Trump victory propels US stock market and Bitcoin to new highs

Donald Trump’s victory spurred a significant surge in US stocks,

with the Dow Jones up 1,429 points at the time of writing and the

S&P 500 projected to increase 15% by 2025, according to UBS’s

Solita Marcelli. Investors are betting on less regulation and

taxes, as well as gains in the cryptocurrency sector.

Bitcoin (COIN:BTCUSD) reached an all-time high of $75,900.00,

currently up 9.1% at $75,604. Ethereum also rose by 10.4% to

$2,673.81. Shares of Trump Media & Technology Group

(NASDAQ:DJT) are up 3.7% at $35.18, while shares of MicroStrategy

(NASDAQ:MSTR), Coinbase (NASDAQ:COIN), and Marathon Digital

(NASDAQ:MARA) climbed 12.8%, 31.3%, and 20.0%, respectively.

Bitcoin’s rise reflects expectations of a more favorable

regulatory environment for crypto-assets. Investors speculate that

deregulation and the possible replacement of Gary Gensler at the

SEC will bring more freedom to the sector.

Trump pledged to make the US a global crypto hub, with

initiatives like a Crypto Advisory Council and a “Strategic Bitcoin

Reserve” to strengthen the US’s role in the market. He plans to

keep government-seized bitcoins and supports Bitcoin mining in the

US to boost the nation’s energy economy.

Polymarket has finalized its 2024 election contract, which moved

over $3.6 billion. The contract concluded following Associated

Press and NBC projections of Trump’s victory. A French bettor named

Theo, identified as the top winner, made $47.5 million betting on

Trump, while a second user, ‘zxgngl,’ won $11.4 million. The

contract’s popularity has sparked interest in the accuracy of

prediction markets over traditional polls.

After securing the presidency and Senate control, Republicans

are still vying for a majority in the House of Representatives,

which will influence the legislative agenda. On November 6, the AP

reported 199 seats for Republicans and 181 for Democrats, with 55

contests still undecided. Final results are awaited to determine

full legislative control.

Fernando Pereira, an analyst at Bitget, commented that “although

a Republican-led Congress may ease certain regulatory barriers,

political initiatives generally require detailed negotiations and

may be subject to procedural delays. Investors remain cautiously

optimistic, understanding that significant legislative changes may

take time to materialize despite a promising environment.”

Pro-crypto PACs supported candidates from both parties,

including Yassamin Ansari and Shri Thanedar, to strengthen

cryptocurrency policies. Senator Elizabeth Warren won her third

term in Massachusetts, defeating pro-crypto Republican John Deaton

with 73% of the vote. Deaton, popular in the crypto community and

endorsed by figures like Mark Cuban and Ripple CEO Brad

Garlinghouse, advocated for a balanced regulatory approach.

Although Warren has softened her stance on crypto, her victory

indicates that regulatory debates on digital assets will remain

prominent in Washington.

Altcoins surge with pro-crypto victory in the US

With Donald Trump’s victory and expectations of more favorable

regulation, altcoins, especially Uniswap (COIN:UNIUSD), surged

rapidly. UNI saw a 28.7% increase in 24 hours, with open interest

rising 20%, reflecting greater interest in future positions.

Funding rates doubled, indicating traders’ optimism for UNI’s

appreciation.

Avalanche (COIN:AVAXUSD) and ChainLink (COIN:LINKUSD) also

performed well, rising 10.8% and 10.2%, respectively. Solana

(COIN:SOLUSD) gained 12.6% to $187.46, a three-month high. Solana’s

Total Value Locked (TVL) soared to $6.54 billion, reflecting

growing demand for SOL tokens. Experts suggest SOL may hit

resistance between $200 and $220 but caution about a critical

support level at $180.

The Aave (COIN:AAVEUSD), a decentralized finance (DeFi) token,

rose 25% in the last 24 hours, boosted by World Liberty Financial’s

proposal to integrate with Aave V3. World Liberty Financial,

associated with Trump, proposed to AaveDAO to share 20% of its fees

and 7% of the WLFI token. Other DeFi tokens, like Maker

(COIN:MKRUSD) and Lido (COIN:LDOUSD), are also up 17.4% and 27.7%,

respectively.

Dogecoin rally: Critical resistance could determine next move

Dogecoin (COIN:DOGEUSD) is up 13.4% in the last 24 hours,

trading at $0.19274 after reaching an intraday high of $0.2193, a

seven-month peak. The $0.20 level represents a crucial resistance

point, which, if broken, could drive further gains. However,

Dogecoin’s Relative Strength Index (RSI), above 70, indicates an

overbought zone, suggesting a reversal risk. With 94% of the supply

in profit, profit-taking could lead to a correction, bringing the

price down to $0.17 or even $0.14 if selling pressure

increases.

