Trump Media & Technology Group (NASDAQ:DJT)

– Donald Trump’s media company reported a $19.2 million loss in Q3,

driven by $12.1 million in legal fees tied to a streaming deal and

SPAC. Research and development expenses totaled $3.9 million.

Despite the loss, shares surged 32.7% in pre-market after Trump

declared victory in the presidential election, pushing the stock

price to $45.23, reflecting increased optimism for Trump’s chances.

His stake in the company is now valued around $5.8 billion.

Tesla (NASDAQ:TSLA) – Tesla shares rose 13.1%

in pre-market trading, driven by Elon Musk’s support for Donald

Trump’s presidential campaign against Kamala Harris.

Coinbase (NASDAQ:COIN) – Coinbase shares rose

12.7% in pre-market trading, following a record surge in Bitcoin’s

value.

Apple (NASDAQ:AAPL) – Apple may face its first

fine under the EU’s new digital antitrust rules for violating the

Digital Markets Act (DMA) by blocking developers from directing

users to cheaper options outside the App Store. The penalty could

be imposed before Commissioner Margrethe Vestager steps down later

this month. The fine could reach up to 10% of Apple’s annual global

sales. Shares rose 0.4% in pre-market.

Nvidia (NASDAQ:NVDA) – Nvidia surpassed Apple

in market capitalization as demand for its AI chips remains strong,

with Chinese startup DeepRoute.ai highlighting its collaboration

with the company in new funding. Shares rose 1.5% in pre-market

after closing up 2.8% on Tuesday.

Alphabet (NASDAQ:GOOGL) – A federal judge

dismissed a class action against Google, which accused it of

profiting from Google Play gift card scams. Judge Beth Labson

Freeman ruled that the plaintiff, Judy May, failed to prove Google

caused her losses or knew about the stolen funds. May claimed a

$1,000 loss in the scam, but the judge found Google not liable. She

may refile her case. Shares rose 2.1% in pre-market.

Amazon (NASDAQ:AMZN) – Amazon CEO Andy Jassy

stated that the decision requiring employees to work five days a

week in the office isn’t aimed at reducing headcount or appeasing

local leaders. While the policy has caused discontent, Jassy

clarified that it focuses on strengthening corporate culture. Some

employees raised concerns about efficiency and work-life balance,

but Jassy noted that Amazon is providing support, such as

transportation benefits. Shares rose 1.0% in pre-market.

iRobot (NASDAQ:IRBT) – The home robot maker

announced a restructuring plan on Tuesday, including the layoff of

about 105 employees, or 16% of its global workforce. The company

estimates restructuring costs of $5.3 million, mainly in severance

packages, with most of these costs expected in Q4 2024. Shares fell

2.9% in pre-market.

Emerson Electric (NYSE:EMR) – Emerson Electric

has proposed acquiring the remaining stake of AspenTech for $15.1

billion, offering $240 per share. Since 2021, Emerson has held 55%

of AspenTech, and the deal aims to bolster its focus on industrial

automation. AspenTech is reviewing the proposal. Emerson’s shares

closed up 7.2% on Tuesday.

Palantir Technologies (NYSE:PLTR) – Palantir

executives plan to sell more than $580 million in company shares

over the coming months, using Rule 10b5-1 plans to avoid conflicts

of interest. CTO Shyam Sankar and other directors adopted new sales

plans, reducing the number of shares compared to previous plans.

Palantir shares, which have nearly tripled this year, rose 3.1% in

pre-market after closing up 23.5% on Tuesday.

Walmart (NYSE:WMT) – Christmas product imports

to the U.S. dropped significantly this year. According to Reuters,

Walmart reduced these imports from 1.9 million in 2022 to 340,000

kilos in 2024, signaling a weaker holiday season. This reflects

consumer spending concerns, rising costs, and economic uncertainty.

Shares rose 0.9% in pre-market.

Peloton (NASDAQ:PTON), Roblox

(NYSE:RBLX) – Peloton and Roblox recently received new buy ratings

from analysts despite challenges. Bank of America projects Peloton

at $9 per share, while Morgan Stanley sees Roblox reaching $65.

Peloton shares rose 4.7% in pre-market, while Roblox shares gained

2.2%.

Stellantis (NYSE:STLA) – Stellantis CEO Carlos

Tavares did not confirm Maserati’s electrification plans during a

meeting with union leaders, raising concerns about the brand. Union

representatives noted that no mention was made of electric

production for the MC20, scheduled for 2025, and expressed

uncertainty about new models. Shares rose 2.8% in pre-market.

Honda Motor (NYSE:HMC) – A Honda executive

stated that tariffs on cars imported from Mexico to the U.S. could

disrupt vehicle delivery. With Trump favoring such tariffs and

promising to cut subsidies for electric vehicles, companies may

revise production strategies and consider lobbying efforts. Shares

fell 7.6% in pre-market.

