Tesla (NASDAQ:TSLA) – Tesla sold 68,280

China-made vehicles in October, a 5.3% drop from the previous year,

with Model 3 and Model Y deliveries down 22.7% month-over-month.

Tesla extended its interest-free financing for certain models into

November after exceeding third-quarter profit expectations but was

outperformed by BYD in revenue. Additionally, Tesla sold $499

million in securities based on loans for solar equipment customers.

Deutsche Bank led the transaction, with Fitch Ratings giving

investment-grade ratings to all tranches due to customers’ strong

credit quality. Demand exceeded supply, with a 4.83% coupon on the

main tranche. CEO Elon Musk faced a legal setback regarding

severance claims from former Twitter executives dismissed during

his 2022 acquisition. A judge allowed former executives, including

Parag Agrawal, to proceed with claims that Musk strategically fired

them to avoid severances. Similar cases against Musk continue.

Shares fell 1.2% premarket.

Intel (NASDAQ:INTC), Nvidia

(NASDAQ:NVDA), Sherwin-Williams (NYSE:SHW) – Intel

will be removed from the Dow Jones Industrial Average after 25

years, replaced by Nvidia and Sherwin-Williams, underscoring

Nvidia’s rise in the chip sector and Intel’s struggles. Nvidia, a

leader in AI chips, has seen its stock soar with the AI boom, while

Intel faces market value declines and competitive challenges. The

index exit may impact Intel’s stock, removing it from Dow-tracking

ETFs. Intel shares fell 2.4% premarket, while Sherwin-Williams rose

5.6%.

Nvidia (NASDAQ:NVDA) – Nvidia CEO Jensen Huang

requested SK Hynix to accelerate the delivery of next-generation

HBM4 memory chips by six months, initially set for the second half

of 2025. The request reflects high demand for higher-capacity chips

essential for Nvidia’s AI-oriented GPUs, a sector where the company

holds global dominance. Shares rose 2.3% premarket.

Air Transport Services Group (NASDAQ:ATSG) –

Stonepeak is in advanced talks to acquire ATSG, an aircraft leasing

and cargo transport company, for approximately $3.1 billion. The

offer is $22.50 per share, a 30% premium over ATSG’s last price,

with a possible announcement as early as Monday. Shares rose 20.6%

premarket.

Viking Therapeutics (NASDAQ:VKTX) – Viking

Therapeutics reported promising results for its oral weight-loss

drug VK2735, showing an average 8% weight reduction in obese adults

after four weeks at the highest dose. This outcome surpasses other

oral drugs in development, with JPMorgan analysts calling it an

“excellent result” and noting its tolerability at higher doses.

Shares rose 24.2% premarket.

Novo Nordisk A/S (NYSE:NVO) – Novo Nordisk’s

semaglutide injection, sold as Ozempic and Wegovy, is expected to

become the world’s top drug franchise in 2024, with a market of up

to $130 billion by 2030. To maintain leadership, Novo is betting on

CagriSema, combining semaglutide and cagrilintide, aiming to

improve weight-loss efficacy over Wegovy and Eli Lilly’s Zepbound.

However, CagriSema faces production challenges and potential side

effects, with investors closely watching December’s clinical

results. Additionally, Wegovy showed efficacy in treating

obesity-related liver disease in an advanced study, improving liver

fibrosis in 37% of patients and resolving the disease in 62.9%.

With regulatory approval expected by 2025, Wegovy could expand its

use beyond weight loss, benefiting patients with MASH and enhancing

its value to insurers. Shares fell 1.0% premarket.

Novartis (NYSE:NVS) – Novartis CEO Vas

Narasimhan expects average annual sales growth of 5% through 2028,

driven by billion-dollar drugs, despite patent expirations like

Entresto. The company will maintain a 40% profit margin to balance

research investments and growth. Complementary acquisitions focused

on smaller businesses are also on the radar, though major

acquisitions are approached cautiously. Shares rose 1.2%

premarket.

