US index futures rose in Monday’s pre-market as investors

awaited major tech earnings, boosting Nasdaq prospects. Optimism

was furthered by easing geopolitical tensions following Israel’s

strikes on Iran, which avoided critical targets. Traders also look

to key economic data this week, including GDP, PCE, and the

September jobs report.

At 5:21 AM, Dow Jones futures (DOWI:DJI) rose 201 points, or

0.47%. S&P 500 futures gained 0.58%, and Nasdaq-100 futures

rose 0.74%. The 10-year Treasury yield stood at 4.27%.

In commodities, West Texas Intermediate crude for December fell

5.61% to $67.75 a barrel, while Brent for December dropped 5.42% to

$71.93.

Oil prices declined as Israel’s strike on Iran targeted military

installations, avoiding nuclear and oil facilities, and didn’t

disrupt energy supplies, easing Middle East tensions. The prospect

of a ceasefire between Israel and Hamas also reduced geopolitical

risk, prompting Citi to cut its Brent forecast to $70.

Gold (PM:XAUUSD) dipped as Israel’s strikes on Iran were less

extensive than anticipated, with the metal trading near $2,732.93

per ounce. Without an immediate response from Tehran, gold’s demand

as a safe haven dropped. Investors now focus on U.S. inflation and

employment data, which could influence Federal Reserve rate

decisions and benefit gold if rates fall.

In Asia-Pacific markets, South Korea’s Kospi rose 1.13%, with

the Kosdaq up 1.8%, recovering from a six-week low. Australia’s

S&P/ASX 200 gained 0.12%, while Hong Kong’s Hang Seng reversed

losses, climbing 0.18% in the final hour of trading.

China’s CSI 300 rose 0.2%, led by steelmakers after the industry

association announced plans to support the sector amid low demand

and reduced profits. Companies like Angang Steel

and Maanshan Iron & Steel saw significant

stock increases amid speculation of consolidation favoring major

state producers in a market affected by the property crisis and

threatened exports.

Moreover, the People’s Bank of China introduced a new reverse

repo tool to inject liquidity and support credit ahead of large

medium-term loan maturities totaling $406.6 billion (2.9 trillion

yuan). The move aims to improve credit availability and modernize

the bank’s monetary policy, aligning it with U.S. and European

standards.

Japan’s Nikkei closed 1.82% higher after Prime Minister Shigeru

Ishiba’s coalition lost its parliamentary majority, raising

political uncertainty. The yen’s decline favored exporters like

Toyota and Nissan, which gained 4% and 3.5%, respectively. Analysts

warn that political instability could limit ambitious economic

policies and raise fiscal concerns.

Bank of Japan Governor Kazuo Ueda highlighted the need to

improve communication with markets after an unexpected rate hike in

July triggered a market decline. According to Reuters, Vice

Governor Himino and other leaders recognize the need for clearer,

more frequent communication to prevent surprises but acknowledge

challenges in unifying messages among bank policymakers.

In Singapore, disinflation remains steady, and economic growth

is expected to last through 2025, with the central bank projecting

core inflation at 2% this year and between 1.5% and 2.5% by 2025.

Risks include trade tensions and a slowdown in China, potentially

affecting recovery and raising prices.

European markets opened higher on Monday as investors cautiously

assessed the Middle East crisis, with most sectors performing

positively. Philips (EU:PHIA) shares, however,

plummeted after revising its annual forecast downwards due to

weaker demand in China.

In other highlights, online trading platform

Plus500 (LSE:PLUS) expects its revenue and EBITDA

to reach $724.5 million and $338.3 million, respectively. In Q3,

EBITDA rose 2% to $82.2 million, with revenue growing 11% to $187.3

million.

The UK’s Financial Conduct Authority fined Wise

(LSE:WISE) CEO Kristo Kaarmann $453,705 for tax defaults in fiscal

year 2017-18. Although the fine followed an investigation, it

didn’t question Kaarmann’s integrity in leading Wise.

UK-based rail ticketing company Trainline

(LSE:TRN) again raised its 2023 forecast, now expecting revenue

growth between 11% and 13%, up from the prior 7%-11% range, and

adjusted EBITDA at 2.6% of net ticket sales.

On Friday, U.S. stock indices had mixed performance. The Nasdaq

rose 0.6%, while the Dow fell for the fifth consecutive session,

reflecting rate concerns. The Dow Jones dropped 0.6% on Friday,

marking a weekly loss of 2.7%. The S&P 500 had a slight

1.74-point decline for a weekly decrease of 1.0%. The Nasdaq

achieved a seventh consecutive week of gains, though the Dow and

S&P closed six-week positive streaks.

Initial optimism waned as Treasury yields rose. In economic

data, the consumer confidence index climbed to 70.5, the highest

since April, as markets await upcoming employment reports and major

earnings.

On the quarterly earnings front, reports are expected from

Onsemi (NASDAQ:ON), Philips (NYSE:PHG), Cemex (NYSE:CX), CenterPoint

Energy (NYSE:CNP), Procept

Biorobotics (NASDAQ:PRCT), Acadia Realty

Trust (NYSE:AKR), Bank of

Marin (NASDAQ:BMRC), Bank of

Hawaii (NYSE:BOH), SJW

Group (NYSE:SJW) and Alliance Resource

Partners (NASDAQ:ARLP) before the opening.

After the close, earnings from

Ford (NYSE:F), TransMedics (NASDAQ:TMDX), Cadence

Design Systems (NASDAQ:CDNS), Waste

Management (NYSE:WM), Rambus (NASDAQ:RMBS), VF

Corporation (NYSE:VFC), F5

Networks (NASDAQ:FFIV), Brown &

Brown (NYSE:BRO), Amkor

Technology (NASDAQ:AMKR) and Ultra Clean

Holdings (NASDAQ:UCTT) are anticipated.

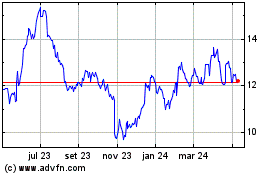

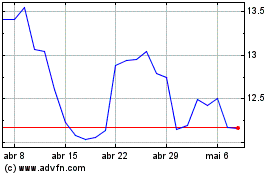

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Set 2024 até Out 2024

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024