Nvidia Earnings In Focus On Wall Street

20 Novembro 2024 - 11:05AM

IH Market News

The major U.S. index futures are currently pointing to initial

strength on Wednesday, with stocks likely to see further upside

after ending the previous session mostly higher.

The upward momentum on Wall Street comes as traders look ahead

to release of quarterly results from AI darling Nvidia

(NASDAQ:NVDA) after the close of today’s trading.

Nvidia, which has recently been a major market leader, is up by

0.5 percent in pre-market trading after surging by 4.9 percent on

Tuesday.

Early buying interest may be somewhat subdued, however, as

traders continue to express concerns about escalating tensions

between Ukraine and Russia.

A lack of major U.S. economic data may also keep some traders on

the sidelines ahead of Nvidia’s results, although comments from

several Fed officials may attract attention.

Among individual stocks, shares of Target (NYSE:TGT) are moving

sharply lower in pre-market trading after the retailer reported

weaker than expected third quarter results and lowered its

full-year guidance.

Chinese electric vehicle maker Nio (NYSE:NIO) may also move to

the downside after reporting third quarter sales that missed

analyst estimates.

On the other hand, shares of Comcast (NASDAQ:CMCSA) may see

initial strength after the company announced its intent to spin off

a portfolio of NBCUniversal’s cable television networks, including

USA Network, CNBC, and MSNBC, into a new publicly traded

company.

Stocks moved to the downside early in the session on Tuesday but

showed a significant rebound over the course of the trading day.

The Nasdaq and the S&P 500 climbed well off their early lows

and into positive territory, although the narrower Dow remained

stuck in the red.

The major averages eventually ended the day mixed. While the Dow

fell 120.66 points or 0.3 percent to 43,268.94, the S&P 500

rose 23.36 points or 0.4 percent to 5,916.98 and the Nasdaq jumped

195.66 points or 1.0 percent to 18,987.47.

The early weakness on Wall Street came amid concerns about

escalating tensions between the U.S. and Russia over the war in

Ukraine.

After President Joe Biden gave Ukraine permission to attack

Russian territory using U.S.-made long-range missiles, Russian

President Vladimir Putin has signed a decree amending the country’s

nuclear doctrine.

Kremlin Spokesperson Dmitry Peskov said the updated doctrine

says Russia “reserves the right to use nuclear weapons in the event

of aggression with the use of conventional weapons against it or

the Republic of Belarus, which creates a critical threat to

sovereignty or territorial integrity.”

“Aggression against the Russian Federation by any non-nuclear

state with the participation or support of a nuclear state is

considered a joint attack,” Peskov added, according to NBC

News.

Shortly before the Kremlin updated its nuclear weapons doctrine,

Ukraine reportedly used U.S.-made long-range missiles to attack a

Russian military facility in the Bryansk border region.

Selling pressure waned shortly after the start of trading,

however, with an advance by shares of Nvidia helping lead the

turnaround by the Nasdaq.

Retail giant Walmart (NYSE:WMT) also showed a notable move to

the upside after reporting better than expected third quarter

results and raising its full-year guidance.

Meanwhile, shares of Lowe’s (NYSE:LOW) slumped after the home

improvement retailer reported third quarter results that exceeded

estimates but forecast a decrease by full-year sales.

Computer hardware stocks extended the substantial rebound seen

in the previous session, driving the NYSE Arca Computer Hardware

Index up by 3.3 percent. The index continued to regain ground after

hitting a two-month closing low last Friday.

Super Micro Computer (NASDAQ:SMCI) led the sector higher once

again after announcing BDO as its independent auditor and

submitting a compliance plan to the Nasdaq.

Gold stocks also saw significant strength amid an increase by

the price of the precious metal, with the NYSE Arca Gold Bugs Index

jumping by 2.3 percent.

On the other hand, airline stocks moved sharply lower on the

day, resulting in a 4.6 percent nosedive by the NYSE Arca Airline

Index.

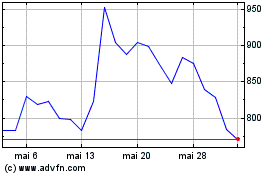

Super Micro Computer (NASDAQ:SMCI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Super Micro Computer (NASDAQ:SMCI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025