Bargain Hunting, Tesla Earnings May Trigger Rebound On Wall Street

24 Outubro 2024 - 10:06AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Thursday, with stocks likely to regain ground following the

steep drop seen in the previous session.

Traders may look to pick up stocks at somewhat reduced levels

following recent weakness on Wall Street, which has seen the Dow

and the S&P 500 pull back well of last Friday’s record closing

highs.

The tech-heavy Nasdaq is likely to benefit from a surge by

shares of Tesla (TSLA), as the electric vehicle maker is soaring by

14.2 percent in pre-market trading.

The spike by Tesla comes after the company reported better than

expected third quarter earnings and CEO Elon Musk said his “best

guess” is “vehicle growth” will reach 20 to 30 percent next

year.

Shares of UPS (NYSE:UPS) are also seeing significant pre-market

strength after the delivery giant reported third quarter results

that exceeded analyst estimates on both the top and bottom

lines.

On the other hand, a slump by shares of IBM (NYSE:IBM) may limit

any upside for the Dow, with the tech giant tumbling by 3.1 percent

in pre-market trading after reporting weaker than expected third

quarter revenues.

Fellow Dow component Boeing (NYSE:BA) may also come under

pressure after the aerospace giant’s machinists union rejected a

new labor deal, extending a six-week strike.

Nonetheless, the broader markets may benefit from a pullback by

treasury yields, with the yield on the benchmark ten-year note

giving back ground after reaching its highest levels in almost

three months.

Stocks came under pressure early in the session on Wednesday and

saw further downside over the course of the trading day. The major

averages all moved notably lower, with the Dow and the S&P 500

extending their losing streaks to three days.

The major averages climbed off their worst levels late in the

session but remained firmly negative. The Dow slumped 409.94 points

or 1.0 percent to 42,514.95, the Nasdaq tumbled 296.47 points or

1.6 percent to 18,276.65 and the S&P 500 slid 53.78 points or

0.9 percent to 5,797.42.

The weakness on Wall Street came amid a continued increase by

treasury yields, which have moved sharply higher over the past few

sessions.

The yield on the benchmark ten-year note has risen to its

highest level in almost three months amid worries the Federal

Reserve will lower interest rates slower than previously

anticipated.

While the Fed is still widely expected to lower interest rates

by a quarter point next month, there is increasing skepticism about

another rate cut in December.

CME Group’s FedWatch Tool suggests the chances the Fed will

leave rates unchanged in December have jumped to 30.2 percent from

just 13.9 percent a week ago.

A steep drop by shares of McDonald’s (NYSE:MCD) also weighed on

the Dow, with the fast food giant plunging by 5.1 percent.

McDonald’s came under pressure after the Center for Disease

Control said a severe E. coli outbreak in Mountain West states has

been linked to the chain’s Quarter Pounders.

Fellow Dow component Coca-Cola (NYSE:KO) also showed a notable

move to the downside despite reporting better than expected third

quarter results.

Meanwhile, shares of AT&T (NYSE:T) surged after the telecom

giant reported third quarter earnings that exceeded analyst

estimates.

Computer hardware stocks showed a substantial move to the

downside on the day, resulting in a 2.2 percent slump by the NYSE

Arca Computer Hardware Index.

A pullback by the price of gold also contributed to considerable

weakness among gold stocks, as reflected by the 1.8 percent loss

posted by the NYSE Arca Gold Bugs Index.

Oil service stocks also saw significant weakness amid a decrease

by the price of crude oil, dragging the Philadelphia Oil Service

Index down by 1.4 percent.

Steel, biotechnology and semiconductor stocks also showed

notable moves to the downside, while airline stocks bucked the

downtrend.

Spirit Airlines (NYSE:SAVE) led the sector higher, soaring by 46

percent after a report from the Wall Street Journal said Frontier

Airlines is exploring a renewed bid for the budget airline.

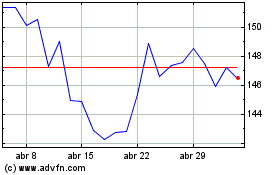

United Parcel Service (NYSE:UPS)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

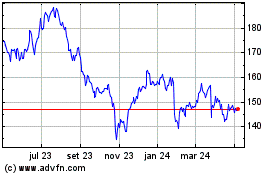

United Parcel Service (NYSE:UPS)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024