Amazon (NASDAQ:AMZN) – Amazon exceeded

expectations for the third quarter with earnings per share of

$1.43, compared to the anticipated $1.14, and revenue of $158.88

billion, surpassing estimates of $157.2 billion. AWS performed

slightly below expectations with revenue of $27.4 billion, while

advertising rose 19% to $14.3 billion. Next quarter’s revenue

projection between $181.5 billion and $188.5 billion suggests

moderate growth of 7% to 11%, though investors had expected an

average projection of $186.2 billion. Shares rose 6.1%

pre-market.

Intel (NASDAQ:INTC) – Intel beat third-quarter

expectations with adjusted earnings per share of 17 cents, better

than analysts’ predicted loss of 2 cents. Revenue reached $13.28

billion, exceeding the expected $13.02 billion. Data center and AI

segment revenue grew 9%, totaling $3.35 billion. CEO Pat Gelsinger

highlighted progress in cost-cutting and portfolio simplification.

The company still faces restructuring expenses but expects gross

margin recovery to 39.5% next quarter. Intel also forecasts

fourth-quarter adjusted earnings of 12 cents per share and revenue

between $13.3 billion and $14.3 billion, exceeding Wall Street

expectations. Shares rose 5.7% pre-market.

Atlassian (NASDAQ:TEAM) – Atlassian posted a

first-quarter fiscal loss of $123.8 million, or 48 cents per share.

Adjusted earnings were 77 cents per share, surpassing analysts’

expectations of 63 cents. Revenue came in at $1.19 billion, beating

the expected $1.15 billion. For the next quarter, Atlassian

projects revenue between $1.23 billion and $1.24 billion. Shares

rose 20.4% pre-market.

Apple (NASDAQ:AAPL) – Apple exceeded estimates

with adjusted earnings per share of $1.64 (vs. $1.60 expected) and

revenue of $94.93 billion (vs. $94.58 billion). iPhone revenue

reached $46.22 billion, boosted by the iPhone 16 launch. However,

net income fell to $14.73 billion after a one-time tax charge of

$10.2 billion. For the next quarter, Apple projects moderate sales

growth. Shares dropped 1.2% pre-market.

ICF International (NASDAQ:ICFI) – ICF

International will release third-quarter 2024 earnings on October

31, with consensus estimates pointing to revenue of $528.02 million

and earnings of $1.43 per share. For 2024, ICF expects revenue of

$2.06 billion and earnings of $5.75 per share. Last quarter,

revenue was $512.03 million, surpassing expectations of $505.79

million, with earnings of $1.36 per share.

Eldorado Gold (NYSE:EGO) – Eldorado Gold

exceeded third-quarter earnings expectations with an adjusted

profit of $2.13 per share, beating the projected $1.81, totaling

$32.7 million. Revenue came in at $517 million, below the expected

$532.5 million. The company projects annual earnings between $7.40

and $7.50 per share.

Ardelyx (NASDAQ:ARDX) – Ardelyx reported

third-quarter sales of $98.24 million, surpassing the expected

$86.64 million. IBSRELA revenue reached $40.6 million, with 2024

projections ranging from $145 million to $150 million. XPHOZAH

contributed $51.5 million, and the company ended the quarter with

around $190 million in cash and investments. Shares rose 0.5%

pre-market.

AES Corporation (NYSE:AES) – AES Corporation

posted third-quarter net income of $502 million, or $0.71 per

share, exceeding estimates and surpassing last year’s $231 million

($0.32 per share). Adjusted earnings also hit $0.71 per share.

Revenue decreased by 4.2% to $3.29 billion, down from $3.43 billion

last year. Shares increased 0.1% pre-market.

Nine Energy Service (NYSE:NINE) – Nine Energy

Service reported revenue of $138.2 million, above Wall Street’s

$134 million estimate and within its forecasted range. The net loss

was $10.1 million ($0.26 per share), while adjusted EBITDA reached

$14.3 million. With total liquidity at $43.3 million, capital

expenditures were $3.6 million as expected. Shares rose 7.3%

pre-market.

United States Steel (NYSE:X) – US Steel

surpassed third-quarter expectations with EBITDA of $319 million on

sales of $3.9 billion, exceeding Wall Street’s projections of $305

million and $3.7 billion. For the fourth quarter, US Steel

forecasts EBITDA between $225 million and $275 million, compared to

the market’s $266 million projection. The company is navigating a

proposed merger with Nippon Steel amid political and union

opposition. Shares rose 0.3% pre-market.