Chewy (NYSE:CHWY) – Chewy will join the S&P

MidCap 400 on November 6, replacing Stericycle, acquired by Waste

Management. Founded by GameStop chairman Ryan Cohen, Chewy has

attracted meme stock investor interest. Shares rose 5.6%

premarket.

Meta Platforms (NASDAQ:META),

Alphabet (NASDAQ:GOOGL), Equinix

(NASDAQ:EQIX) – U.S. tech companies warned that Vietnam’s proposed

data protection law could hinder social media platform and data

center expansions. The law, requiring prior approval for data

transfers and allowing broad government access, raises concerns

about foreign investment impact and business environment. Meta

shares fell 0.1% premarket.

Microsoft (NASDAQ:MSFT) – Abu Dhabi National

Oil Co. partnered with AIQ to utilize agentic AI developed with

Microsoft and G42 to enhance the energy sector. The technology

enables rapid data analysis, boosting efficiency, cutting

emissions, and improving production forecasts by up to 90%,

according to CEO Sultan Al Jaber. Shares rose 0.3% premarket.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway reduced its Apple stake by 25%, ending the quarter with

300 million shares, still valuing Apple as its largest investment

at $69.9 billion, down from $174.3 billion the previous year.

Warren Buffett indicated that tax considerations and portfolio

rebalancing partially drove Apple sales, amid Apple’s sales growth

challenges and regulatory pressures. The $36.1 billion sale raised

Berkshire’s cash reserve to a record $325.2 billion, reflecting

caution amid economic uncertainties. Quarterly operating profit

fell 6% to $10.09 billion or $7,019 per Class A share, below LSEG’s

estimate of $7,611 per share, due to insurance and currency losses.

Insurance investment revenue rose 48%, reaching $3.66 billion. Net

income was $26.25 billion, reversing a $12.77 billion loss from the

previous year, while insurance underwriting profit dropped 69%,

reflecting $565 million in losses from Hurricane Helene. Berkshire

projects $1.3-$1.5 billion in fourth-quarter losses from Hurricane

Milton. No stock repurchase occurred.

Blackstone (NYSE:BX), Retail

Opportunity Investments Corp (NASDAQ:ROIC) – Blackstone is

in advanced talks to acquire Retail Opportunity Investments (ROIC),

a U.S. shopping center owner, valued at $3.4 billion, including

debt. A deal could close within weeks, with Blackstone outpacing

rivals like Bain Capital. ROIC, with 93 retail centers, reported

strong rent growth last quarter, attracting Blackstone’s interest

in expanding its real estate portfolio. Blackstone also plans to

enter two new European wealth management markets in 2025, focusing

on high-net-worth investors, though the specific markets remain

undisclosed. Currently, Blackstone is active in London, Paris,

Zurich, Milan, and Frankfurt.

KKR (NYSE:KKR), Thames Water

(LSE:TES) – KKR is in talks to invest $3.88 billion (£3 billion) in

Thames Water, as part of a recapitalization plan for the

financially troubled UK utility. The decision hinges on regulatory

review by Ofwat, expected by January, and may require antitrust

review due to KKR’s stake in Northumbrian Water. KKR shares rose

0.3% premarket.

Goldman Sachs Group (NYSE:GS) – Goldman Sachs

predicts that South Africa will avoid the projected revenue deficit

and maintains a positive outlook on stabilizing debt below 70% of

GDP. Fitch and S&P may revise credit ratings post-budget,

potentially upgrading ratings within six months.

JPMorgan Chase (NYSE:JPM) – Judy Dimon, wife of

JPMorgan Chase CEO Jamie Dimon, campaigned in Michigan for Kamala

Harris, despite Jamie not publicly endorsing any candidate.

Although a Republican, Jamie dismissed support for Trump after a

mistaken post. Judy, a Democratic supporter, donated $250,000 to

Harris and the Democratic Committee, emphasizing the election’s

importance for fundamental principles and future opportunities.

