Escalating Tensions With Russia May Lead To Pullback On Wall Street

19 Novembro 2024 - 11:07AM

IH Market News

The major U.S. index futures are currently pointing to a lower

open on Tuesday, with stocks likely to move back to the downside

following the rebound seen in the previous session.

The downward momentum on Wall Street comes amid concerns about

escalating tensions between the U.S. and Russia.

After President Joe Biden gave Ukraine permission to attack

Russian territory using U.S.-made long-range missiles, Russian

President Vladimir Putin has signed a decree amending the country’s

nuclear doctrine.

Kremlin Spokesperson Dmitry Peskov said the updated doctrine

says Russia “reserves the right to use nuclear weapons in the event

of aggression with the use of conventional weapons against it or

the Republic of Belarus, which creates a critical threat to

sovereignty or territorial integrity.”

“Aggression against the Russian Federation by any non-nuclear

state with the participation or support of a nuclear state is

considered a joint attack,” Peskov added, according to NBC

News.

Shortly before the Kremlin updated its nuclear weapons doctrine,

Ukraine reportedly used U.S.-made long-range missiles to attack a

Russian military facility in the Bryansk border region.

Following the sell-off seen during last Friday’s session, stocks

moved back to the upside during trading on Monday. The Nasdaq and

the S&P 500 regained ground, although the narrower Dow ended

the day modestly lower.

While the Nasdaq climbed 111.69 points or 0.6 percent to

18,791.81 and the S&P 500 rose 23.00 points or 0.4 percent to

5,893.62, the Dow edged down 55.39 points or 0.1 percent to

43,389.60.

The rebound on Wall Street may partly have reflected bargain

hunting, as traders looked to pick up stocks at somewhat subdued

levels following the steep drop seen last week.

The major averages pulled back well off their record highs last

week amid concerns about the outlook for interest rates along with

worries about the impact of President-elect Donald Trump’s proposed

policies and cabinet nominees.

Buying interest was somewhat subdued, however, as traders looked

ahead to the release of quarterly results from AI darling Nvidia

(NASDAQ:NVDA).

Nvidia, which has recently been a driver of the markets, is

scheduled to release its fiscal third quarter results after the

close of trading on Wednesday.

In U.S. economic news, the National Association of Home Builders

released a report showing homebuilder confidence has improved by

much more than anticipated in the month of November.

The report said the NAHB/Wells Fargo Housing Market Index

climbed to 46 in November after rising to 43 in October. Economists

had expected the index to inch up to 44.

With the much bigger than expected increase, the housing market

index reached its highest level since hitting 51 in April.

Gold stocks moved sharply higher on the day, resulting in a 4.2

percent spike by the NYSE Arca Gold Bugs Index. The rally by gold

stocks came amid a substantial increase by the price of the

precious metal.

Considerable strength was also visible among computer hardware

stocks, as reflected by the 2.8 percent surge by the NYSE Arca

Computer Hardware Index.

Super Micro Computer (NASDAQ:SMCI) led the sector higher after a

report from Barron’s said the company is expected to file a plan to

avoid being delisted from the Nasdaq.

Natural gas, steel and oil stocks also saw significant strength,

while airline stocks showed a notable move to the downside.

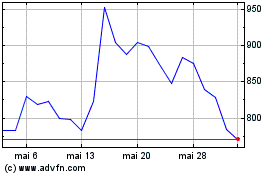

Super Micro Computer (NASDAQ:SMCI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Super Micro Computer (NASDAQ:SMCI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025