Juniper Networks (NYSE:JNPR) – Juniper Networks

exceeded third-quarter revenue and earnings expectations, achieving

$1.33 billion, above the $1.26 billion forecast. Adjusted earnings

were 48 cents per share, surpassing the expected 44 cents. Strong

cloud enterprise demand drives these results, while the acquisition

by Hewlett Packard Enterprise, valued at $14 billion, is expected

to close in 2024 or 2025. Shares fell 0.3% pre-market.

Nomura Holdings (NYSE:NMR) – Nomura Holdings

doubled its quarterly profit to ¥98.4 billion ($645 million),

driven by wholesale and wealth management performance despite a

recent securities manipulation scandal. The firm paid a $143,000

fine (¥21.8 million) and announced enhanced internal controls and

voluntary executive pay cuts. Shares rose 1.5% pre-market.

Coterra Energy (NYSE:CTRA) – Coterra Energy

reported adjusted earnings of 32 cents per share, below Wall

Street’s 34-cent forecast, due to declining commodity prices.

Natural gas revenue dropped, with the average price falling to

$1.30 per mcf from $1.80 last year. Total production reached

669,100 boepd, slightly lower than the prior period. For 2024,

Coterra projects 660,000 to 675,000 boepd, with 5% annual growth in

oil production.

Avis Budget (NASDAQ:CAR) – Avis Budget’s

third-quarter profits fell short of expectations, with net income

dropping to $238 million ($6.65 per share) from $627 million last

year, and revenue falling to $3.48 billion. The company is

preparing for high holiday demand and maintains strong liquidity,

with over $1.2 billion available.

Li Auto (NASDAQ:LI) – Li Auto issued a weak

fourth-quarter forecast, projecting revenue between $6.2 billion

and $6.5 billion, below Wall Street’s $6.7 billion expectation. In

the third quarter, the company achieved a 21.5% gross margin, a 24%

increase in sales, and a net profit of ¥2.81 billion with a 20.9%

profit margin. Analysts remain concerned about growth clarity and

upcoming EV models. Shares rose 0.1% pre-market, following a 13.6%

drop on Thursday.

Chevron (NYSE:CVX) – Chevron is expected to

report third-quarter earnings above estimates, with analysts

forecasting $2.43 per share, down from last year’s $3.05, due to

lower oil and gas prices. Challenges include a dispute with Exxon

over Hess’s acquisition. Chevron focuses on growth in key areas

like the Permian Basin and Gulf of Mexico, targeting daily

production of one million barrels in the Permian by 2024. Analysts

see Chevron as an attractive option against rival Exxon. Shares

rose 0.8% pre-market.

More Corporate Highlights

Abbott Laboratories (NYSE:ABT) – A jury cleared

Abbott and Reckitt of accusations that their formulas caused severe

intestinal illness in premature babies, boosting the companies’

stock. This verdict marks the first victory amid over 1,000

lawsuits. Analysts believe this could reduce the projected

financial liabilities for both companies by hundreds of millions of

dollars. Shares rose 5.0% pre-market.

AbbVie (NYSE:ABBV) – AbbVie announced a $1.4

billion acquisition of the startup Aliada to explore an innovative

Alzheimer’s treatment that crosses the blood-brain barrier more

effectively than current drugs. Meanwhile, Roche is also advancing

Alzheimer’s treatments with its trontinomab antibody, with Phase 2

results expected soon.

Microsoft (NASDAQ:MSFT) – Microsoft hired

former Facebook senior engineer Jay Parikh to aid in the rapid

expansion of its data centers to meet increasing AI product demand.

Parikh, known for large-scale infrastructure expertise, will report

to CEO Satya Nadella. Microsoft aims to bolster its Azure cloud and

AI project capacity, driven by its partnership with OpenAI. Shares

rose 1.0% pre-market.

Alphabet (NASDAQ:GOOGL) – Indonesia has now

banned sales of Google’s Pixel smartphones, following Apple’s

iPhone 16 ban, for not meeting the 40% local component requirement.

This policy aims to ensure equality for investors, though it has

raised concerns about foreign investor confidence in Indonesia, a

major market dominated by OPPO and Samsung. Additionally, Google

updated Maps and Waze with Gemini AI features, including natural

language queries and voice-activated traffic reports. Developers

can also use Google’s AI to verify information with its extensive

data. The company won a legal battle to retain the YouTube Shorts

name, avoiding global changes that might affect its competition

with TikTok and Instagram Reels. Shares fell 0.4% pre-market.

