Microsoft (NASDAQ:MSFT) – Microsoft exceeded

expectations in the first fiscal quarter with earnings per share of

$3.30 (above the expected $3.10) and revenue of $65.59 billion

(surpassing the estimated $64.51 billion). Microsoft’s Intelligent

Cloud segment reported revenue of $24.09 billion, a 20% increase,

slightly above StreetAccount’s expectation of $24.04 billion.

Despite a 16% year-over-year revenue increase, the moderate growth

forecast for the next quarter and delays in data center

infrastructure affected investor reactions. Shares fell 3.9% in

pre-market trading.

Meta Platforms (NASDAQ:META) – Meta exceeded

expectations with earnings per share of $6.03 (against the

anticipated $5.25) and revenue of $40.59 billion (above the

expected $40.29 billion). Advertising revenue rose 18.7% year over

year. However, the daily active user count of 3.29 billion fell

short of projections. The company raised its capital expenditure

forecast for 2024 and warned about rising infrastructure costs in

2025, particularly in AI. Shares fell 3.6% in pre-market

trading.

Roku (NASDAQ:ROKU) – Roku surpassed

expectations in the third quarter, with revenue of $1.06 billion, a

16% increase, and a loss per share of just 6 cents, compared to the

expected loss of 32 cents. Revenue from its dominant platform,

including advertising, also grew 16%, totaling $908 million. This

was the first quarter the company exceeded $1 billion in revenue,

marking a significant financial milestone. However, shares fell

14.3% in pre-market trading after estimating that gross profit for

the current quarter would hit $465 million and adjusted EBITDA of

$30 million, both metrics below Wall Street expectations.

Booking Holdings (NASDAQ:BKNG) – Booking

Holdings exceeded expectations with adjusted earnings of $83.89 per

share, above the expected $77.52, and revenue of $7.99 billion,

surpassing the forecast of $7.63 billion. Strong demand for

international travel, especially in Europe and Asia, offset

weakness in the U.S. and China domestic markets. The company

recorded 299 million room nights, an 8.1% increase. Shares rose

6.1% in pre-market trading.

Carvana (NYSE:CVNA) – Carvana surpassed

expectations in the third quarter, reporting earnings per share of

64 cents (against the expected 25 cents) and revenue of $3.65

billion, above the forecast of $3.45 billion. Net income was $148

million, adjusted EBITDA was $429 million, and the adjusted EBITDA

margin was 11.7%. The company raised its adjusted EBITDA forecast

for 2024, indicating optimism in reaching values well above the

previous target of up to $1.2 billion. Shares rose 20.4% in

pre-market trading.

Starbucks (NASDAQ:SBUX) – Starbucks reported

earnings per share of 80 cents and revenue of $9.07 billion, both

below expectations of $1.03 and $9.36 billion, respectively. Global

same-store sales fell 7%, with declines of 6% in the U.S. and 14%

in China. Under the new leadership of Brian Niccol, the company is

seeking a strategic restructuring to win back customers and regain

growth. Niccol announced plans to prioritize speed and simplicity,

aiming to deliver coffee orders in under four minutes and ensure

punctuality for online orders. He also plans to streamline the

menu, reintroduce customizations, and create a welcoming

experience. Additionally, Starbucks is eliminating the extra charge

for non-dairy milk to stimulate sales, thereby reducing costs for

some customers. Shares rose 0.5% in pre-market trading.

DoorDash (NASDAQ:DASH) – DoorDash reported a

25% increase in third-quarter revenue, reaching $2.71 billion and

surpassing the forecast of $2.66 billion. For the first time since

its IPO, the company reported earnings per share of 38 cents, above

the expected 22 cents. For the fourth quarter, it projects adjusted

EBITDA between $525 million and $575 million, exceeding

expectations. Shares rose 1.8% in pre-market trading.

eBay (NASDAQ:EBAY) – eBay’s revenue in the

third quarter was $2.58 billion, slightly above estimates, with a

2% increase in gross merchandise volume, totaling $18.3 billion.

eBay projected fourth-quarter revenue between $2.53 billion and

$2.59 billion, below the analysts’ expectation of $2.65 billion,

due to consumer caution regarding collectible and refurbished

items. Shares fell 9.8% in pre-market trading.

Allegiant Travel Company (NASDAQ:ALGT) –

Allegiant Travel Co. projected adjusted earnings of 50 cents per

share for the fourth quarter, below the expected 67 cents, impacted

by hurricanes that will reduce revenue by up to $40 million. In the

third quarter, the company reported an adjusted loss of $2.02 per

share, worse than the anticipated deficit of $1.86, while revenue

of $562.2 million exceeded the forecast of $560.4 million. Shares

fell 8.7% in pre-market trading.

