Philips (NYSE:PHG) – In the third quarter,

Philips recorded €4.4 billion in sales, a 2% annual decline, though

net income doubled to €181 million, and diluted earnings per share

rose from €0.09 to €0.19. Adjusted EBITA increased to €516 million,

up from €456 million the previous year, reflecting higher margins

and a focus on productivity. Philips lowered its annual sales

forecast due to declining demand in China, impacting orders by 2%

in Q3. Now, it expects sales growth of 0.5% to 1.5%, down from the

previous forecast of 3% to 5%, with an adjusted EBITA margin of

11.5%. Shares dropped 16.4% pre-market.

BP plc (NYSE:BP) – Italy’s Eni and the UK’s BP

resumed oil exploration activities in Libya after a hiatus since

2014. The Libyan National Oil Corporation (NOC) reported that Eni

began drilling in the Ghadames Basin region on Saturday. BP shares

fell 1.5% in pre-market trading.

Alibaba (NYSE:BABA) – Alibaba agreed to pay

$433.5 million to settle a U.S. class-action lawsuit filed by

investors alleging monopolistic practices. The company denied

wrongdoing, stating the settlement was to avoid higher costs and

disputes. The proposal still awaits court approval in the New York

District Court. Shares rose 2.2% in pre-market trading.

Alphabet (NASDAQ:GOOGL) – Google is developing

AI technology, known as Project Jarvis, which could autonomously

perform navigation tasks such as searching and shopping. A

demonstration is planned for December alongside the launch of the

Gemini language model. Microsoft and Anthropic are also exploring

autonomous agents that interact directly with browsers and

computers. Additionally, Alphabet’s autonomous driving unit, Waymo,

secured $5.6 billion in its largest funding round, led by Alphabet

with contributions from Andreessen Horowitz, Fidelity, and T. Rowe

Price. Offering robotaxi services in cities like San Francisco and

Phoenix, Waymo recently partnered with Uber to expand operations.

Shares rose 1.4% in pre-market trading.

Apple (NASDAQ:AAPL), Masimo

(NASDAQ:MASI) – Apple convinced a federal jury that older versions

of Masimo’s smartwatches infringed two of Apple’s design patents.

Despite the win, the jury awarded only $250 in damages, but Apple

seeks an injunction to block Masimo’s current sales. The jury,

however, concluded that Masimo’s current models do not infringe

Apple’s patents, which the company sees as a win.

Apple (NASDAQ:AAPL) – Apple is expanding into

digital health. The company tested an app with employees to help

pre-diabetics monitor diet and lifestyle adjustments to prevent

diabetes. Though no release is planned, the technology could

integrate a non-invasive glucose tracker. Additionally, Indonesia

blocked sales of the new iPhone 16, as Apple failed to meet the 40%

local content requirement, mandating 40% of product value come from

local components, production, or services. Apple invested $95

million in Indonesia, prioritizing developer academies over local

factories, unlike competitors like Samsung and Xiaomi. Shares rose

0.7% in pre-market trading.

Nvidia (NASDAQ:NVDA) – Nvidia briefly surpassed

Apple in market value on Friday, reaching $3.53 trillion, before

closing with a market cap of $3.47 trillion while Apple closed at

$3.52 trillion. This move is driven by increased investments in AI,

while Apple faces declining iPhone sales in China, impacting its

market position. Nvidia shares rose 1.2% pre-market.

Taiwan Semiconductor Manufacturing Company

(NYSE:TSM) – TSMC suspended shipments to Chinese company Sophgo

after one of its branded chips was found in a Huawei AI processor,

which is restricted from accessing certain U.S. technologies. While

Sophgo denies any connection with Huawei, TSMC notified Taiwanese

and U.S. authorities and is investigating. Shares fell 1.8%

pre-market.

BlackBerry (NYSE:BB) – BlackBerry opened its

Asia-Pacific regional cybersecurity headquarters in Kuala Lumpur,

Malaysia. The unit includes sales, marketing, threat research, and

technical support teams. The initiative follows an agreement with

the Malaysian government in November to provide cybersecurity

infrastructure and training. Shares rose 0.4% in pre-market

trading.

CrowdStrike (NASDAQ:CRWD) – Last fall,

CrowdStrike’s CEO George Kurtz reported a $32 million deal with

Carahsoft, reportedly intended for the IRS, boosting the company’s

stock. However, the IRS never purchased the software. The

transaction, although paid for by Carahsoft, raised legal and

accounting questions about transparency and pre-recognition of

revenue, with experts highlighting compliance risks. Shares rose

0.2% pre-market.

Delta Air Lines (NYSE:DAL),

CrowdStrike (NASDAQ:CRWD) – Delta sued

CrowdStrike, claiming a defective software update caused a global

outage in July, resulting in 7,000 canceled flights and impacting

1.3 million passengers, with losses exceeding $500 million.

CrowdStrike denied the allegations, attributing damages to Delta’s

outdated IT infrastructure while apologizing for the incident.

Delta shares rose 2.6%, and CrowdStrike shares rose 1.4%

pre-market.