BlackRock’s Bitcoin ETF sees $1 billion in 20 minutes

BlackRock’s spot Bitcoin ETF (NASDAQ:IBIT) moved over $1 billion

in the first 20 minutes of trading on November 6, according to

Bloomberg analyst Eric Balchunas. Total volume exceeded $2.5

billion throughout the day, reflecting strong demand. While the

volume does not represent net inflows, historically, these peaks

precede significant investments in Bitcoin ETFs.

On November 5, IBIT recorded net outflows of $44.2 million. The

11 US-listed spot Bitcoin ETFs collectively saw total outflows of

$116.8 million, as institutional investors exercised caution amid

US election uncertainties. Bitwise (AMEX:BITB) was the only ETF to

post an inflow of $19.3 million on Tuesday.

BNB Chain launches no-code tokenization for real-world assets

BNB Chain (COIN:BNBUSD) has introduced a streamlined

tokenization service for companies and individuals, enabling quick

tokenization of real-world assets with built-in compliance tools.

This process reduces costs and time, facilitating the tokenization

of physical assets like art and carbon credits with fractional

ownership options. Tokenization also enhances loyalty programs and

could reach a market value of $600 billion by 2030. Major financial

institutions are embracing tokenization, as evidenced by a recent

pilot with MAS and partners.

TRON announces Chainlink oracles and new developments at SmartCon

in Hong Kong

TRON (COIN:TRXUSD) continues its global expansion with over 270

million users and record transactions. TRON founder Justin Sun

announced at SmartCon that TRON DAO will integrate Chainlink Data

Feeds as official oracles, enhancing security for DeFi apps like

JustLend and JustStable, with $6.5 billion in Total Value Locked.

TRON will cover initial oracle network costs, fostering a

self-sustaining ecosystem. Sun also announced new projects,

including a Bitcoin Layer 2 solution and fee-free stablecoin

transfers.

JPMorgan renames Onyx to Kinexys and expands asset tokenization

JPMorgan Chase (NYSE:JPM) is expanding blockchain use in global

financial services with an initiative aiming to automate

multi-currency clearing and settlement 24/7. The bank relaunched

its blockchain platform, now named Kinexys, to advance real-world

asset tokenization and enhance multichain interoperability. With

over $1.5 trillion processed since 2020, Kinexys is advancing

tokenization and digital payments, including on-chain FX

capabilities between the dollar and the euro.

Crypto.com expands portfolio with stablecoins, ETF, and banking

services for 2025

According to CryptoSlate, Singapore-based cryptocurrency

exchange Crypto.com plans to launch stablecoins and an ETF focused

on its Cronos token in 2025, as well as expand into traditional

financial services like banking and stock trading. Having surpassed

Coinbase in trading volume in 2024, the platform anticipates a

“transformative year” with a pro-crypto US president. Other

initiatives include exchange services for the US and Canada,

Bitcoin rewards, and card expansions for Latin America, the Middle

East, and Africa, aiming to attract new global users.

SingularityNET and ASI Alliance launch autonomous proto-AGI in

Minecraft

SingularityNET (COIN:AGIXUSD) and ASI Alliance unveiled AIRIS,

an autonomous proto-AGI that learns and adapts in real-time in the

Minecraft environment. Unlike traditional AI, AIRIS adjusts its

actions dynamically, creating rules and strategies without

predefined instructions. This technology could pave the way for

robotics and intelligent systems. Minecraft’s open world is the

ideal environment for testing AIRIS’s adaptive learning, offering

insights into AGI’s future applications in complex real-world

scenarios, according to ASI Alliance.

Cathie Wood sees tech growth potential with less regulation under

Trump

Cathie Wood, CEO of ARK Invest, believes a Trump administration

focused on deregulation could boost sectors like blockchain, AI,

and robotics. In a YouTube video, Wood suggests that reducing

regulations and federal spending would accelerate exponential

growth in 14 deflationary technologies. While Trump has criticized

cryptocurrencies in the past, he is now seeking sector support,

setting him apart from Biden.

OpenSea announces new platform for December amid NFT stagnation

OpenSea will launch a redesigned platform in December to

revitalize the NFT market. CEO Devin Finzer highlighted that the

revamp was built from the ground up, aiming for innovation and an

enhanced user experience. With rumors of potential airdrops and new

features like smart accounts and SocialFi integration, the market

is responding with anticipation. Despite trading volumes below the

2022 peak, the update could boost OpenSea during a challenging time

for NFTs.

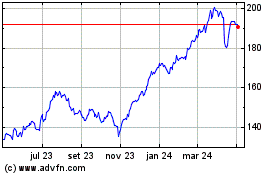

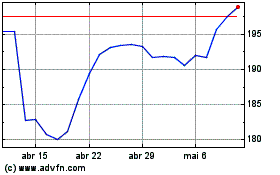

JP Morgan Chase (NYSE:JPM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

JP Morgan Chase (NYSE:JPM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024