Coinbase (NASDAQ:COIN) – Coinbase reported

earnings per share of 28 cents and revenue of $1.21 billion, both

below LSEG expectations of 41 cents and $1.26 billion,

respectively, due to a weaker cryptocurrency market. Net income was

$75.5 million. Revenue from subscriptions and services grew 66%

year over year, while stablecoins and institutional trading

performed strongly. Shares fell 1.8% in pre-market trading.

Robinhood (NASDAQ:HOOD) – Robinhood reported

adjusted earnings per share of 17 cents and revenue of $637 million

in the third quarter, slightly below expectations of 18 cents and

$661 million, respectively. Net income was $150 million. Compared

to the previous quarter, adjusted EBITDA fell from $301 million to

$268 million, and customer net deposits declined from $13.2 billion

to $10 billion. The company announced new products, such as the

advanced trading platform Robinhood Legend and event contracts, and

reported the suspension of the 1% incentive on deposits for Gold

customers. Shares fell 11.3% in pre-market trading.

STMicroelectronics (NYSE:STM) –

STMicroelectronics revised its annual forecast to the lower end of

the range of $13.2 billion to $13.7 billion, expecting revenue of

$13.27 billion amid weak industrial demand. In the third quarter,

revenue fell 26.6% to $3.25 billion, while EBIT exceeded

expectations, totaling $381 million. The company forecasts a sharp

revenue decline between the fourth quarter of 2024 and the first

quarter of 2025. Shares rose 0.2% in pre-market trading.

Cognizant Technology Solutions (NASDAQ:CTSH) –

Cognizant exceeded expectations in the third quarter, with adjusted

earnings per share of $1.25 (above the expected $1.15) and revenue

of $5.04 billion, surpassing the estimate of $5 billion. Driven by

recovering demand for IT services, the company raised its annual

revenue forecast to between $19.7 billion and $19.8 billion, above

the previous projection.

Equinix (NASDAQ:EQIX) – In the third quarter,

Equinix’s revenue rose 2% to $2.20 billion, while adjusted funds

from operations reached $9.05 per share, exceeding the estimate of

$8.49. The EPS was $3.10, better than the estimate of $2.92.

Equinix projected fourth-quarter revenue between $2.26 billion and

$2.30 billion, slightly above the analysts’ average expectation of

$2.26 billion, driven by strong demand for data centers to support

AI.

LPL Financial (NASDAQ:LPLA) – LPL Financial

exceeded third-quarter expectations with adjusted earnings of $4.16

per share, 12% above the estimate of $3.71, and revenue of $3.10

billion, surpassing the consensus of $3.04 billion. With $27

billion in new organic assets, LPL also expanded to 23,686 advisors

and expects to repurchase up to $100 million in stock in the fourth

quarter.

Prudential Financial (NYSE:PRU) – Prudential

Financial reported earnings per share of $3.48 in the third

quarter, slightly above the analysts’ estimate of $3.47. Quarterly

revenue was $14.48 billion, below the consensus of $14.89 billion.

International operating revenue fell to $766 million. Despite this,

its investment management unit, PGIM, saw an increase in profits to

$241 million, with assets under management rising to $1.56

trillion.

CF Industries (NYSE:CF) – CF Industries,

headquartered in Northbrook, Illinois, reported net income of $276

million, or $1.55 per share, in the third quarter ended September

30. This marks a significant increase compared to net income of

$164 million, or 85 cents per share, in the same period last year.

The company recorded a 68% increase in third-quarter profit, driven

by higher prices for nitrogen fertilizers, with ammonia rising to

$530 per ton in September. Natural gas, a raw material for

fertilizers, remained cheap, aiding the company’s margins.

Sunnova (NYSE:NOVA) – Sunnova Energy reported a

loss of $122.6 million in the third quarter, or 98 cents per share,

larger than the estimated loss of 53 cents from analysts. Revenue

was $235.3 million, below the forecast of $241.2 million. Shares

fell 5.6% in pre-market trading.

Shell (NYSE:SHEL) – Shell reported earnings of

$6 billion in the third quarter, exceeding forecasts by 12%, driven

by LNG sales, which grew to 17 million tons. Despite a 57% drop in

refining profits due to weaker global margins, the company

announced a new $3.5 billion share buyback program, maintaining the

dividend at 34 cents per share. Shares rose 0.9% in pre-market

trading.

