Boeing (NYSE:BA) – Boeing workers on the U.S.

West Coast ended a seven-week strike after approving a contract

that includes a 38% wage increase over four years. The strike,

which impacted 737 MAX production and other models, cost Boeing

about $100 million per day. The contract also includes a $12,000

bonus and increased 401(k) contributions. Shares rose 2.0% in

pre-market.

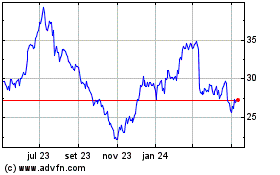

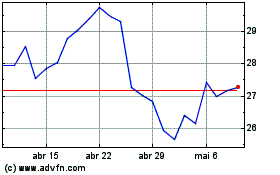

Southwest Airlines (NYSE:LUV) – Southwest

Airlines appointed Rakesh Gangwal, aviation veteran and co-founder

of Indigo, as independent board chair after an agreement with

Elliott Investment Management. Gangwal acquired Southwest shares

before the resolution, which included board concessions and CEO Bob

Jordan’s retention. As part of the agreement, Southwest added five

Elliott nominees, including Gregg Saretsky as finance committee

chair. Shares rose 0.5% in pre-market after closing down 2.3% on

Monday.

Dollar Tree (NASDAQ:DLTR) – Rick Dreiling

resigned as CEO of Dollar Tree for health reasons on November 3,

2024. Chief Operating Officer Michael Creedon Jr. takes over as

interim CEO, while Edward J. Kelly III, Independent Director, was

named Chair. The Board is searching for a new CEO, considering

internal and external candidates. The company reaffirmed its

financial forecast for the third quarter and continues its

strategic review of Family Dollar, which could include a potential

sale. Shares rose 3.8% in pre-market after closing up 0.3% on

Monday.

Apple (NASDAQ:AAPL) – According to Bloomberg,

Apple launched Project “Atlas” to research smart glasses, gathering

internal feedback and evaluating devices on the market. This study,

led by the Product Systems Quality team, aims to develop

affordable, functional glasses potentially integrated with the

iPhone, following criticism over the high cost and weight of the

Vision Pro. In Indonesia, Apple plans a $10 million investment in a

factory to manufacture components and meet local content

requirements. The goal is to lift the local sales ban on the iPhone

16. Shares fell 0.23% in pre-market.

Foxconn (USOTC:FXCOF) – Apple’s main

manufacturer reported its lowest monthly sales growth since

February, with NT$804.9 billion (US$25.2 billion) in October, an

8.6% increase but below expectations. This performance reflects

Apple’s weak holiday quarter forecast.

Meta Platforms (NASDAQ:META) – Meta plans to

use AI to identify teens lying about their age on Instagram,

automatically placing them in more restrictive privacy settings.

Using a tool called the “adult classifier,” AI analyzes account

data, followers, and interactions to predict users’ ages. Meta also

authorized U.S. defense agencies and contractors to use its AI

models, Llama, to bolster national security. In an exception to

military restrictions, the company aims to expand Llama’s reach and

support allies, emphasizing the importance of ethical and

responsible technology use. Additionally, Meta was fined $15.67

million by South Korea for collecting sensitive data from

approximately 980,000 South Korean users without consent, sharing

it with advertisers. Seoul’s data protection agency noted that

information on religion, politics, and sexuality was used by 4,000

advertisers, while Meta denied user requests for data access. On

the misinformation front, Meta will maintain a ban on new political

ads after the U.S. elections until the end of the week. During this

restriction, only active political ads with at least one prior

impression may continue, but with limited edits. Shares rose 0.42%

in pre-market.

OpenAI – OpenAI is negotiating with

California’s attorney general to change its structure to a

for-profit company, a significant shift since its founding as a

nonprofit in 2015. This would attract more investors, while the

original OpenAI would retain a minority stake. Recently, the

company raised $6.6 billion, valuing it at up to $157 billion.

Intel (NASDAQ:INTC), Bain

Capital (NYSE:BCSF) – Silver Lake, Bain Capital, and

Francisco Partners are interested in acquiring a minority stake in

Altera, Intel’s programmable chip division. Intel seeks to raise

cash to cut costs and expects a valuation similar to the $17

billion paid in 2015, preparing Altera for a future IPO. Altera

continues with 14% revenue growth, reaching $412 million last

quarter. Intel shares rose 0.13% in pre-market after closing down

2.93% on Monday.

