Tapestry (NYSE:TPR), Capri

(NYSE:CPRI) – A U.S. judge blocked the $8.5 billion merger between

Tapestry and Capri, favoring the Federal Trade Commission (FTC) and

marking a win for the Biden administration before the elections.

The FTC argued the merger would reduce competition among top U.S.

handbag makers, raising prices. Tapestry’s shares rose 12.4%

pre-market, while Capri’s fell -45.4%.

Apple (NASDAQ:AAPL) – iPhone sales in China

dropped 0.3% in Q3 2024, while Huawei’s rose 42%, intensifying

competition in the Chinese market. Apple held second place with a

15.6% share, while Huawei was third at 15.3%. Vivo, known for more

affordable devices, led with 18.6%. Apple shares fell 1.0%

pre-market.

Alphabet (NASDAQ:GOOGL) – Missouri Attorney

General Andrew Bailey began an investigation into Google over

alleged censorship of conservative speech, an accusation the

company denies. Republicans have long claimed bias against

conservatives on tech platforms, and Donald Trump has promised to

sue Google if he wins the presidential election. Shares rose 0.4%

pre-market.

Microsoft (NASDAQ:MSFT) – Microsoft CEO Satya

Nadella’s compensation rose 63% in 2024, totaling $79.1 million,

mainly driven by stock awards that increased from $39 million to

$71 million. Microsoft’s shares gained around 31.2%, and its

investment in OpenAI bolstered its role in advancing generative AI.

Shares were up 0.4% pre-market.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – TSMC achieved higher initial yields at its Arizona

plant compared to Taiwan, marking a significant step in its U.S.

expansion despite labor challenges. The facility, producing with

4-nanometer technology, supports the Biden administration’s plan to

bolster domestic semiconductor production. Shares rose 1.0%

pre-market.

Tesla (NASDAQ:TSLA) – Tesla shares surged

nearly 22% on Thursday, marking the biggest one-day gain in over a

decade, after Elon Musk forecasted 20%-30% sales growth in 2024 and

reported its highest profit in a decade. This increase raised

Musk’s fortune by $33.5 billion, now totaling $270.3 billion. Musk

promised an affordable vehicle by 2025 and discussed cost

reductions that improved Q3 margins, pleasing investors. Ahead of

the presidential election, Musk donated an additional $56 million

to support Donald Trump and other Republicans, bringing his 2024

campaign contributions to $132 million. His donations include funds

to the America PAC, aimed at increasing voter turnout in crucial

states, and contributions to Republican Senate committees,

enhancing his political influence. Shares dropped 2.3%

pre-market.

Boeing (NYSE:BA) – The White House urged Boeing

and the machinists union to continue negotiations after the

rejection of the latest contract offer. With the strike affecting

737 MAX production, Acting Labor Secretary Julie Su maintains

contact with both sides to facilitate an agreement. The union seeks

a 40% wage increase and the return of pensions. Shares fell 0.1%

pre-market.

Spirit Airlines (NYSE:SAVE) – Spirit Airlines

sold 23 Airbus planes for $519 million, boosting its liquidity by

$225 million through the end of 2025. The sale comes amid talks of

possible bankruptcy to facilitate an acquisition by Frontier after

a merger block with JetBlue. Shares rose 14.1% pre-market.

Wells Fargo (NYSE:WFC) – CEO Charlie Scharf of

Wells Fargo noted the bank could face $2-$3 billion in losses from

commercial real estate loans, though it has reserves for this.

Losses are expected over three to four years, despite a recovering

commercial real estate sector facing reduced office demand. Shares

were up 0.1% pre-market.

Morgan Stanley (NYSE:MS) – Morgan Stanley

announced Ted Pick will succeed James Gorman as CEO and chair, with

Gorman taking on Disney’s board chair role in January. Gorman will

act as an advisor at Morgan Stanley until 2026. This transition

upholds Wall Street’s tradition of consolidating CEO and chair

roles for swift decision-making.

HSBC Holdings Plc (NYSE:HSBC) – HSBC has joined

China’s payment system, facilitating yuan transactions and helping

clients utilize the currency in global trade. With countries and

companies seeking alternatives to the dollar, the yuan is gaining

traction, though its global transaction presence remains minor.

Shares rose 0.8% pre-market.

BlackRock (NYSE:BLK) – BlackRock launched three

new ETFs: iShares Top 20 US Stocks ETF, iShares Nasdaq Top 30

Stocks ETF, and iShares Nasdaq-100 ex Top 30 ETF. Two target the

largest U.S. stocks, and one focuses on smaller companies, catering

to diverse investor profiles. These funds leverage megacaps’

popularity and demand for diversification. The firm manages over

1,400 ETFs, with $4.2 trillion in assets.

Santander (NYSE:SAN) – Santander Chair Ana

Botin announced the bank will have a fully digital U.S. operation

by 2025, offering high-yield savings accounts to fund up to $30

billion in loans and expand its retail sector. Santander, one of

few European banks still in the U.S. market, anticipates a mild

economic recovery and more investment after the U.S. elections.

Shares rose 0.4% pre-market.

Phunware (NASDAQ:PHUN) – Phunware’s shares

closed down 40% on Thursday, the steepest drop since January,

following CEO Mike Snavely’s exit, with Stephen Chen taking over as

interim CEO on October 22. Known for its involvement with Trump’s

campaign and recent AI projects, Phunware saw strong gains in 2024.

Shares were up 12.7% pre-market.

McDonald’s (NYSE:MCD), Yum

Brands (NYSE:YUM) – Colorado resident Eric Stelly sued

McDonald’s after contracting E. coli from a Quarter Pounder linked

to an outbreak causing one death and sickening 50 others. The

lawsuit in Cook County, Illinois, seeks over $50,000 for alleged

food handling negligence. Yum Brands announced it would remove

fresh onions from select Taco Bell, Pizza Hut, and KFC restaurants

as a precaution.