TotalEnergies (NYSE:TTE) – TotalEnergies

reported adjusted net income of $4.1 billion in the third quarter,

marking a three-year low, impacted by refining margins down 65% and

upstream disruptions. Profit fell 37% year over year, nearly

aligned with the forecast of $4.2 billion. Production averaged 2.4

million barrels per day, influenced by disruptions in Libya and

Australia. EBITDA fell 23.6% year over year to $10 billion. Shares

fell 1.7% in pre-market trading.

Etsy (NASDAQ:ETSY) – Etsy reported earnings per

share of $0.45 in the third quarter, below the analysts’

expectation of $0.53. However, revenue exceeded forecasts, reaching

$662.4 million, above the consensus of $653.45 million. Shares rose

6.9% in pre-market trading.

Riot Platforms (NASDAQ:RIOT) – Riot Platforms

reported a loss per share of $-0.54 in the third quarter, worse

than the analysts’ estimate of $-0.17. Revenue also fell short of

expectations, totaling $84.79 million against the consensus of

$92.79 million. Shares fell 4.5% in pre-market trading.

MGM Resorts International (NYSE:MGM) – MGM

Resorts reported adjusted earnings per share of 54 cents, below the

expected 61 cents, and revenue of $4.18 billion, slightly below the

forecast of $4.21 billion. The 13% drop in revenue from casinos in

Las Vegas, totaling $476 million, contributed to the

underperformance. Shares fell 6.1% in pre-market trading.

Stellantis (NYSE:STLA) – Stellantis reported a

27% drop in third-quarter net revenues, totaling €33 billion ($35.8

billion), below the expected €36.6 billion. The decline was

attributed to lower shipments and pricing and exchange challenges.

The company advanced its U.S. inventory reduction, targeting a cut

of 100,000 units by November. Shares rose 3.0% in pre-market

trading.

MetLife (NYSE:MET) – MetLife reported adjusted

earnings of $1.95 per share in the third quarter, slightly below

the $1.97 from the previous year, with a 27% drop in collective

benefits profits, totaling $373 million. The unit was impacted by a

review of actuarial assumptions and weak non-medical health

underwriting. In contrast, investment revenue rose 8% to $5.3

billion due to higher interest rates.

Amgen (NASDAQ:AMGN) – Amgen reported adjusted

earnings of $5.58 per share in the third quarter (a 13%

year-over-year increase), above the expected $5.11, with revenue of

$8.5 billion, in line with forecasts. Growth was driven by higher

sales of cholesterol medications (Repatha, +40%) and osteoporosis

treatments (Prolia, +6%). The company plans to disclose promising

results for its potential obesity drug, MariTide, by year-end.

Merck (NYSE:MRK) – Merck reported adjusted

earnings of $1.57 per share in the third quarter, surpassing the

estimate of $1.50, with revenue of $16.66 billion, above the

expected $16.46 billion. Sales of Keytruda rose 17%, reaching $7.43

billion, while Gardasil vaccine sales fell 11% to $2.31 billion.

The company revised its annual sales forecast to between $63.6

billion and $64.1 billion.

Anheuser-Busch InBev NV (NYSE:BUD) –

Anheuser-Busch InBev recorded a 2.4% decline in beer volumes in the

third quarter, impacted by weaker sales in China and Argentina. The

company announced a $2 billion share buyback and is seeking to cut

costs to improve margins. While it experienced growth in some

markets, China saw a significant decline, and global consumers are

opting for cheaper beer options due to economic slowdown.

Third-quarter revenue fell short of estimates, with a 2.1%

increase, although its profits exceeded estimates. Shares fell 4.4%

in pre-market trading.

Clorox (NYSE:CLX) – Clorox Co. reported net

income of $99 million in the first quarter, or 80 cents per share.

Excluding one-time costs, adjusted earnings were $1.86 per share,

surpassing the analysts’ expectation of $1.36. Revenue was $1.76

billion, above the forecast of $1.63 billion. Clorox raised its

annual earnings forecast to up to $6.90 per share, above the

previous estimate of $6.80 and the average analyst estimate of

$6.65. The company reported a 31% increase in organic sales in the

last quarter, driven by market recovery following the cyber attack,

supported by advertising and discounts to attract customers

back.