Snowflake (NYSE:SNOW) – Alexander “Connor”

Moucka was arrested in Canada, suspected of cyberattacks against

165 Snowflake Inc. clients, including extortion and data theft.

Moucka, considered a leading threat actor in 2024, targeted over

100 companies since April, exploiting security gaps in

organizations lacking multi-factor authentication. Shares rose 0.7%

in pre-market after closing down 1.5% on Monday.

Paramount Global (NASDAQ:PARA) – Shari Redstone

will not remain on the board of Paramount Global following its

merger with Skydance Media. Although she and her son Tyler Korff

have the option to join the new entity’s board, they do not intend

to do so. After the merger, Skydance founder David Ellison will

become CEO of the new Paramount. Shares rose 0.2% in pre-market

after closing down 1.0% on Monday.

Amazon (NASDAQ:AMZN) – Amazon confirmed plans

to build a data center campus in Pennsylvania next to Talen

Energy’s nuclear plant, despite regulatory rejection of a special

power supply deal. The $650 million project, funded by Amazon Web

Services, aims to supply up to 960 megawatts directly from the

Susquehanna plant, reducing fossil fuel dependence for its

expanding operations. In Mexico, Amazon partnered with Jüsto, a

Mexican food delivery startup, to expand its fresh produce

offerings, enhancing its strategy to deliver essential goods

quickly. Shares rose 0.1% in pre-market after closing down 1.1% on

Monday.

Uber Technologies (NYSE:UBER) – Uber suggested

a 6.1% reduction in per-mile rates to New York’s Taxi and Limousine

Commission, citing lower gasoline costs. The goal is to make rides

cheaper and attract more passengers, but drivers worry about

further cuts amid frequent blocks and rule changes that have

already impacted earnings. The TLC is reviewing Uber’s proposal,

while drivers and unions protest, advocating for better working

conditions and financial stability. Shares rose 0.3% in

pre-market.

Tesla (NASDAQ:TSLA) – Tesla raised wages by 4%

for all employees at its German gigafactory, effective in November.

The increase follows the conversion of 500 temporary workers to

permanent status. The union IG Metall was not involved in the

decision. Shares rose 2.0% in pre-market after closing down 2.5% on

Monday.

Toyota Motor (NYSE:TM) – Toyota is expected to

report a 14% drop in annual operating profit for the second

quarter, totaling $7.9 billion, according to LSEG. With hybrids

accounting for 41% of sales, Toyota faces challenges in China and a

slight decline in global sales, with EVs representing only 1.5% of

sales.

Ford Motor (NYSE:F) – The National Highway

Traffic Safety Administration (NHTSA) closed an investigation into

411,000 Ford vehicles, including models like Bronco, Edge, and

F-150, over a valve defect in 2.7L and 3.0L EcoBoost engines that

could cause sudden power loss. Following a recall of 90,000 units,

Ford offers a 10-year or 150,000-mile extended warranty and

resolved the valve material issue in models manufactured after

October 2021. Shares rose 0.3% in pre-market after closing up 1.4%

on Monday.

Morgan Stanley (NYSE:MS) – Morgan Stanley

received final approval to launch futures operations in China,

becoming the second major U.S. bank with a standalone derivatives

unit in the country. The new unit will serve local clients and

foreign investors, planning to begin operations in collaboration

with Chinese regulators and exchanges.

BlackRock (NYSE:BLK) – BlackRock will support

Naturgy’s energy transition projects after acquiring a 20.6% stake

through the $12.5 billion purchase of Global Infrastructure

Partners. The company commits to maintaining Naturgy’s control over

key subsidiaries, expanding its infrastructure platform, which now

manages over $150 billion in assets.

Robinhood Markets (NASDAQ:HOOD) – A consortium

of cryptocurrency companies, including Robinhood, Kraken, and

Galaxy Digital, launched a stablecoin called USDG, pegged to the

U.S. dollar and issued in Singapore by Paxos. The Global Dollar

Network aims to promote global stablecoin usage, offering economic

advantages to partners. This initiative seeks to compete with

giants like Tether and USD Coin, which dominate the market. Shares

rose 0.5% in pre-market after closing up 1.5% on Monday.

Indivior Plc (NASDAQ:INDV) – Indivior Plc

secured a refinancing agreement to extend its loan maturity,

securing new six-year credit lines. The pharmaceutical company

raised $400 million in senior secured notes, with proceeds

allocated to pay off existing debt and improve liquidity by over

$250 million. Shares fell 0.4% in pre-market after closing down

1.8% on Monday.

