HSBC Holdings (NYSE:HSBC) – In the third

quarter, HSBC reported a profit of $8.5 billion, surpassing

projections of $7.6 billion. Revenue rose 5% to $17 billion,

especially in the FX, global debt, and wealth sectors. The bank

also announced an additional $3 billion share buyback, and the

interim dividend was set at $0.10 per share. Shares rose 3.9% in

pre-market trading.

Boot Barn (NYSE:BOOT), Ross

Stores (NASDAQ:ROST) – Boot Barn announced that CEO Jim

Conroy will leave his position in November to lead Ross Stores,

with John Hazen taking over as interim CEO. Boot Barn reported a

13.7% increase in revenue in the second quarter, reaching $425.8

million, exceeding the estimate of $424 million. Net income was

$29.4 million, or $0.95 per share, above the expected $0.94. For

fiscal 2025, the company projects revenue between $1.874 and $1.907

billion, and earnings per share of $5.30 to $5.60, both above the

previous forecast. Boot Barn’s shares fell 4.2% in pre-market

trading.

TransMedics (NASDAQ:TMDX) – The transplant

technology company reported revenue of $108.76 million, below

estimates of $115 million, and earnings per share of $0.12,

compared to the expected $0.30. Total revenue increased 64%

year-over-year, driven by expanded use of the Organ Care System and

logistics services. Annual revenue guidance remains between $425

million and $445 million, while Wall Street estimates $444.36

million. Shares dropped 23.7% in pre-market trading.

VF Corporation (NYSE:VFC) – The apparel brand

posted a profit after two quarters of losses, exceeding sales

estimates with revenue of $2.76 billion (above the expected $2.71

billion). Adjusted earnings were $0.60 per share, beating the

projected $0.37. Gross margin expanded to 52.2%, benefiting from

inventory clearance and growth in China, the Americas, and EMEA.

Shares rose 21.9% in pre-market trading.

Santander (NYSE:SAN) – Santander reported net

income of $3.5 billion (€3.25 billion) in the third quarter, up 12%

annually, exceeding estimates of €3.1 billion, driven by strong

retail performance and lower loan-loss provisions. Earnings per

share increased to €0.20, an 18% year-over-year rise, while total

revenue reached €15.1 billion. The UK unit faced a delay in

publishing results due to a court decision, but the bank expects no

significant financial impacts from this issue. Shares fell 3.4% in

pre-market trading.

Ford Motor (NYSE:F) – Ford Motor exceeded Wall

Street expectations, reporting adjusted earnings per share of $0.49

(versus the expected $0.47) and automotive revenue of $43.07

billion, above the $41.88 billion forecast. With adjusted EBIT of

$2.55 billion, the company adjusted its profit forecast to the

lower end of $10 billion for 2024, maintaining free cash flow

between $7.5 billion and $8.5 billion. Shares fell 6.1% in

pre-market trading.

BP Plc (NYSE:BP) – BP reported adjusted net

income of $2.27 billion in the third quarter, exceeding analyst

estimates, and maintained share buybacks at $1.75 billion. However,

with the impact of lower oil prices, net debt increased to $24.27

billion. The company plans to maintain buybacks until 2025 but will

review its strategy in February. Shares fell 1.0% in pre-market

trading.

Cadence Design Systems (NASDAQ:CDNS) – The

electronic design software company reported adjusted earnings of

$1.64 per share, above the forecast of $1.44, and revenue of $1.22

billion, exceeding the estimate of $1.18 billion. Revenue grew 19%,

and earnings rose 30% year-over-year, driven by strong results in

the IP, SD&A, and AI portfolios. For the fourth quarter,

Cadence projected adjusted earnings of $1.81 per share and revenue

of $1.35 billion, below analyst estimates of $1.98 per share and

$1.38 billion. Shares rose 5.9% in pre-market trading.

Waste Management (NYSE:WM) – The sustainable

waste solutions company exceeded expectations with revenue of $5.6

billion, above the projected $5.5 billion. Net income reached $760

million, reflecting gains in efficiency and cost control. Earnings

per share (EPS) were $1.88, while operational EBITDA reached $1.7

billion, with a margin of 29.9%, demonstrating strong cash

generation capacity to sustain new investments and shareholder

returns.

Rambus (NASDAQ:RMBS) – The semiconductor

innovation company reported net income of $48.7 million, equivalent

to $0.45 per share. Revenue reached $145.5 million. Excluding

one-time items, adjusted earnings were $0.50 per share.

F5 Networks (NASDAQ:FFIV) – The digital

security and applications company exceeded expectations with

adjusted earnings of $3.67 per share (estimate of $3.45) and

revenue of $746.67 million (above the projected $730.39 million),

an annual increase of 5.6%. Software revenue grew 19%. The company

projects revenue growth of 4% to 5% for 2025 and launched a new $1

billion share buyback program.

Brown & Brown (NYSE:BRO) – The insurance

and consulting company reported revenue of $1.2 billion, an 11%

year-over-year increase, exceeding the estimate of $1.165 billion.

