U.S. index futures rose slightly in pre-market trading on

Tuesday as markets await the outcome of a tight presidential race

between Trump and Harris. With voting set to begin and an uncertain

race that could delay vote counts, caution prevails. Additionally,

the Federal Reserve’s decision and earnings reports are expected to

impact markets in the coming days.

As of 5:38 AM, Dow Jones futures (DOWI:DJI) were up 54 points,

or 0.13%. S&P 500 futures gained 0.17%, while Nasdaq-100

futures rose 0.27%. The 10-year Treasury yield stood at 4.307%.

In commodities, West Texas Intermediate crude for December rose

0.35% to $71.72 per barrel, and Brent for January gained 0.33% to

$75.33 per barrel.

Oil prices are trading in a narrow range as the market remains

cautious ahead of the U.S. presidential election and the Federal

Reserve meeting. OPEC+’s decision to delay production hikes has

supported prices, but economic uncertainty and events like China’s

Congress and possible storms in the Gulf of Mexico are limiting

major moves. Oil production recovery in Libya and Iran’s expansion

plans are also influencing short-term supply.

Spot gold (PM:XAUUSD) increased by 0.06% to $2,738.405 per

ounce.

Copper (CCOM:COPPER) rose for the third consecutive day, driven

by positive economic data from China and expectations for further

support measures from Beijing. Chinese services activity expanded

rapidly, and recent stimulus efforts appear effective. The

government is expected to announce more economic support this

week.

In the U.S. economic calendar today, the September trade deficit

is set for release at 8:30 AM, with an expected increase to -$84.0

billion from -$70.4 billion. At 10:00 AM, the ISM Services Index

for October will be released, expected to fall to 53.7% from 54.9%

in the previous month.

Asia-Pacific markets closed mixed on Tuesday, with notable gains

in Japanese stocks, which rose on strong corporate earnings during

the first day of extended trading. The Topix closed up 0.76%, and

the Nikkei 225 gained 1.11%, supported by exporters and positive

results from companies like Nomura Holdings and

Murata Manufacturing.

China’s CSI 300 index rose 2.53%, and Hong Kong’s Hang Seng rose

1.8% in the final hour of trading. South Korea’s Kospi fell 0.47%,

while Australia’s S&P/ASX 200 declined 0.4%.

In China, services activity accelerated in October, with the

Caixin/S&P Global services PMI rising to 52.0, boosted by

Beijing’s stimulus efforts. This aligns with the official PMI,

showing expansion in services and construction sectors. Business

confidence improved, though deflationary pressures and weak loan

demand mean stimulus efforts are essential to sustaining economic

growth in 2024.

In South Korea, inflation slowed to 1.3% in October, the lowest

since January 2021 and below the Bank of Korea’s 2% target. This

result raises expectations for rate cuts, currently at 3.25%.

Declines in oil and food prices contributed to the slowdown, and

core inflation, excluding food and energy, rose by just 1.8%.

Australia’s Reserve Bank (RBA) held rates at 4.35%, a 12-year

high, signaling a restrictive stance to control underlying

inflation. The RBA expects a gradual slowdown in core inflation,

projecting 3.4% by the end of 2024 and 2.5% by 2026. Employment

growth is expected to reach 2.6% by year-end, with unemployment

rising to 4.5% by 2025.

Nintendo cut its annual operating profit

forecast by 10% to $2.36 billion due to weakening Switch console

sales. Sales for the first fiscal half reached 4.7 million units,

compared to 6.8 million the prior year. Annual Switch sales

expectations were reduced by 7% to 12.5 million units.

European markets are trading slightly higher amid anticipation

for the U.S. presidential election. Mining is the top-performing

sector, while oil and gas are lagging.

Notably, Hugo Boss (TG:BOSS) slightly exceeded

third-quarter operating profit expectations, reporting EBIT of €95

million, above the forecast of €90 million, despite a 7%

year-over-year decline. Currency-adjusted sales reached €1.029

billion, supported by cost management and moderate demand.

Associated British Foods Plc (LSE:ABF) saw

profits rise, driven by Primark’s continued recovery as input costs

decreased. The company, which has divisions in sugar and food,

raised its dividend by 50% and launched a £500 million share

buyback. Despite retail challenges, Primark’s autumn and winter

sales were strong. AB Foods anticipates lower sugar sector profits

due to reduced prices but projects a recovery in 2026.

Schroders Plc (LSE:SDR) experienced outflows of

$3 billion (£2.3 billion) last quarter and expects an additional £8

billion this quarter due to a Scottish Widows contract and

institutional client losses. Facing challenges amid outflows and

slow growth, the firm appointed Richard Oldfield, former CFO and

new CEO, replacing Peter Harrison.