Earnings

Palantir (NYSE:PLTR) – Palantir exceeded

third-quarter estimates with adjusted earnings of 10 cents per

share, above the expected 9 cents, and revenue of $725.5 million,

up 30% year-over-year, surpassing the forecasted $701 million. U.S.

government revenue increased 40%, representing 44% of total sales.

Net income rose to $143.5 million, driven by strong demand for AI.

The 2024 revenue forecast was raised to between $2.805 billion and

$2.809 billion, beating the consensus of $2.76 billion. Shares

surged 12.7% in pre-market after closing down 1.2% on Monday.

Hims & Hers Health (NYSE:HIMS) – Hims &

Hers Health Inc. surpassed third-quarter expectations with adjusted

earnings of $0.32 per share, well above the $0.10 estimate. Revenue

reached $401.6 million, a 77% increase year-over-year, exceeding

the $382.2 million projection. Subscribers grew 44%, reaching 2

million. The company raised its annual revenue forecast to between

$1.460 billion and $1.465 billion, above the $1.4 billion estimate.

Shares rose 11.8% in pre-market after closing up 2.0% on

Monday.

Astera Labs (NASDAQ:ALAB) – Astera Labs

exceeded expectations in the third quarter with adjusted earnings

of $0.23 per share and revenue of $113.1 million, above the

projections of $0.17 per share and $97.5 million. Revenue grew 47%

quarter-over-quarter and 206% YoY. For the fourth quarter, it

projects earnings of $0.26 per share and revenue of $128 million,

above Wall Street estimates. Shares jumped 25.5% in pre-market

after closing down 4.1% on Monday.

Marqeta Inc. (NASDAQ:MQ) – Marqeta expressed

dissatisfaction with its projections as some clients are bringing

functions in-house. The company expects 10% to 12% revenue growth

and a 13% to 15% increase in gross profit for the fourth quarter,

below previous forecasts. Marqeta reported third-quarter revenue of

$128 million, an 18% year-over-year increase, hitting the upper end

of its expectations. The company halved its net loss, recording

$28.64 million (6 cents per share), exceeding the adjusted Ebitda

estimate with a profit of $9 million, above the $7 million

consensus. Shares plummeted 39% in pre-market after closing up 1.7%

on Monday.

Lattice Semiconductor (NASDAQ:LSCC) – Lattice

Semiconductor reported third-quarter revenue of $2.65 billion,

below the estimate of $2.7 billion. Earnings were $1.06 per share,

significantly below the $2.75 expectation and last year’s $8.69.

With plans to cut 14% of its workforce, Lattice aims to improve

profitability to single digits in 2024. Shares fell 17.2% in

pre-market after closing down 0.7% on Monday.

Cleveland-Cliffs (NYSE:CLF) – Cleveland-Cliffs

Inc. reported an adjusted third-quarter loss of $0.33 per share,

worse than the expected $0.30 loss. Revenue was $4.57 billion,

below the $4.74 billion estimate and down from $5.1 billion in the

previous quarter. With reduced demand and lower prices, the company

temporarily shut down Cleveland #6 blast furnace and expects sector

recovery by 2025. Shares dropped 6.9% in pre-market after closing

down 1.2% on Monday.

Wynn Resorts (NASDAQ:WYNN) – Wynn Resorts

reported adjusted earnings of $0.90 per share, below the $1.04

estimate. Revenue was $1.69 billion, short of the expected $1.73

billion. Net loss was $32.1 million. Wynn Macau’s revenue grew

19.3%, while Las Vegas revenue dropped 1.9% to $607.17 million,

driven by a 13.6% decrease in casino revenue despite a 20% increase

in entertainment and retail sales. The board approved a $1 billion

share buyback. Shares fell 4.5% in pre-market.

American International Group (NYSE:AIG) – AIG

beat Wall Street’s expectations in the third quarter with adjusted

earnings of $1.23 per share, above the $1.10 forecast. General

insurance premiums rose 6%, totaling $6.38 billion, and the

combined insurance ratio was 88.3%. Investment income increased 14%

to $973 million, helping offset $417 million in catastrophic

losses, mostly due to storms in North America.