Comcast (NASDAQ:CMCSA), Morgan

Stanley (NYSE:MS) – Comcast is exploring options for its

cable TV networks with Morgan Stanley’s help, considering a

possible spinoff. The goal is to explore new media market

opportunities and increase shareholder value, especially amid

declining cable TV subscriptions. A separation could facilitate

favorable mergers or make the business more attractive for

acquisitions.

Coinbase (NASDAQ:COIN) – Coinbase executives

and directors adopted trading plans to sell about $900 million in

stock, including 3.75 million shares from CEO Brian Armstrong.

These plans adhere to Rule 10b5-1, automating sales based on preset

criteria to avoid bias. CFO Alesia Haas noted these sales represent

a minor portion of insiders’ total holdings. Shares fell 2.3%

premarket.

Affirm (NASDAQ:AFRM) – Affirm, a “buy now, pay

later” fintech founded in 2012, expanded to the UK, offering

installment loans with interest-free options. Approved by the

Financial Conduct Authority, it competes with Klarna and PayPal.

Shares rose 1.1% premarket.

Boeing (NYSE:BA) – Boeing’s striking machinists

will decide on Monday about a new contract offer, including over

40% pay raises over four years and a $12,000 bonus. This is

Boeing’s fourth offer since the strike began in September. Boeing

raised over $23.5 billion through a large stock issuance to bolster

its finances and avoid credit downgrades. Four banks, including

Goldman Sachs and JPMorgan, will receive up to $75 million each for

coordinating. The issuance, one of the largest ever, comes amid a

sales slowdown ahead of the U.S. elections. Shares rose 0.4%

premarket.

Ryanair (NASDAQ:RYAAY) – Ryanair reported

strong bookings after a tough summer with declining profits and

fares. Half-year profit fell 18%, while average fares dropped 10%.

For the next quarter, fare declines are expected to be below 5%.

Next year’s passenger target was adjusted from 215 million to 210

million due to Boeing 737 MAX delivery delays. Half-year post-tax

profit was €1.79 billion ($1.95 billion), matching analysts’ €1.8

billion forecast.

Nio Inc (NYSE:NIO) – Nio will launch its first

hybrid model in 2026, exclusive to international markets like the

Middle East, North Africa, and Europe. Branded as Firefly, the

model aims to avoid European tariffs on Chinese EVs and meet

regions with limited charging infrastructure, supported by Abu

Dhabi’s CYVN Holdings. Shares rose 1.6% premarket.

Stellantis (NYSE:STLA) – Donald Trump stated

that, if elected, he would impose a 100% tariff on Stellantis if

the company shifts jobs from the U.S. to Mexico. He claimed this

would prevent the automaker from relocating. Shares rose 2.0%

premarket.

TotalEnergies (NYSE:TTE) – TotalEnergies CEO

Patrick Pouyanne stated that the next U.S. president should

prioritize maintaining national energy dominance. With the U.S.

leading in shale oil and gas production, energy is a strategic

competitive advantage. Kamala Harris supports fracking, while

Donald Trump and Republicans advocate for deregulation. Despite

restrictions, the Biden administration approved Alaska projects,

reinforcing an “America first” stance in energy. Shares rose 1.4%

premarket.

Talen Energy (NASDAQ:TLN) – The Federal Energy

Regulatory Commission rejected a revised interconnection agreement

in Pennsylvania between Talen and an Amazon data center. The

agreement involved connecting a nuclear plant, operated by Talen,

to Amazon’s data center. Shares fell 14.9% premarket.

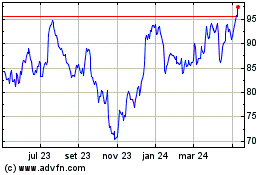

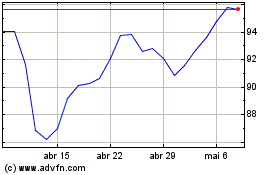

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024