U.S. index futures surged in pre-market trading

on Wednesday, driven by expectations of a Donald Trump victory and

Republican control of Congress, which could benefit companies

through his tax cut and tariff agenda. Trump reportedly secured 270

electoral votes, though other networks have yet to call the race.

Sectors like banking and healthcare led gains, while clean energy

stocks fell amid expectations of less regulatory support.

Investors bought dollars, bitcoins, and stocks while selling

bonds in response to Trump’s potential win and Republican control

of Congress. This scenario pushed stock futures to record highs,

strengthened the dollar, and boosted bitcoin above $75,000.

At 5:11 AM, Dow Jones futures (DOWI:DJI) jumped 1,177 points or

2.77%, S&P 500 futures rose 2.22%, and Nasdaq-100 futures

increased 1.71%. The 10-year Treasury yield stood at 4.428%.

A Trump win is expected to support tax cuts, deregulation, and

strengthening sectors like finance and tech, while also increasing

global volatility and Treasury yields. His victory would broadly

impact U.S. trade, tax, and climate policies, as well as

immigration, energy, and international conflicts.

Trump’s proposals include higher import tariffs, corporate tax

cuts, and increased fossil fuel production. He also advocates for

mass deportations, stricter borders, citizenship law changes, and

reevaluating U.S. support for Ukraine and NATO’s role.

In commodities, oil, metals, and grains fell due to the stronger

dollar as investors reacted to Trump’s potential victory. Soybeans

(CCOM:SOYBEAN) dropped 1.74%, and copper (CCOM:COPPER) -2.24%.

Gold (PM:XAUUSD) fell 0.75% to $2,725.635, as the dollar’s

strength made it pricier and higher Treasury yields pressured the

metal. Despite this, gold remains appealing as a safe haven amid

trade tensions and economic uncertainty, especially given Trump’s

proposed tariffs.

Oil prices declined after two days of gains.

Besides the dollar’s appreciation, U.S. crude inventory increases

exceeded expectations. If elected, Trump may enforce protectionist

policies affecting demand from China, the world’s largest importer.

The strong dollar makes oil more expensive for other nations,

reducing demand.

West Texas Intermediate crude for December fell 1.28% to $71.07

per barrel, while Brent for January declined 1.26% to $74.58.

In crypto markets, Bitcoin (COIN:BTCUSD) is up 6.2% over the

past 24 hours at $73,578 after reaching a record high of $75,410.10

overnight, fueled by the prospect of a Trump victory in the U.S.,

suggesting a more lenient approach to cryptocurrency regulation.

Investors speculate a Republican administration would encourage

innovation in the crypto sector. Ether (COIN:ETHUSD) is up 8.1% at

$2,618.

Today’s U.S. economic agenda includes the final October U.S.

services PMI at 09:45 AM, measured by S&P, previously at

55.3.

Asia-Pacific markets closed mixed on Wednesday. Japan’s Nikkei

225 rose 2.61%, and the Topix gained 1.94% on optimism around the

Bank of Japan’s policies. Meanwhile, South Korea’s Kospi dropped

0.52%, and Kosdaq fell 1.13%. Hong Kong’s Hang Seng lost 2.5% in

the final trading hour, while China’s CSI 300 closed down 0.5%.

Australia’s S&P/ASX 200 rose 0.83%.

China’s National People’s Congress is holding a five-day meeting

to discuss economic stabilization measures, drawing investor

attention for potential stimulus announcements and policy updates.

Additionally, the People’s Bank of China’s governor reiterated the

central bank’s commitment to supportive monetary policy to boost

economic growth, as reported by state media.

In Japan, manufacturing confidence declined in November,

impacted by China’s weakened economy and high inflation, according

to a Reuters survey. The services sector confidence dropped for the

fifth consecutive month, pressured by high costs and labor

shortages. Companies also cited currency market volatility as a

concern. The manufacturing sector confidence index fell to 5, while

services hit 19, the lowest since February 2023.

European markets are trading higher, led by gains in healthcare

stocks, with Siemens Healthineers (TG:SHL) and

Novo Nordisk (TG:NOV) among top performers, while

utilities lagged.

Novo Nordisk met quarterly profit expectations, while Siemens

Healthineers saw a 4.7% revenue increase for the fiscal year.

