U.S. index futures rose slightly in pre-market trading on Monday

as investors focused on the presidential election and the Federal

Reserve’s rate decision. Tuesday’s election is seen as a crucial

catalyst; a divided Congress would maintain the status quo, while a

unified victory could bring new spending and tax reform plans.

Additionally, the market is watching S&P 500 earnings reports,

where 70% of companies have exceeded expectations, and the upcoming

Fed meeting, with a 96% chance of a rate cut according to CME

Group’s FedWatch.

At 5:21 AM, Dow Jones futures (DOWI:DJI) were up 30 points, or

0.07%. S&P 500 futures gained 0.19%, and Nasdaq-100 futures

advanced 0.15%. The 10-year Treasury yield stood at 4.297%.

In the commodities market, West Texas Intermediate crude for

December rose 2.83% to $71.46 per barrel, while Brent for January

rose 2.65% to $75.04 per barrel.

Oil prices were boosted after OPEC+ postponed its December

production increase to January, keeping supply tight. The group

will maintain its 2.2 million barrels per day cut, countering

expectations of a production increase. Analysts note OPEC+ appears

focused on supporting prices, while geopolitical tensions and

events like the U.S. elections and the Chinese legislative meeting

keep investors alert.

Brent and WTI fell about 4% and 3% last week due to U.S. record

production, but both contracts rose on Friday amid reports that

Iran could retaliate against Israel, as cited by Axios.

Copper (CCOM:COPPER), aluminum (CCOM:ALUMINUM), nickel, and iron

ore gained with the dollar weakening ahead of the U.S. elections

and expectations of new Chinese stimulus. A weaker dollar lowers

commodity prices, while investors await economic support measures

from the Chinese government.

In today’s U.S. economic calendar, the September factory orders

report is due at 10 AM. The median forecast points to a 0.5% drop,

a slowdown from the previous month’s -0.2%.

Asia-Pacific markets closed higher on Monday. China’s CSI 300

rose 1.41%, ending at 3,944.76. In Hong Kong, the Hang Seng was up

0.27% at the final trading hour, while Australia’s S&P/ASX 200

closed with a 0.56% gain. Taiwan rose 0.81%. Japanese markets were

closed for a holiday.

South Korean stocks gained, with the Kospi up 1.83% and the

Kosdaq rising 3.43%, following the opposition party’s support for

the government’s decision to drop the capital gains tax for retail

investors. The move aims to strengthen the local market and attract

domestic investors.

BYD (USOTC:BYDDY) increased production by

200,000 units from August to October and hired 200,000 employees.

In Q3, net profit grew 11.5%, and revenue rose 24%, reaching $28.24

billion, surpassing Tesla (NASDAQ:TSLA).

This week, investors are focused on China’s parliamentary

meeting, with expected fiscal support announcements by Friday. On

Thursday, China’s October trade data will be released following

weak September results. In South Korea, October inflation data will

be released on Tuesday, projected to fall to 1.4% year-over-year.

Australia’s central bank will also decide on interest rates on

Tuesday, likely holding at 4.35%.

European markets are mixed, with notable gains in the automotive

sector, while technology declines.

Among major highlights, shares of Burberry

(LSE:BRBY) rose amid rumors that Moncler

(BIT:MONC) might make a buyout offer.

Volvo Car AB (TG:8JO1) reported a 3% global

sales increase in October, with strong sales of electrified models

in Europe, where sales rose 21%. In total, 48% of sales were

electric or hybrid models.

Wizz Air (LSE:WIZZ) reported an increase in

passengers and capacity in October, carrying 5.6 million people,

4.1% more than last year. Capacity increased by 3.7%, with a load

factor of 92.9%.

European leaders congratulated Maia Sandu on winning Moldova’s

presidential runoff, reinforcing the country’s pro-European

direction. Sandu defeated the pro-Russia candidate with 55.4% of

the vote, driven by diaspora support. The victory is celebrated as

a democratic advance and a step toward European integration.

On Friday, the U.S. market rebounded after a sharp sell-off on

Thursday, with the Nasdaq rising 0.8%, the Dow 0.7%, and the

S&P 500 0.4%. For the week, the Dow fell 0.2%, while the

S&P 500 and Nasdaq dropped 1.4% and 1.5%, respectively.

Intel (NASDAQ:INTC) and Amazon

(NASDAQ:AMZN) boosted the Nasdaq with gains of 7.8% and 6.2%,

respectively. Conversely, Apple (NASDAQ:AAPL) fell

despite strong results.

The jobs report showed a smaller-than-expected increase, fueling

optimism regarding interest rates. Nonfarm employment rose by just

12,000 in October, below the 113,000 forecast, with the

unemployment rate steady at 4.1%.

Millions of Americans will vote on Tuesday in one of the closest

presidential races. Kamala Harris and Donald Trump are in a virtual

tie, focusing on seven battleground states, including Pennsylvania,

which has a strong history of deciding elections. Beyond the

presidency, Congress’s renewal is also at stake, influencing the

balance of power. Vote counting may take days, especially in states

with significant early voting and no central counting

authority.

Harris holds a slight edge in some polls, such as ABC

News/Ipsos, which shows her leading 49%-46%, and the New York

Times/Siena poll, where she leads in five of seven battleground

states. In traditionally Republican Iowa, a Des Moines Register

poll shows Harris ahead, indicating gains among Midwestern

voters.

In quarterly reports, Constellation Energy

Corp. (NASDAQ:CEG), Marriott

International (NASDAQ:MAR), Berkshire

Hathaway (NYSE:BRK.B), DigitalOcean (NYSE:DOCN), Freshpet (NASDAQ:FRPT), YumChina (NYSE:YUMC), SelectQuote (NYSE:SLQT), Fidelity

National Information

Services (NYSE:FIS), Franklin

Templeton (NYSE:BEN)

and Zoetis (NYSE:ZTS) will report

earnings before the open.

After the close, reports are expected from

Palantir (NYSE:PLTR), Hims &

Hers Health (NYSE:HIMS), Cliffs Natural

Resources (NYSE:CLF), Wynn

Resorts (NASDAQ:WYNN), NXP

Semiconductors (NASDAQ:NXPI), Lattice

Semiconductor (NASDAQ:LSCC), Astera

Labs (NASDAQ:ALAB), Navitas

Semiconductor (NASDAQ:NVTS), Progressive (NYSE:PGR)

and Teradata (NYSE:TDC), among

others.

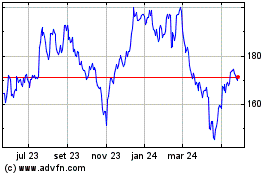

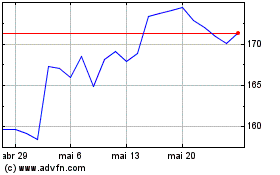

Zoetis (NYSE:ZTS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Zoetis (NYSE:ZTS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024