Futures Pointing To Initial Weakness On Wall Street

23 Outubro 2024 - 10:08AM

IH Market News

The major U.S. index futures are currently pointing to a lower

open on Wednesday, with stocks likely to move back to the downside

after recovering from early weakness to end the previous session

roughly flat.

The downward momentum on Wall Street comes amid a continued

increase by treasury yields, which have moved sharply higher over

the past few sessions.

The ten-year yield has risen to its highest level in almost

three months amid worries the Federal Reserve will lower interest

rates slower than previously anticipated.

After the Fed slashed interest rates by 50 basis points last

month, CME Group’s FedWatch Tool is currently indicating a 91.0

percent chance of just a 25 basis point rate cut next month.

A steep drop by shares of McDonald’s (NYSE:MCD) is likely to

weigh on the Dow, with the fast food giant plunging by 6.8 percent

in pre-market trading.

McDonald’s is under pressure after the Center for Disease

control said a severe E. coli outbreak in Mountain West states has

been linked to the chain’s Quarter Pounders.

Coffee giant Starbucks (NASDAQ:SBUX) is also seeing significant

pre-market weakness after reporting a decrease in fiscal fourth

quarter sales and suspending its guidance for fiscal year 2025.

Meanwhile, shares of AT&T (NYSE:T) are likely to see initial

strength after the telecom giant reported better than expected

third quarter earnings.

After coming under pressure early in the session, stocks

regained ground over the course of the trading day on Tuesday. The

major averages climbed well off their worst levels of the day

before ending the day little changed.

The major averages moved to the downside going into the close,

finishing narrowly mixed. While the Nasdaq rose 33.12 points or 0.2

percent to 18,573.13, the Dow edged down 6.71 points or less than a

tenth of a percent to 42,924.89 and the S&P 500 slipped 2.78

points or 0.1 percent to 5,851.20.

The early weakness on Wall Street partly reflected renewed

concerns about the outlook for interest rates following a recent

surge by U.S. treasury yields.

Treasury yields have moved notably higher in recent days amid

worries about the U.S. fiscal deficit and comments from Federal

Reserve officials hinting at gradual rate cuts.

The subsequent recovery by the markets came even though the

yield on the benchmark ten-year note crept up to a nearly

three-month closing high, as traders remain optimistic about the

economic outlook

A steep drop by shares of Verizon (NYSE:VZ) contributed to the

dip by the Dow, with the telecom giant tumbling by 5.0 percent on

the day.

The slump by Verizon came after the company reported third

quarter earnings that beat analyst estimates but weaker than

expected revenues.

Fellow Dow component 3M (NYSE:MMM) also moved to the downside

even though the industrial conglomerate reported third quarter

earnings that exceeded expectations.

On the other hand, shares of General Motors (NYSE:GM) spiked by

9.8 percent after the auto giant reported better than expected

third quarter results.

Housing stocks moved sharply lower amid concerns about the

outlook for interest rates, resulting in a 3.1 percent plunge by

the Philadelphia Housing Sector Index. The index pulled back

further off the record closing high set last Friday.

Substantial weakness was also visible among computer hardware

stocks, as reflected by the 2.3 percent slump by the NYSE Arca

Computer Hardware Index.

Logitech (NASDAQ:LOGI) helped lead the sector lower, with the

computer accessories maker plummeting by 8.5 percent despite

reporting better than expected fiscal second quarter results.

Telecom and airline stocks also saw notable weakness on the day,

while tobacco and gold stocks showed significant moves to the

upside.

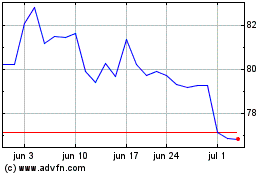

Starbucks (NASDAQ:SBUX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Starbucks (NASDAQ:SBUX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025