General Motors (NYSE:GM) – General Motors has

recalled some 2020-2022 Chevrolet Bolt electric vehicles in the

U.S. due to a fire risk, involving 107 vehicles following an

earlier recall of 142,000 units for the same issue. A software flaw

linked to the previous recall prevented battery defect warnings. GM

is working to resolve the issue quickly. Shares rose 4.1% in

pre-market.

Spirit AeroSystems (NYSE:SPR) – The Boeing

supplier warned of uncertainties in its continuity due to cash flow

reduction, exacerbated by a recent Boeing workers’ strike impacting

737 MAX production. With a cash balance of $218 million in Q3,

Spirit Aero is exploring financial alternatives, including a $350

million bridge loan and a $425 million advance from Boeing.

Hawaiian Electric (NYSE:HE) – Hawaiian Electric

signed a $2 billion deal to settle damages from a fire that

devastated Lahaina, causing over 100 deaths. Under a provisional

agreement, the company, along with other defendants, will

contribute to a total fund of $4 billion to settle fire-related

lawsuits. This agreement excludes claims from insurers, which

remain in court. Shares rose 1.7% in pre-market.

KKR (NYSE:KKR) – KKR acquired a 35% stake in

Japanese software firm Fuji Soft after the first phase of its

public offer. With this stake, KKR can block a rival bid from Bain

Capital, which recently offered 9,450 yen per share to take Fuji

Soft private. Investors 3D Investment Partners and Farallon Capital

had agreed to sell their shares to KKR for 8,800 yen each. Shares

rose 5.0% in pre-market.

Blackstone (NYSE:BX) – Avery Lodge,

Blackstone’s workforce housing specialist, has attracted interest

from investors like Bain Capital and Apollo Global Management. The

portfolio, featuring four complexes with 1,700 units, could be

valued at around $568 million.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway could become one of the largest corporate taxpayers this

year after selling two-thirds of its Apple stake. With stock sales

that could generate over $20 billion in taxes, the company faces a

significant tax bill, reflecting its large gains. Warren Buffett

believes paying taxes is appropriate and necessary, emphasizing

Berkshire’s fiscal responsibility. Shares rose 2.7% in

pre-market.

Wells Fargo (NYSE:WFC) – Wells Fargo tripled

its donations to groups that influence state elections, totaling

$704,300 in 2024. This reflects the growing importance of local

politics for big businesses. Donations, evenly split between

Democrats and Republicans, have risen over 200% since 2014. Shares

rose 7.2% in pre-market.

JPMorgan Chase & Co. (NYSE:JPM) – JPMorgan

will offer instant settlement for USD-EUR currency conversions via

its Kinexys blockchain platform, with plans to add GBP in the

future. The solution uses tokenized deposits with JPM Coin,

processing over $2 billion daily. The Kinexys expansion aims to

attract clients and break even in three to five years, executives

say. Shares rose 5.9% in pre-market.

American Financial Group (NYSE:AFG) – American

Financial Group announced a special dividend of $4 per share,

payable on November 26 to shareholders of record on November 15.

This additional payment raises total special dividends to $50 per

share since 2021.

LPL Financial (NASDAQ:LPLA) – The Securities

and Exchange Commission (SEC) is investigating LPL Financial’s

practices regarding clients’ uninvested cash, which is transferred

to accounts that pay minimal interest. Several investors have sued

LPL, alleging breach of fiduciary duty. LPL stated it is

cooperating with the SEC and defending its practices.

Moderna (NASDAQ:MRNA) – Stephane Bancel,

Moderna’s CEO, will step down as Chief Commercial Officer, as

reported by Bloomberg. Company President Stephen Hoge will take on

sales and medical affairs responsibilities. Bancel will remain CEO.

Shares fell 0.4% in pre-market.

Earnings

Supermicro Computer (NASDAQ:SMCI) – The server

solutions company reported adjusted earnings per share of 75 to 76

cents for Q1, above FactSet’s average estimate of 73 cents.

However, revenue ranged from $5.9 to $6 billion, below the $6.44

billion expectations. For next quarter, it forecasts sales of $5.5

to $6.1 billion, short of the $6.84 billion expected. The recent

exit of auditor Ernst & Young, citing governance concerns, led

to a 14% drop in shares. Accounting issues and potential Nasdaq

delisting intensified the crisis, straining investor relations.

Shares fell 18.1% in pre-market.

Novo Nordisk (NYSE:NVO) – The maker of Wegovy

and Ozempic reported a 26% increase in Q3 operating profit,

totaling $4.86 billion (33.8 billion Danish kroner), slightly above

analysts’ estimate of 33.6 billion kroner. EBIT reached 33.8

billion, slightly exceeding expectations. Net profit was $3.92

billion. Full-year sales growth projection adjusted to 23%-27%,

with operating profit revised to 21%-27%, reflecting strong demand

for GLP-1 drugs. Shares rose 5.3% in pre-market.