Net income rose 33% year-over-year to $234 million, with GAAP EPS

of $0.81, 30.6% higher than the previous year, and above analysts’

expected $0.77.

Amkor Technology (NASDAQ:AMKR) – The

semiconductor packaging company reported EPS of $0.49, slightly

below the expectation of $0.50, and revenue of $1.86 billion,

surpassing the estimate of $1.84 billion. For the fourth quarter,

it projects EPS between $0.28 and $0.44, below the consensus of

$0.57, and revenue between $1.6 billion and $1.7 billion, also

below estimates. Shares fell 12.2% in pre-market trading.

Ultra Clean Holdings (NASDAQ:UCTT) – The

electronic manufacturing solutions company reported a loss of $2.3

million, equivalent to $0.05 per share, while adjusted earnings

were $0.35 per share. Revenue was $540.4 million. For the fourth

quarter, the company projects earnings per share between $0.06 and

$0.26 and revenue between $535 million and $585 million.

Novartis (NYSE:NVS) – Novartis will pay $150

million to Monte Rosa Therapeutics for a global license to develop

and commercialize “molecular glue degraders” — drugs that treat

challenging diseases by degrading problematic proteins. Monte Rosa

may receive up to $2.1 billion in future payments and royalties.

Novartis thus strengthens its portfolio to offset patent losses.

Additionally, the company raised its outlook. In the third quarter,

Novartis reported earnings per share up 18%, reaching $2.06, with

sales growth of 9% to $12.82 billion. Shares fell 3.9% in

pre-market trading.

Corporate Highlights

Apple (NASDAQ:AAPL) – Apple launched the

24-inch iMac with the M4 chip, designed to improve the AI

experience, priced at $1,299. The iMac offers faster speeds and an

enhanced Neural Engine for AI tasks, available in new colors. The

company also introduced Apple Intelligence for iPhones, iPads, and

Macs, integrating advanced AI functions, with a full release

scheduled for December. In India, iPhone exports increased 33% by

September, reflecting its strategy to reduce reliance on China. The

company produced $14 billion worth of iPhones last fiscal year and

exported about $10 billion. Local subsidies and middle-class growth

have driven expansion, with annual sales in India potentially

reaching $33 billion by 2030, according to Bloomberg. Shares fell

0.3% in pre-market trading.

Microsoft (NASDAQ:MSFT) – Microsoft is expected

to announce this week its slowest quarterly growth in a year, as

investors question the return on its large AI investments. While

the company leads sector innovation, adoption of Copilot and other

tools has been slower than anticipated. According to LSEG,

Microsoft’s revenue is expected to grow 14.1%, while capital

spending for the quarter is projected to increase 71.7%, reflecting

costs with AI and cloud. Shares rose 0.1% in pre-market

trading.

Meta Platforms (NASDAQ:META) – Meta is

developing its own search engine to support its AI chatbot,

reducing dependence on Google and Bing, according to The

Information. This engine will retrieve information directly from

the web to provide data on news, sports, and stocks. Additionally,

the Brazilian Institute of Collective Defense has filed a lawsuit

against TikTok, Kwai, and Meta, seeking $525 million for alleged

lack of protection for minors on their platforms. In response, Meta

highlighted the upcoming launch of the “Teen Account” on Instagram,

to restrict content and interactions visible to teens, offering

more safety. Shares rose 0.3% in pre-market trading.

AT&T (NYSE:T), Corning

(NYSE:GLW) – AT&T signed a $1 billion contract with Corning to

acquire fiber solutions and expand its high-speed internet. With

the wireless market slowing down, AT&T is ramping up fiber

investments, aiming to reach over 30 million fiber points by 2025.

AT&T’s shares fell 0.3% in pre-market trading, while Corning’s

shares rose 0.9%.

Amphenol (NYSE:APH), CommScope Holding

Co. (NASDAQ:COMM) – Amphenol issued $1.5 billion in

investment-grade bonds to fund the acquisition of CommScope’s

antenna systems. Most bonds, with a 30-year maturity, will yield

0.95% above Treasuries. The acquisition, valued at $2.1 billion,

strengthens Amphenol’s presence in mobile networks and advanced

technology infrastructure, such as 6G. Shares of Amphenol fell 0.2%

in pre-market trading.

Boeing (NYSE:BA) – Boeing raised $21 billion in

an expanded share sale, helping to bolster its finances and avoid a

potential credit downgrade. The sale included 112.5 million shares

at $143 each and $5 billion in depositary shares. Boeing will use

these funds to maintain its investment-grade status and resume jet

production after stoppages. Shares fell 0.7% in pre-market

trading.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines will face a lawsuit for allegedly intimidating and

illegally disciplining pilots associated with the union. The U.S.

Court of Appeals ruled that the Dallas-based airline showed

sufficient “anti-union sentiment” for the case to proceed.

Southwest disputes the decision and is considering its legal

options.

Polestar (NASDAQ:PSNY) – Polestar stated that a

proposed Biden administration rule to ban Chinese vehicle software

and hardware in the U.S. would halt its sales in the country,

including cars manufactured in South Carolina. Although a Swedish

Volvo brand, Polestar is controlled by China’s Geely, potentially

subjecting it to U.S. national security restrictions, challenging

its operations and investments in the U.S. market. Shares fell 0.7%

in pre-market trading.