Keurig Dr Pepper (NASDAQ:KDP) – Keurig Dr

Pepper acquired the energy drink brand Ghost, expanding its

portfolio beyond coffee and sodas, for over $1 billion. The deal

involves an initial 60% stake for $990 million, with the remaining

40% to be acquired in 2028, based on Ghost’s 2027 financial

performance. Known for flavors like Sour Patch Kids, Ghost will

remain led by its founders.

Exxon Mobil (NYSE:XOM) – Federal regulators

granted Exxon Mobil and Qatar Energy LNG a three-year extension to

complete the Golden Pass LNG plant, following delays due to the

March bankruptcy of contractor Zachry Holdings. Located at Sabine

Pass, the facility aims to expand U.S. LNG export capacity.

Avangrid (NYSE:AGR), Dominion

Energy (NYSE:D) – Avangrid, part of the Iberdrola Group,

sold its Kitty Hawk North offshore wind lease to Dominion Energy

for $160 million. The deal includes the nearly 40,000-acre site and

related assets. Avangrid retains the Kitty Hawk South lease, with

potential to generate 2.4 gigawatts.

Earnings

Coursera (NYSE:COUR) – Coursera reported Q3

revenue of $176.1 million, beating FactSet’s $174 million estimate,

with a loss per share of 9 cents, better than the forecasted

16-cent loss. However, Coursera revised its 2024 revenue guidance

to $690-$694 million, down from the previous $695-$705 million

range. Shares fell 18.6% pre-market.

Sanofi (NASDAQ:SNY) – French pharmaceutical

company Sanofi saw a 14.4% increase in Q3 operating profit,

reaching €4.6 billion ($5 billion), above the €4 billion forecast,

due to early vaccine sales, which rose 25.5% to €3.8 billion. The

company is also nearing a sale of 50% of its consumer division,

valued at €16 billion, to focus on new drugs. Shares rose 2.7%

pre-market.

Vale (NYSE:VALE) – Vale reported a 15% drop in

Q3 net income due to lower iron ore prices and provisions linked to

the Mariana disaster. Nonetheless, net income was $2.41 billion,

surpassing expectations of $1.65 billion. Net revenue fell 10% to

$9.55 billion. EBITDA dropped 18% YoY to $3.62 billion but was

above projections. Shares rose 1.1% pre-market.

Televisa (NYSE:TV) – Televisa CEO Emilio

Azcarraga entered “administrative leave” as he awaits results from

a U.S. Department of Justice investigation into alleged bribes for

securing World Cup rights. Televisa, which agreed to a $95 million

investor lawsuit settlement, reported $33.85 million Q3 profit,

bolstered by its Univision partnership, although total revenue fell

6% to $780 million, mainly due to SKY unit losses.

Capital One (NYSE:COF) – Capital One reported a

1.6% increase in Q3 net income, aided by high-interest rates

boosting credit card debt revenue. Total net revenue rose 7% to $10

billion, while net interest income rose nearly 9% to $8.1 billion.

Adjusted net income reached $1.73 billion, or $4.51 per share, with

delinquency rising to 3.27%.

L3Harris (NYSE:LHX) – In Q3, L3Harris reported

adjusted EPS of $3.34 and sales of $5.29 billion, both slightly

above analyst estimates. L3Harris raised its 2024 EPS and revenue

guidance, driven by strong demand for weapons and defense spending

amid rising global tensions. It now expects adjusted EPS of

$12.95-$13.15, with revenue of $21.1-$21.3 billion.

Deckers Outdoor (NYSE:DECK) – Deckers Outdoor

exceeded Q2 expectations and raised its annual sales forecast due

to high demand for UGG and Hoka brands. Net sales rose 20% to $1.31

billion, and adjusted EPS was $1.59, surpassing the $1.20 billion

and $1.23 estimates. Gross margin increased to 55.9%. Deckers now

projects a 12% sales growth, reaching $4.8 billion annually. Shares

rose 14.7% pre-market.

Dexcom (NASDAQ:DXCM) – Dexcom reported adjusted

EPS of 45 cents, beating the 43-cent estimate, with revenue of $994

million, slightly above the $990 million projection. Annual revenue

grew 2%, though U.S. market sales fell 2%. Dexcom maintained its

annual revenue guidance of $4-$4.05 billion. Shares fell 7.0%

pre-market.

Western Digital (NASDAQ:WDC) – Western Digital

posted adjusted EPS of $1.78, above the $1.71 forecast, with

revenue at $1.10 billion, slightly below the $1.11 billion

estimate. Cloud revenue, comprising 54% of the total, rose 153%

year-over-year. Next quarter’s guidance includes EPS of $1.75-$2.05

and revenue of $4.20-$4.40 billion. Shares rose 10.6%

pre-market.

Skechers (NYSE:SKX) – Skechers reported Q3

sales of $2.35 billion, up 15.9% year-over-year, with diluted EPS

of $1.26. For Q4, it projects sales of $2.165-$2.215 billion and

EPS of $0.70-$0.75. In 2024, it expects sales of $8.925-$8.975

billion, with EPS of $4.20-$4.25.

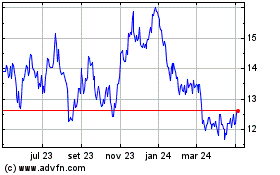

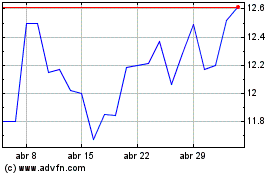

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025