investors await data

and rate decisions from the European Central Bank and comments from

the Fed. Additionally, France reopens public debt auctions for

3-month, 6-month, 7-month, and 1-year bonds, and Germany reopens a

1-year public debt auction.

The European Central Bank (ECB) is likely to cut interest rates

this week, despite ruling out such a possibility a month ago. This

quarter-point cut would be the third of the cycle, and economists

expect more reductions to alleviate the impact of high borrowing

costs on the eurozone economy.

In Britain, natural gas production fell 13% through August,

faster than expected, increasing dependence on imports. Offshore

Energies UK warns that this decline may continue in 2024 and is

seeking government support for new investments. Oil production is

also decreasing, exacerbating energy concerns.

In Germany, the Social Democrats (SPD), led by Olaf Scholz, have

proposed tax exemptions and investment support to protect jobs and

attract voters ahead of the 2025 elections. The plan includes tax

breaks for investors, gradual minimum wage increases, and bonuses

for local electric vehicles, aimed at addressing the recession.

Among individual stocks, Spanish state-owned shipbuilder

Navantia is in exclusive talks to acquire the UK’s Harland

& Wolff (LSE:HARL), according to the Telegraph. The

deal, expected next month, would include the company’s four

shipyards.

Renault (EU:RNO) launched the R4 E-Tech, a

compact electric car made in France designed to compete with

affordable models from Chinese manufacturers like BYD. Priced under

€35,000, the R4 offers a 400 km range and advanced

technologies.

Shares of Emmerson (LSE:EML) plunged 76% after

the company requested clarification on the Moroccan regulatory

review of its Khemisset potash project. The Regional Investment

Commission issued an unfavorable recommendation on environmental

approval, but the company has not yet received formal notification

and is evaluating appeal options.

Mulberry (LSE:MUL) shares jumped 15.6% after

majority shareholder Challice Limited rejected an improved offer

from Frasers Group, which valued the company at $145 million (£111

million).

Shares of Ashmore Group (LSE:ASHM) rose over 5%

after reporting a larger-than-expected increase in assets under

management, reaching $51.8 billion in the fiscal first quarter of

2025.

Entain and Flutter shares fell on Monday after reports that the

UK may increase taxes on online casinos and bookmakers.

Entain (LSE:ENT) dropped 13.4% and

Flutter (LSE:FLTR) 7.6%, with speculation that

these taxes could double, possibly in the next budget.

LondonMetric Property (LSE:LMP) reported that

its recent transactions have increased rental income by $11.1

million (£8.5 million) for the fiscal year so far. Additionally,

139 rent reviews resulted in an extra £5.7 million, with a 17%

increase over five years, and urban logistics generated 25%

growth.

LVMH (EU:MC) investors are hopeful that China’s

new stimulus measures will reignite Chinese consumer spending,

boosting luxury sales ahead of Singles’ Day. With LVMH set to

report quarterly revenue soon, uncertainty looms due to a slowdown

in the Chinese market. If consumer confidence improves, spending

may rebound significantly.

On Friday, the market saw a sharp rebound, with the Dow Jones

rising 1.0% to close at 42,863.86 points, the S&P 500 up 0.6%,

and the Nasdaq growing 0.3%. Optimism was driven by a report of

stable producer prices in September, reinforcing expectations of a

Federal Reserve rate cut. Tesla (NASDAQ:TSLA)

shares fell 8.8%, limiting Nasdaq’s gains. The transportation and

brokerage sectors also performed strongly.

The first-quarter earnings from major U.S. banks indicated a

stable economy, with consumer spending holding up but loan demand

still weak due to high-interest rates. Bank stocks like

Wells Fargo (NYSE:WFC) and

JPMorgan (BOV:JPM) saw significant gains: despite

falling profits, results exceeded analysts’ expectations of a

steeper decline.

After the market closes, Karooooo Ltd.

(NASDAQ:KARO) is expected to report its quarterly results.

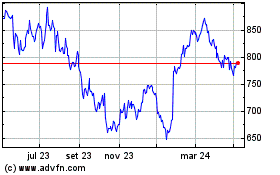

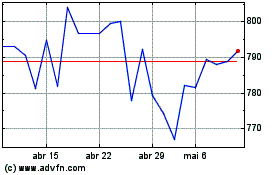

Lvmh Moet Hennessy Louis... (EU:MC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Lvmh Moet Hennessy Louis... (EU:MC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024