Sony Group (NYSE:SONY) – Sony filed a lawsuit

against CBS for contract violations in distributing “Wheel of

Fortune” and “Jeopardy!” Sony seeks compensation for performance

shortfalls in international contracts, claiming CBS has profited

over $1 billion from these rights. Shares rose 0.1% pre-market.

Trump Media (NASDAQ:DJT) – Trump Media stock,

owned by former President Donald Trump, dropped 11.7% on Thursday

to $35.34, following a steep 22% decline the day prior. These

swings attract speculative investors, especially with the upcoming

presidential election. The stock reflects sentiment on Trump’s

election chances, though the company’s $8 billion market cap seems

disproportionate to its actual revenue. Shares rose 2.7%

pre-market.

Mercado Libre (NASDAQ:MELI) – Mercado Libre

received its first investment-grade rating, with Fitch Ratings

upgrading it to BBB-, reflecting the company’s financial stability

and growth potential. Its market capitalization now exceeds $100

billion, surpassing Petrobras.

Boeing (NYSE:BA) – Boeing workers will vote on

a new contract proposal on Monday, offering a 38% wage increase

over four years and a larger signing bonus, endorsed by the union.

The offer is considered crucial for Boeing, which seeks to raise

$24.3 billion to address financial challenges. The strike has

already impacted production and affected suppliers and airlines.

Approval isn’t guaranteed, however. Additionally, Boeing dismantled

its DEI department, merging it with the HR talent team. Former DEI

VP Sara Liang Bowen announced her departure on LinkedIn. Shares

rose 2.3% pre-market.

Tesla (NASDAQ:TSLA) – A Delaware judge will

rule by year-end on restoring Elon Musk’s $56 billion Tesla

compensation package after shareholder votes. The judge will also

decide if Tesla should pay up to $1 billion in attorney fees to

shareholders who sued Musk. Shares rose 0.6% pre-market.

Ford Motor (NYSE:F) – Ford will halt production

of its F-150 Lightning electric pickups for six weeks, from

November 18 to January 6, to adjust its sales strategy and improve

profitability. The automaker, focusing more on hybrids, reported a

45% increase in EV sales but faces challenges in cutting production

costs.

JPMorgan Chase (NYSE:JPM) – JPMorgan agreed to

pay $151 million to settle SEC claims of misleading disclosures to

clients. The settlement includes $61 million in fines and $90

million in restitution. The SEC alleges the bank exposed clients to

risk while recommending more profitable products for itself.

BlackRock (NYSE:BX) – BlackRock sought SEC

approval to offer ETF classes for its mutual funds, joining over 30

managers requesting similar clearance after Vanguard’s patent

expired in 2023. While SEC authorization remains exclusive to

Vanguard, the CBOE is pressing for a decision by the end of

2024.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway increased its stake in Sirius XM to 33.2%, purchasing

$60.7 million in shares over three days, becoming the largest

investor after Liberty Media. Shares rose 0.4% pre-market.

Goldman Sachs (NYSE:GS) – Goldman Sachs

suggests higher US tariffs on Chinese goods could impact China’s

growth but boost domestic consumption. In case of new tariffs,

Beijing may enhance fiscal support to maintain demand. If Trump

implements a 20% tariff, China’s GDP could drop 0.7%, potentially

leading to a weaker yuan and expanded consumption incentives.

Citigroup (NYSE:C) – Citigroup’s head of

banking for China, Luke Lu, is stepping down for personal reasons

after less than a year. Howard Yang will temporarily lead as

Citibank (China) president, while Aveline San becomes interim

director. Shares rose 1.0% pre-market.

Exxon Mobil (NYSE:XOM) – Exxon Mobil agreed to

sell most of its shale assets in Argentina’s Vaca Muerta to

Pluspetrol, pending provincial approval. The decision reflects

Exxon’s focus on other projects like those in Guyana. Under

President Javier Milei, Vaca Muerta’s output has grown with

pro-business policies and new pipelines. Shares rose 1.0%

pre-market.

Ioneer (NASDAQ:IONR) – Environmental and

Indigenous groups sued the US Interior Department, challenging the

approval of Ioneer’s Rhyolite Ridge lithium mine in Nevada. They

argue the mine threatens the Tiehm’s buckwheat flower and local

ecosystems. Ioneer, which recently received a permit after six

years of review, remains confident in the project, backed by a $700

million loan and additional investments to supply lithium for EV

manufacturers.

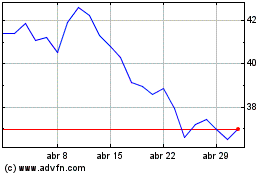

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Mar 2025 até Abr 2025

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Abr 2024 até Abr 2025