Bargain Hunting, Window Dressing May Lead To Rebound On Wall Street

31 Dezembro 2024 - 11:03AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Tuesday, with stocks likely to regain ground following the

steep drop seen over the two previous sessions.

Traders may look to pick up stocks at relatively reduced levels

following the recent pullback, which dragged the major averages

down near the one-month lows set earlier in December.

Window-dressing may also contribute to strength on Wall Street,

as some traders look to boost their portfolios going into the end

of the year.

Despite the recent softness, the major averages are already

poised to post standout gains for 2024, with the tech-heavy Nasdaq

up by nearly 30 percent for the year.

The Dow has also surged by 13 percent for the year, while the

S&P 500 is on pace to post its second consecutive yearly gain

of more than 20 percent.

Overall trading activity is likely to wane over the course of

the session, however, as traders look to get a head start on their

New Year’s Eve celebrations.

After moving sharply lower early in the session, stocks regained

some ground over the course of the trading day on Monday but

remained firmly in negative territory. The major averages added to

the steep losses posted last Friday.

The Dow climbed off its worst levels after tumbling by more than

700 points in early trading but still ended the day down 418.48

points or 1.0 percent at 42,573.73.

The tech-heavy Nasdaq also dove 235.25 points or 1.2 percent to

19,486.78 and the S&P 500 slumped 63.90 points or 1.1 percent

to 5,906.94.

The early weakness on Wall Street reflected an extension of the

sell-off seen last Friday, with some traders taking profits going

into the end of the year.

The major averages still remain poised to post substantial gains

for 2024, as the tech-heavy Nasdaq is up by nearly 30 percent for

the year.

Technology stocks climbed off their worst levels after helping

lead the early slump but still ended the day notably lower.

Significant weakness was visible among semiconductor stocks, as

reflected by the 1.9 percent loss posted by the Philadelphia

Semiconductor Index.

Outside the tech sector, gold stocks saw considerable weakness

amid a decrease by the price of the precious metal, dragging the

NYSE Arca Gold Bugs Index down by 1.8 percent.

Pharmaceutical, healthcare and retail stocks also saw notable

weakness, moving lower along with most of the other major

sectors.

A slump by shares of Boeing (NYSE:BA) also weighed on the Dow,

as the aerospace giant tumbled by 2.3 percent after South Korea’s

Transport Ministry ordered an inspection of B737-800 aircraft after

the deadly Jeju Air crash over the weekend.

The early sell-off on Wall Street may have been exaggerated by

below average volume, as many traders remain away from their desks

ahead of the New Year’s Day holiday on Wednesday.

In U.S. economic news, a report released by the National

Association of Realtors showed pending home sales surged by much

more than expected in the month of November.

NAR said its pending home sales index shot up by 2.2 percent to

79.0 in November after jumping by 1.8 percent to 77.3 in October.

Economists had expected pending home sales to climb by 0.7

percent.

The pending home sales index increased for the fourth

consecutive month, reaching its highest level since February

2023.

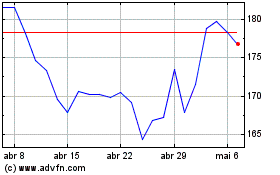

Boeing (NYSE:BA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Boeing (NYSE:BA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025