Other corporate highlights

Alphabet (NASDAQ:GOOGL) – Eric Schmidt, former

CEO of Google, suggests that U.S. military replace old tanks with

drones using artificial intelligence, noting that low-cost drones

can easily destroy expensive tanks. Schmidt, who advises on

military technology, emphasizes that rapid changes in drone tactics

indicate that the future of conflicts will be dominated by this

technology. Shares fell 1.1% in pre-market trading.

Amazon (NASDAQ:AMZN) – Amazon is updating Alexa

to compete with ChatGPT and launched a beta version in 2024.

However, delays, inconsistent responses, and technical challenges

are complicating the full launch, which has been postponed to 2025.

Additionally, over 500 Amazon employees have urged AWS CEO Matt

Garman to reverse the mandatory return-to-office policy,

challenging his statement that most support this measure. They

criticized the lack of data backing the decision and emphasized

that the rule negatively impacts workers with family

responsibilities and special needs. Shares fell 1.2% in pre-market

trading.

PepsiCo (NASDAQ:PEP) – PepsiCo is sharing more

data with major retailers to gain insights into consumer behavior

and streamline its supply chain. To address falling snack sales,

the company is reformulating products and packaging, in addition to

increasing collaboration with retailers, such as Carrefour, to

optimize orders and boost sales.

Super Micro Computer (NASDAQ:SMCI) – Super

Micro Computer revealed that Ernst & Young (EY) resigned as its

auditor, raising concerns among investors regarding the company’s

accounting. EY cited governance and financial control issues

following an internal investigation and new data received. In

response, Super Micro disagreed with the decision and stated it

does not expect significant revisions in its financial reports.

Shares fell 4.9% in pre-market trading after closing down 33% on

Wednesday.

Vodafone (NASDAQ:VOD) – Vodafone and Romanian

operator Digi signed a memorandum with the Hellenic

Telecommunications Organization to acquire Telekom Romania Mobile.

Vodafone would buy the majority of the company and assets, while

Digi would take over some others. Negotiations are in the early

stages and do not guarantee an agreement. Shares fell 1.2% in

pre-market trading.

Blackstone (NYSE:BX), Rogers

Communications (NYSE:RCI) – Blackstone made a $5.03

billion (C$7 billion) bid for a minority stake in Rogers

Communications’ mobile phone infrastructure, according to the Globe

and Mail. The deal, which will help Rogers reduce its debt,

involves selling a part of its wireless backhaul

infrastructure.

Spirit Airlines (NYSE:SAVE) – Spirit Airlines,

aiming to cut costs and strengthen its finances, will place around

330 pilots on leave in January 2025 and demote 120 captains. Facing

ongoing losses and a drop in shares following a failed merger with

JetBlue, the company plans to reduce its capacity and sell older

aircraft to generate liquidity.

Azul SA (NYSE:AZUL) – S&P downgraded Azul

from CCC+ to CC with a negative outlook, viewing its financing

agreement of up to $500 million as a “default.” The transaction

improves Azul’s cash flow by $150 million and may convert up to

$800 million in debt to equity if targets are met.

Toyota Motor (NYSE:TM) – Toyota and Nippon

Telegraph & Telephone Corp. will invest $3.3 billion (¥500

billion) by 2030 to develop autonomous driving technology with AI,

planned for 2028 and available to other companies. The technology

aims to improve road safety by using a network that anticipates and

responds to accidents.

Nike (NYSE:NKE) – John Slusher, a veteran at

Nike, has been appointed CEO of US Olympic and Paralympic

Properties (USOPP), responsible for marketing the Los Angeles 2028

Games and Team USA rights until that date. Slusher, with 26 years

of experience in sports marketing at Nike, will lead sponsorship,

product, hospitality, and ticket revenue. Shares fell 0.2% in

pre-market trading.

AstraZeneca (NASDAQ:AZN) – The Chinese

investigation into AstraZeneca has reached high levels, including

local president Leon Wang, over aggressive sales practices,

especially regarding oncology drugs Tagrisso and Imjudo. Employees

have been arrested for allegedly manipulating results for insurance

qualification. AstraZeneca, known for reduced prices to enter

China’s reimbursement list, now faces a significant impact on its

local operations. Shares fell 1.0% in pre-market trading.

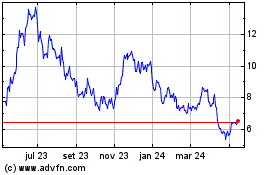

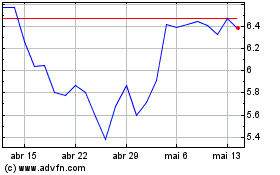

Azul (NYSE:AZUL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Azul (NYSE:AZUL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024