Other corporate highlights include BMW (TG:BMW)

reporting a 61% drop in quarterly profit due to weak sales in China

and brake issues. Revenue fell 15.7% to 32.4 billion euros, missing

analyst expectations. BMW expects a Q4 recovery with higher

deliveries and a more profitable product mix, aiming for an

operating margin between 6% and 7% for the year.

Puma (TG:PUM) posted a 5% increase in

currency-adjusted sales, reaching $2.48 billion, driven by demand

for running and soccer footwear. Its annual revenue and profit

forecast were maintained.

Marks & Spencer (LSE:MKS) reported

half-year profit of $524.6 million, beating expectations and up

17.2%, driven by market share gains. Revenue rose 5.7% with growth

in food and clothing sales, marking successful recovery efforts led

by CEO Stuart Machin.

Barry Callebaut saw annual revenue rise by

22.6% to 10.4 billion Swiss francs, passing cocoa costs onto

customers. However, sales volume remained flat due to high

ingredient costs and challenges in the gourmet division.

UniCredit (BIT:UCG) raised its 2024 profit

forecast above 9 billion euros and announced a 50% dividend payout

from 2025 profits. Q3 net profit was 2.51 billion euros, surpassing

estimates, with a 3% annual revenue increase driven by net interest

income.

Credit Agricole (BIT:1ACA) reported a 4.7% drop

in Q3 net profit to 1.67 billion euros ($1.83 billion), above the

forecast of 1.58 billion. Strong investment banking performance

offset retail weaknesses. Revenue grew 2.3%, with risk provisions

below expectations. The joint venture with Worldline remains on

track for March 2025.

Persimmon (LSE:PSN) reported growth in private

home sales in Q3 and projects annual growth, driven by autumn

demand. Improved affordability with more high loan-to-value

mortgages benefited buyers, especially first-time purchasers.

Microlise (LSE:SAAS) expects its services to

normalize by the end of next week following a recent cyberattack.

The company states the financial impact will be minimal, though

employee data was affected, with no customer data compromised.

Wizz Air (LSE:WIZZ) lost its appeal in the

General Court of Luxembourg against a 2 million euro aid granted to

TAROM by Romania, approved by the European Commission. The court

ruled the aid proportional and compliant with state aid rules.

Eurozone business activity stabilized in October, with the

services sector offsetting industrial decline. The Purchasing

Managers’ Index rose to 50.0 from 49.6 in September, indicating

economic stability. The services sector saw slight growth,

essential to avoid a recession. Demand for services dipped

slightly, but lower inflation and higher wages are expected to spur

consumer spending.

On Tuesday, U.S. stocks closed higher, led by a tech-driven

Nasdaq rally, up 1.4%, followed by the S&P 500 rising 1.2%, and

the Dow Jones 1.0%. Optimism was fueled by the tight Kamala

Harris-Donald Trump election race and a surprising acceleration in

the services sector, with October’s PMI rising to 56.0 from 54.9 in

September. The trade deficit increase also drew attention,

reflecting import growth.

Upcoming earnings reports include

Celsius (NASDAQ:CELH), CVS

Health (NYSE:CVS), Howmet

Aerospace (NYSE:HWM), Aurora

Cannabis (NASDAQ:ACB), Teva (NYSE:TEVA), Toyota (NYSE:TM), Six

Flags (NYSE:FUN), Johnson

Controls (NYSE:JCI)

and MarketAxess (NASDAQ:MKTX) before the

open.

After the close, results are expected from Arm

Holdings (NASDAQ:ARM), Qualcomm (NASDAQ:QCOM), AMC

Entertainment (NYSE:AMC), e.l.f.

Beauty (NYSE:ELF), Clover

Health (NASDAQ:CLOV), AppLovin (NASDAQ:APP), MercadoLibre (NASDAQ:MELI), Coeur

Mining (NYSE:CDE), Hecla

Mining (NYSE:HL)

and Albemarle (NYSE:ALB), among

others.

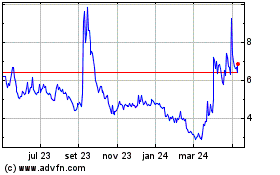

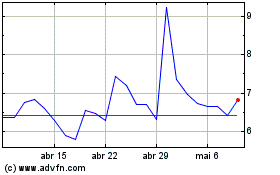

Aurora Cannabis (NASDAQ:ACB)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Aurora Cannabis (NASDAQ:ACB)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025