Boeing (NYSE:BA) – Boeing plans to raise over

$15 billion through a stock and convertible note sale on Monday to

improve its financial standing, affected by a workers’ strike. It

recently recorded a $6 billion loss and obtained a $10 billion loan

from major banks, aiming to maintain its investment grade. Boeing

is also considering selling parts of its space business, including

the Starliner vehicle and International Space Station support

operations, but keeping the Space Launch System division, which

faces technical issues and delays, with losses exceeding $1.8

billion. Shares fell 0.8% pre-market.

Tesla (NASDAQ:TSLA) – A U.S. appeals court

ruled 9-8 that Elon Musk didn’t have to delete a 2018 tweet

suggesting Tesla employees would lose stock options if they

unionized. The court argued that the tweet is protected free speech

under the First Amendment, ordering the NLRB to reassess the

reinstatement of a pro-union employee who was fired. Shares rose

0.2% pre-market.

Ford Motor (NYSE:F) – Ford will release its

third-quarter earnings report after the market closes. Estimates

predict earnings of 46 cents per share on revenue of $45.1 billion,

compared to last year’s 39 cents per share on revenue of $43.8

billion. Shares rose 0.7% in pre-market trading.

Toyota Motor (NYSE:TM),

Hyundai (KOSPI:005380) – Toyota and Hyundai’s

presidents, Akio Toyoda and Euisun Chung, joined together at an

event in South Korea, highlighting the collaboration of the two

largest Asian automakers in the transition to electric vehicles.

The festival showcased advanced models and hydrogen-powered cars,

reflecting their unity in facing increasing competition in the

automotive sector. Toyota shares rose 2.4% pre-market.

Hawaiian Electric (NYSE:HE) – Ken Griffin’s

Citadel and related funds acquired a stake in Hawaiian Electric

Industries. Griffin now owns about 8.9 million shares, representing

5.4% of the company’s total, according to regulatory filings.

McDonald’s (NYSE:MCD) – McDonald’s ruled out

beef as the source of the E. coli outbreak linked to Quarter

Pounder burgers, which caused one death and nearly 75 contamination

cases. Negative tests on meat batches confirmed safety. The chain

removed fresh onions, suspected to be the source, and the Quarter

Pounder will return to restaurants next week. Supplier Taylor Farms

initiated a product recall. By Friday, the number of affected

people rose to 75. Shares rose 1.0% pre-market after closing 3%

lower on Friday.

Blackstone (NYSE:BX), EQT Corp

(NYSE:EQT) – Blackstone is negotiating to buy minority stakes in

EQT Corp’s interstate pipelines for about $3.5 billion. If

completed, the deal will help EQT reduce its debt, which increased

after acquiring Equitrans Midstream. EQT will retain pipeline

operations, while Blackstone will gain stable income and access to

infrastructure assets, such as the controversial Mountain Valley

Pipeline. EQT Corp shares fell 1.3% pre-market.

Capital One (NYSE:COF), Discover

Financial Service (NYSE:DFS) – New York Attorney General

Letitia James is investigating whether Capital One’s proposed $35.3

billion acquisition of Discover violates antitrust laws. James

requested documents from Capital One, alleging that the merger

could negatively impact New York consumers, particularly the most

vulnerable, by concentrating the market and increasing credit card

fees.

HSBC Holdings (NYSE:HSBC) – According to

S&P Global Visible Alpha estimates for the earnings report due

Tuesday, HSBC is expected to report a 3.7% drop in net income to

$5.41 billion in Q3, compared to $5.62 billion the previous year.

Investors are closely watching for updates on cost-cutting,

possible divestitures, and revenue recovery from interest income,

as well as credit costs. Shares rose 1.5% pre-market.

Abercrombie & Fitch (NYSE:ANF) – Former

Abercrombie & Fitch CEO Mike Jeffries pleaded not guilty to

charges of sex trafficking and prostitution. He and two others

allegedly recruited men with modeling career promises, but

prosecutors claim the goal was to satisfy Jeffries’ and his partner

Matthew Smith’s sexual desires. Victims, coerced into using

substances and signing confidentiality agreements, reportedly

suffered abuse. Jeffries is under house arrest, with a hearing

scheduled for December. Shares rose 0.7% pre-market.

Eli Lilly (NYSE:LLY) – Eli Lilly plans to start

selling its weight-loss drug Mounjaro in Hong Kong by year-end,

following approval for the Kwikpen device, also used for type 2

diabetes treatment. Its active ingredient, tirzepatide, positions

Lilly to compete strongly with Novo Nordisk in the growing Asian

obesity drug market. Shares rose 0.6% pre-market.

Home Depot (NYSE:HD) – Led by Lance Allen and

his merchandising team, Home Depot innovated the Halloween market

with the 12-foot skeleton “Skelly,” launched in 2020, which went

viral and boosted sales. With immense popularity on social media,

the company expanded its seasonal portfolio, adding oversized

holiday decorations, solidifying its reputation in festive

decor.

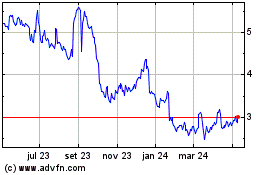

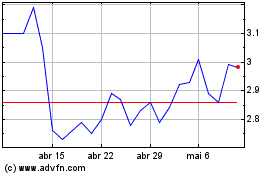

BlackBerry (NYSE:BB)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BlackBerry (NYSE:BB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024