U.S. Stocks Move Sharply Lower On Interest Rate Concerns

15 Novembro 2024 - 6:38PM

IH Market News

After coming under pressure late in Thursday’s session, stocks

showed a more substantial move to the downside during trading on

Friday. The major averages all moved sharply lower on the day,

pulling back well off Monday’s record closing highs.

The major averages climbed off their worst levels in late-day

trading but remained firmly negative. The tech-heavy Nasdaq led the

way lower, plunging 427.53 points or 2.2 percent to 18,680.12.

The S&P 500 (SPI:SP500) also tumbled 78.55 points or 1.3

percent to 5,870.62, while the narrower Dow slid 305.87 points or

0.7 percent to 43,444.99.

With the steep drop on the day, the major averages also moved

significantly lower for the week. The Nasdaq dove by 3.2 percent,

the S&P 500 tumbled by 2.1 percent and the Dow slumped by 1.2

percent.

The sell-off on Wall Street came amid concerns about the outlook

for interest rates following Federal Reserve Chair Powell’s remarks

on Thursday suggesting the central bank doesn’t need to hurry to

lower rates.

Citing the strength of the U.S. economy, Powell said the Fed can

take a careful approach to future monetary policy decisions.

The Fed is still seen as likely to lower interest rates next

month, but CME Group’s FedWatch Tool suggests the chances of a

quarter point rate cut have fallen to 58.4 percent from 72.2

percent on Thursday.

Potentially adding to concerns economic strength will lead the

Fed to hold off on future rate cuts, the Commerce Department

released a report showing retail sales increased by slightly more

than expected in October.

The Commerce Department said retail sales rose by 0.4 percent in

October after growing by an upwardly revised 0.8 percent in

September.

Economists had expected retail sales to climb by 0.3 percent

compared to the 0.4 percent increase originally reported for the

previous month.

The Labor Department also released a report showing unexpected

increases by import and export prices in the month of October,

which may have added to recent worries about sticky inflation.

“Strong retail sales, underpinned by stronger revisions,

underscores a resilient consumer but higher than expected

import/export prices puts the Fed on further alert for hotter

inflation as they assess whether a pause – rather than another rate

cut – is more appropriate at its next Fed meeting,” said Quincy

Krosby, Chief Global Strategist for LPL Financial.

Meanwhile, the Fed released a report showing industrial

production decreased in October, as the effects of recent

hurricanes and the since-resolved strike at Boeing (NYSE:BA)

continued to weigh on growth.

Sector News

Biotechnology stocks moved sharply lower on news President-elect

Donald Trump has picked vaccine skeptic Robert F. Kennedy Jr. as

Health and Human Services Secretary.

Reflecting the weakness in the sector, the NYSE Arca

Biotechnology Index plunged by 3.4 percent to a three-month closing

low.

Substantial weakness was also visible among semiconductor

stocks, as reflected by the 2.4 percent slump by the Philadelphia

Semiconductor Index. The index tumbled to its lowest closing level

in over two months.

Semiconductor equipment maker Applied Materials (NASDAQ:AMAT)

led the sector lower after reporting better than expected fiscal

fourth quarter results but providing disappointing revenue guidance

for the current quarter.

Pharmaceutical, networking, software and retail stocks also saw

considerable weakness, while utilities stocks were among the few

groups to buck the downtrend.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance during trading on Friday.

Japan’s Nikkei 225 Index rose by 0.3 percent, while China’s

Shanghai Composite Index tumbled by 1.5 percent.

Meanwhile, the major European markets all moved to the downside

on the day. While the French CAC 40 Index slid by 0.6 percent, the

German DAX Index fell by 0.3 percent and the U.K.’s FTSE 100 Index

edged down by 0.1 percent.

In the bond market, treasuries recovered from early weakness to

end the day little changed. As a result, the yield on the benchmark

ten-year note, which moves opposite of its price, crept up by just

1.0 basis points to 4.428 percent after reaching a five-month

intraday high of 4.505 percent.

Looking Ahead

Following a busy week on the U.S. economic front, the economic

calendar for next week is relatively quiet, although reports on

housing starts, existing home sales and weekly jobless claims may

still attract attention.

SOURCE: RTTNEWS

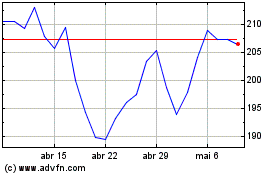

Applied Materials (NASDAQ:AMAT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

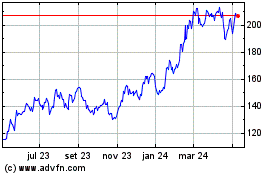

Applied Materials (NASDAQ:AMAT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024