Vestas Wind Systems (AQEU:VWSC) shares fell

sharply after the company lowered its annual EBIT margin forecast

to the lower end of 4-5% and revised its net investment to €1

billion, with service EBIT projected at €450 million.

Adecco Group (LSE:0QNM) reported third-quarter

results below expectations, with net income down to €99 million and

revenue 4% lower. Adjusted EBITDA fell 21% to €186 million, below

analyst forecasts.

AIB Group (LSE:AIBG) maintained its annual

outlook but raised its loan portfolio growth forecast to 5-6% in

2024, up from the previous 4%. In the third quarter, gross loans

rose 5% to €70.4 billion.

Syensqo (EU:SYENS) shares rose 6.5% after

reporting third-quarter profits of €162 million, exceeding

expectations. The company also announced a $326.4 million (300

million euros) share buyback program.

Hornby (LSE:HRN) sold its loss-making Oxford

Diecast brand for $1.8 million to EKD Enterprises, controlled by

former chairman Lyndon Davies. The sale is part of the company’s

restructuring, now focusing on its core Corgi, Hornby train, and

Scalextric racing car brands.

French tech firm Atos SE (EU:ATO), facing

financial difficulties, agreed to sell its Worldgrid unit to

Alten SA (EU:ATE) for $294 million, including

debt. Worldgrid, which specializes in utility consulting, received

regulatory approval and expects to complete the sale by

year-end.

The £15 billion merger between Vodafone

(LSE:VOD) and Three can proceed if they implement

solutions to address competitive concerns. The Competition and

Markets Authority deemed the merger potentially favorable, provided

significant investments and tariff protections are in place. A

final decision is expected by December 7.

Lastly, Schaeffler AG (TG:SHA0) will cut 4,700

jobs across Europe and close two facilities due to the automotive

crisis, aiming to save €290 million.

On Monday, U.S. stocks were volatile, ending slightly down after

a strong performance on Friday. The Dow Jones fell 0.6%, influenced

by Intel (NASDAQ:INTC) and Dow Inc. (NYSE:DOW)

exiting the index, replaced by Nvidia

(NASDAQ:NVDA) and Sherwin-Williams (NYSE:SHW).

Both Nasdaq and S&P 500 dropped 0.3%. The market reflected

uncertainty over the U.S. election and Federal Reserve policy,

expected to cut rates by 25 basis points. Energy stocks rose as oil

prices climbed after the OPEC+ decision.

Election results could impact year-end stock performance, but

short-term volatility is expected. Historically, indices tend to

rise post-election but may decline the following week. Market

instability may increase due to the uncertain outcome, prompting

Wall Street strategists to assess potential economic impacts of

Trump or Harris victories.

Trump proposed Elon Musk lead an efficiency committee, with Musk

planning to reduce the federal budget by $2 trillion. Piper Sandler

listed 100 stocks sensitive to these cuts, including

Boeing (NYSE:BA) and General

Dynamics (NYSE:GD). Defense companies may benefit from

increased military spending in a Republican win, while a Harris

victory would favor electric vehicle companies and

homebuilders.

In addition to the election, the Federal Reserve’s rate decision

and remarks from Jerome Powell are anticipated and may affect

movements.

On the earnings front, reports from

Melco (NASDAQ:MLCO), Sundial

Growers (NASDAQ:SNDL), ADM (ADM), Apellis (NASDAQ:APLS), Ferrari (NYSE:RACE), Apollo (NYSE:APO), Builders

FirstSource (NYSE:BLDR), GlobalFoundries (NASDAQ:GFS), LP

Building Solutions (NYSE:LPX) and Navios

Maritime Partners (NYSE:NMM) are expected before the

open.

After market close, earnings from

Supermicro (NASDAQ:SMCI), Devon

Energy (NYSE:DVN), Lumen (NYSE:LUMN), Pan

American Silver (NYSE:PAAS), Kinross

Gold (NYSE:KGC), Microchip

Technology (NASDAQ:MCHP), Coupang (NYSE:CPNG), BigBear.ai (NYSE:BBAI), Exact

Sciences (NASDAQ:EXAS)

and iRobot (NASDAQ:IRBT), among others,

are anticipated.

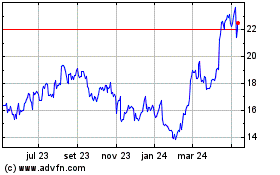

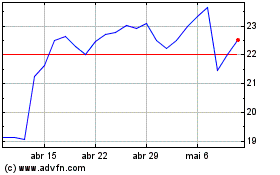

Coupang (NYSE:CPNG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Coupang (NYSE:CPNG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024