NXP Semiconductors (NASDAQ:NXPI) – NXP

Semiconductors reported adjusted third-quarter earnings of $3.45

per share, above the $3.43 estimate. Net income was $718 million,

with revenue of $3.25 billion, in line with forecasts. For the next

quarter, the company projects earnings of $2.93 per share and

revenue between $3 billion and $3.2 billion, below analysts’

estimates due to a slowdown in the automotive sector. Weak demand,

especially in Europe and the Americas, reflects challenging

conditions for automotive chips, as automakers face high inventory

levels and increased competition from Chinese electric

vehicles.

Navitas Semiconductor (NASDAQ:NVTS) – Navitas

Semiconductor reported third-quarter revenue of $21.7 million,

slightly down from $22 million last year but up from $20.5 million

in the previous quarter. The company recorded a GAAP operating loss

of $29 million and a non-GAAP loss of $12.7 million. With $98.6

million in cash, it announced quarterly cost cuts of $2 million,

including a 14% workforce reduction, targeting profitability.

Shares plummeted 19.9% in pre-market after closing up 1.2% on

Monday.

Teradata (NYSE:TDC) – Teradata Corporation

surpassed third-quarter expectations, posting adjusted earnings of

$0.69 per share, above the $0.56 estimate, with revenue of $440

million, beating the $417.71 million forecast. Public cloud ARR

rose 26% year-over-year, though total ARR fell 3%. The company

issued a weaker fourth-quarter outlook, expecting adjusted earnings

of $0.40 to $0.44, below the $0.48 forecast.

Cirrus Logic (NASDAQ:CRUS) – Cirrus Logic

reported record second-quarter revenue of $541.9 million, with GAAP

earnings per share of $1.83 ($2.25 non-GAAP) and a gross margin of

52.2%. New product launches and laptop market expansion fueled the

quarter. For the current quarter, the expected gross margin is

51%-53%, with revenue projected between $480 million and $540

million, while analysts surveyed by LSEG anticipated $590 million.

Shares dropped 10.5% in pre-market after closing up 0.3% on

Monday.

New York Times (NYSE:NYT) – In the third

quarter, The New York Times reported total revenue of $640.2

million, in line with the $640.8 million estimate, driven by an

8.8% increase in digital advertising sales. Adjusted earnings were

45 cents per share, exceeding the 41-cent forecast. However, the

NYT added 260,000 digital subscribers, below the expected 280,200.

Fourth-quarter subscription revenue growth is projected between 7%

and 9%.

Vertex Pharmaceuticals (NASDAQ:VRTX) – In the

third quarter, Vertex Pharmaceuticals’ revenue rose 12% to $2.77

billion, above the $2.72 billion projection, while adjusted

earnings per share reached $4.38, surpassing the $4.14 expectation.

Sales of the cystic fibrosis drug Trikafta grew 13%, totaling $2.59

billion. The company raised its annual revenue forecast to between

$10.8 billion and $10.9 billion, surpassing analysts’ estimates of

$10.75 billion.

Sibanye-Stillwater (NYSE:SBSW) –

Sibanye-Stillwater reported adjusted EBITDA of $184 million in the

third quarter, a 9% increase year-over-year, driven by gold and

zinc operations. South African gold operations yielded $75 million,

while the zinc segment in Australia contributed $31 million,

beating prior expectations. The company reported ongoing

difficulties in the platinum sector, with low prices impacting

margins. Shares rose 9.7% in pre-market after closing down 2.4% on

Monday.

Diamondback Energy (NASDAQ:FANG) – In the third

quarter, Diamondback Energy reported adjusted earnings per share of

$3.38, below the $4.02 estimate. Revenue was $2.65 billion,

exceeding the $2.44 billion forecast. Average production was

571,098 BOE/d, with fourth-quarter projections of 470,000-475,000

barrels of oil per day. The company generated $708 million in free

cash flow during the quarter, repurchased 2.9 million shares for

$515 million, and declared a quarterly dividend of $0.90 per

share.

Archer-Daniels-Midland (NYSE:ADM) –

Archer-Daniels-Midland (ADM) canceled its earnings call and

announced a financial statement review after identifying new

accounting errors, deepening a scandal that has already reduced its

market value by $8 billion. ADM, facing investigations by the

Justice Department and the SEC, will review financial records from

recent quarters. The company also lowered its 2024 earnings

projections to a range of $4.50 to $5 per share, reflecting weak

demand and operational challenges. Shares fell 4.8% in pre-market

after closing up 1.2% on Monday.

Southwest Airlines (NYSE:LUV)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Southwest Airlines (NYSE:LUV)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024