Toyota Motor (NYSE:TM) – Toyota and Nippon

Telegraph and Telephone (NTT) will invest $3.26 billion in AI

software research and development to enhance autonomous driving.

The goal is to create a system that anticipates accidents and takes

control of the vehicle, with plans for a 2028 release and

availability to other automakers.

JPMorgan Chase (NYSE:JPM) – JPMorgan Chase has

initiated lawsuits against clients accused of exploiting a

technical glitch to commit check fraud. In August, an issue allowed

high-value check withdrawals before clearing, and some clients

withdrew over $661,000 from fake checks. In four lawsuits, the bank

seeks to recover these funds and is working with authorities to

hold those involved accountable. On Monday, CEO Jamie Dimon

criticized U.S. financial regulations that, according to him, do

not increase banking safety, such as capital rules, open banking,

and card payments. Dimon stated that banks are willing to challenge

these rules in court, arguing that some harm consumers and

low-income workers while threatening banking competitiveness.

Bank of America (NYSE:BAC) – Bank of America

has appointed 30-year company veteran Brian Weinstein to lead the

Global Markets division in the EMEA region. He will also head fixed

income, currency, and commodity trading in the area, pending

regulatory approval. Weinstein will report to Jim DeMare and Bernie

Mensah. Shares fell 0.1% in pre-market trading.

Citigroup (NYSE:C) – Citigroup relocated a

small number of employees from Lebanon to Turkey due to escalating

conflict between Israel and Hezbollah. Beirut, where Citi’s local

office is based, also experienced attacks. Shares fell 0.2% in

pre-market trading.

Goldman Sachs (NYSE:GS) – Goldman Sachs has

opened a new office in Riyadh’s financial district, strengthening

its presence in Saudi Arabia, where it has operated since 2008. The

bank plans to expand its Asset Management and Banking operations in

the region. Additionally, Goldman highlighted that U.S. financial

markets face sharp, temporary increases in overnight lending rates

at the end of each month, driven by the absorption of new Treasury

bonds. These increases, impacting the Secured Overnight Financing

Rate (SOFR), are worsened by banks’ need to meet regulatory

requirements and the Fed’s quantitative tightening, reducing

available liquidity. Shares fell 0.1% in pre-market trading.

Walmart (NYSE:WMT) – Walmart launched a 50%

discount promotion on its annual Walmart Plus subscription service,

now priced at $49 until December 2, aiming to compete with Amazon

Prime, which costs $139 per year. With benefits like fast delivery

and gas discounts, Walmart seeks to attract consumers in a season

marked by tighter spending due to inflation.

McDonald’s (NYSE:MCD) – Analysts are divided on

the long-term sales impact of the recent E. coli outbreak linked to

the Quarter Pounder burger, as the company releases third-quarter

results. The outbreak, which resulted in one death and 75 cases,

led to a 7% drop in the company’s stock. McDonald’s faces weak

demand among low-income consumers, with projected same-store sales

dropping by 0.72% globally in the third quarter and earnings per

share estimated at $3.20. The recent $5 meal offering slightly

boosted traffic, but negative publicity concerns investors. Shares

rose 0.3% in pre-market trading.

Starbucks (NASDAQ:SBUX) – Starbucks informed

its corporate employees they must be in the office three days a

week, or face potential termination starting in January. This

policy, announced in a memo, includes exemptions for disabilities

and excludes vacations, medical leave, and business trips. The move

reflects a trend among major companies enforcing stricter

return-to-office policies, facing resistance from some employees.

Shares rose 0.2% in pre-market trading.

Estée Lauder (NYSE:EL) – Estée Lauder selected

Stéphane de La Faverie as its new CEO, according to the Wall Street

Journal. He will succeed Fabrizio Freda, who will retire but act as

a consultant until 2026. La Faverie, currently the group president,

joined the company in 2013 after working at L’Oréal.

NextEra Energy (NYSE:NEE) – NextEra Energy

announced plans to raise $1.5 billion through the sale of capital

units to fund new projects. Each capital unit, issued at $50,

includes a contract to purchase common shares of NextEra within

three years, with a premium of 0 to 25% over the October 28 closing

price. The offer also includes a stake in long-term debt. Shares

fell 4.2% in pre-market trading.

TotalEnergies (NYSE:TTE) – QatarEnergy acquired

a 50% stake in a 1.25 GW solar project in Iraq, partnering with

TotalEnergies, which holds the remaining half. Part of the

Integrated Gas Growth Project (GGIP), the initiative aims to power

350,000 homes in the Basra region by 2027. Shares rose 0.2% in

pre-market trading.

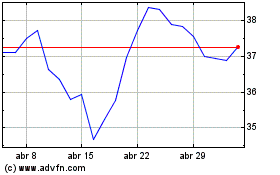

Bank of America (NYSE:BAC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Bank of America (NYSE:BAC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024