Nasdaq, S&P 500 Regain Ground But Dow Extends Losing Streak

24 Outubro 2024 - 5:33PM

IH Market News

Following the steep drop seen during Wednesday’s session, the

major U.S. stock indexes turned in a mixed performance during

trading on Thursday. The Nasdaq and the S&P 500 regained

ground, but the narrower Dow saw further downside to close lower

for the fourth straight day.

The major averages finished the day on opposite sides of the

unchanged line. While the Dow dipped 140.59 points or 0.3 percent

to 42,374.36, the S&P 500 rose 12.44 points or 0.2 percent to

5,809.86 and the Nasdaq climbed 138.83 points or 0.8 percent to

18,415.49.

The rebound by the tech-heavy Nasdaq was partly due to a surge

by shares of Tesla (NASDAQ:TSLA), with the electric vehicle maker

soaring by 21.9 percent.

The spike by Tesla came after the company reported better than

expected third quarter earnings and CEO Elon Musk said his “best

guess” is “vehicle growth” will reach 20 to 30 percent next

year.

Shares of UPS (NYSE:UPS) also saw significant strength after the

delivery giant reported third quarter results that exceeded analyst

estimates on both the top and bottom lines.

On the other hand, a nosedive by shares of IBM (NYSE:IBM)

weighed on the Dow, with the tech giant plunging by 6.2 percent

after reporting weaker than expected third quarter revenues.

Fellow Dow component Honeywell (NASDAQ:HON) also tumbled by 5.1

percent after the conglomerate reported better than expected third

quarter earnings but revenue missed estimates.

Boeing (BA) also moved to the downside after the aerospace

giant’s machinists union rejected a new labor deal, extending a

six-week strike.

Sector News

Most of the major sectors ended the day showing only modest

moves, although substantial weakness was visible among airline

stocks, with the NYSE Arca Airline Index plunging by 3.5

percent.

Southwest Airlines (LUV) led the sector lower, plummeting by 5.6

percent even though the airline reported better than expected third

quarter results.

Gold stocks also showed a substantial move to the downside

despite an increase by the price of the precious metal, dragging

the NYSE Arca Gold Bugs Index down by 2.9 percent.

On the other hand, housing stocks saw considerable strength on

the day, driving the Philadelphia Housing Sector Index up by 1.5

percent.

The strength among housing stocks came after the Commerce

Department released a report showing new home sales surged to their

highest level in over a year in September.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly lower on Thursday. Hong Kong’s Hang Seng Index

tumbled by 1.3 percent and China’s Shanghai Composite Index fell by

0.7 percent, although Japan’s Nikkei 225 Index bucked the downtrend

and inched up by 0.1 percent.

Meanwhile, the major European markets showed modest moves to the

upside on the day. While the German DAX Index rose by 0.3 percent,

the U.K.’s FTSE 100 Index and the French CAC 40 Index both inched

up by 0.1 percent.

In the bond market, treasuries regained ground after moving

notably lower over the past several sessions. Subsequently, the

yield on the benchmark ten-year note, which moves opposite of its

price, fell by 4.2 basis points to 4.200 percent.

Looking Ahead

Trading on Friday may be impacted by reaction to a report on

durable goods orders and a revised reading on consumer

sentiment.

SOURCE: RTTNEWS

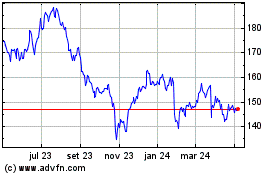

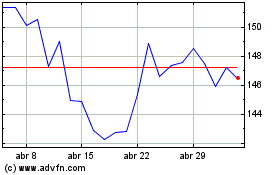

United Parcel Service (NYSE:UPS)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

United Parcel Service (NYSE:UPS)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024