Toyota Motor (NYSE:TM) – Toyota reported an

operating profit of 1.16 trillion yen ($7.55 billion) in Q2, down

20% from a year earlier but in line with analysts’ forecasts of 1.2

trillion yen. Total revenue was $75 billion, and annual production

was revised to 10.85 million units. Toyota sold 2.3 million

vehicles globally last quarter and maintained its fiscal year

forecast of $23 billion profit. Shares fell 0.3% in pre-market.

Honda Motor (NYSE:HMC) – Honda reported

operating profit of 257.9 billion yen ($1.68 billion) in Q2, down

from 302.1 billion yen a year earlier and below analysts’ average

estimate of 427.2 billion yen. The 15% drop was driven by lower

sales in China, despite 9% growth in the U.S. Full-year forecast

remains at 1.42 trillion yen. Shares fell 7.6% in pre-market.

Devon Energy (NYSE:DVN) – The energy producer

reported earnings per share of $1.10 in Q3, slightly below the

analysts’ estimate of $1.11. Quarterly revenue reached $4.02

billion, surpassing the consensus forecast of $3.72 billion. Shares

rose 3.6% in pre-market.

Lumen Technologies (NYSE:LUMN) – The telecom

solutions provider reported Q3 2024 revenue of $3.221 billion,

slightly above the $3.217 billion forecast but down from $3.641

billion in 2023. Net loss was $148 million, widening from $78

million last year, with a per-share loss of $0.15, larger than the

expected negative $0.09. Adjusted EBITDA was $899 million, and free

cash flow surged to $1.198 billion, a huge leap from $43 million in

2023. Shares fell 8.5% in pre-market.

Pan American Silver (NYSE:PAAS) – The silver

miner reported record Q3 2024 results, with free cash flow of

$151.5 million and revenue of $716.1 million. Production reached

5.47 million ounces of silver and 225,000 ounces of gold. Net

income was $57.1 million, or $0.16 per share, while adjusted

earnings were $115.1 million ($0.32 per share). Shares rose 2.0% in

pre-market.

Kinross Gold (NYSE:KGC) – The Canadian gold

miner reported Q3 2024 production of 564,106 ounces of gold, with a

production cost of $976 per ounce and a margin of $1,501 per ounce.

Revenue was $1.43 billion, and net income reached $355.3 million,

or $0.29 per share. Free cash flow hit $414.6 million, more than

tripling from Q3 2023. Shares fell 1.3% in pre-market.

Microchip Technology (NASDAQ:MCHP) – The

semiconductor and microchip maker reported Q2 FY25 net sales of

$1.164 billion, beating the $1.152 billion estimate, but down 48.4%

year-over-year. GAAP diluted earnings per share were $0.14, at the

upper end of guidance. GAAP gross margin was 57.4%, with non-GAAP

at 59.5%. The company returned $261 million to shareholders via

dividends and buybacks. Shares fell 2.5% in pre-market.

Coupang (NYSE:CPNG) – The Korean e-commerce

platform exceeded Q3 expectations with earnings of 4 cents per

share and revenue of $7.9 billion, beating projections of 1 cent

per share and $7.8 billion in sales. Compared to last year, sales

rose from $6.2 billion, though earnings per share fell from 5 to 4

cents. Adjusted EBITDA was $343 million, slightly below the $352

million estimate. Despite consistent double-digit revenue growth

for seven consecutive quarters, Farfetch losses, acquired in

January, weighed on results. CEO Bom Kim noted Farfetch is close to

breakeven. Shares fell 6.6% in pre-market.

BigBear.ai (NYSE:BBAI) – The AI provider

reported a quarterly loss of five cents per share, better than the

seven-cent loss forecast. Revenue of $41.505 million missed the

projected $46.03 million but rose from $33.98 million last year.

Gross margin increased to 25.9%, with a backlog of $437 million.

The company maintains an annual revenue forecast between $165

million and $180 million. Shares fell 10.2% in pre-market.

Exact Sciences (NASDAQ:EXAS) – The molecular

diagnostics company reported a Q3 per-share loss of $0.21, slightly

worse than the $0.20 analysts’ estimate. Revenue was $709 million,

below the $716.8 million forecast. The company lowered its annual

revenue projection to $2.73-$2.75 billion from a consensus of $2.83

billion and adjusted EBITDA guidance to $310-$320 million from

$335-$355 million. Shares fell 25.4% in pre-market.

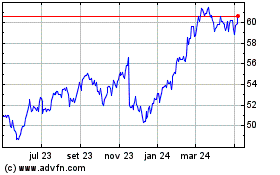

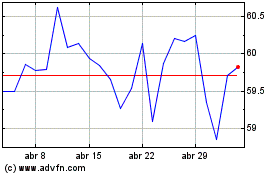

Walmart (NYSE:WMT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Walmart (NYSE:WMT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024