U.S. Stocks Finish Volatile Session Modestly Lower

02 Janeiro 2025 - 6:46PM

IH Market News

Stocks moved notably higher early in the session on Thursday but

failed to sustain the upward move and fluctuated over the course of

the trading day.

The major averages swung back and forth across the unchanged

line in morning trading before sliding more firmly into negative

territory in the early afternoon only to regain ground in the

latter part of the session.

The major averages eventually ended the day modestly lower. The

Dow fell 151.95 points or 0.4 percent to 42,392.27, the Nasdaq

dipped 30.00 points or 0.2 percent to 19,280.79 and the S&P 500

(SPI:SP500) slipped 13.08 points or 0.2 percent to 5,868.55.

The early strength on Wall Street came as some traders looked to

pick up stocks at relatively reduced levels following the notable

downward move seen to close out 2024.

Buying interest waned shortly after the start of trading,

however, as a Labor Department report showing an unexpected decline

by weekly jobless claims seemingly provides support for the Federal

Reserve’s measured approach to lowering interest rates.

The report said initial jobless claims slipped to 211,000 in the

week ended December 28th, a decrease of 9,000 from the previous

week’s revised level of 220,000.

The dip surprised economist, who had expected jobless claims to

inch up to 222,000 from the 219,000 originally reported for the

previous week.

With the unexpected decrease, jobless claims fell to their

lowest level since hitting 209,000 in the week ended April 27,

2024.

“The claims data are consistent with a labor market that is

strong enough to allow the Federal Reserve to proceed with rate

cuts at a more measured pace in 2025,” said Nancy Vanden Houten,

Lead US Economist at Oxford Economics.

She added, “Our baseline is for three rate cuts this year,

although the risk following the mid-December FOMC meeting is for

fewer cuts.”

The subsequent volatility may have reflected below average

volume, as many traders remained away from their desks following

the New Year’s Day holiday on Wednesday.

The modestly lower close by the broader markets came amid a

slump by shares of Tesla (NASDAQ:TSLA), with the electric vehicle

maker plunging by 6.1 percent after reporting a decrease by annual

deliveries in 2024.

Tech giant Apple (NASDAQ:AAPL) also tumbled by 2.6 percent

following news the company is offering discounts on its latest

iPhone models in China amid heightened competition.

Sector News

Despite the modestly lower close by the broader markets, gold

stocks moved sharply higher on the day, resulting in a 4.4 percent

spike by the NYSE Arca Gold Bugs Index. The rally by gold stocks

came amid a jump by the price of the precious metal.

A surge by the price of crude oil also contributed to

significant strength among oil producer stocks, as reflected by the

1.3 percent gain posted by the NYSE Arca Oil Index.

Natural gas and brokerage stocks also saw significant strength,

while housing, airline and commercial real estate stocks showed

notable moves to the downside.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance on Thursday. China’s Shanghai

Composite Index and Hong Kong’s Hang Seng Index tumbled by 2.7

percent and 2.2 percent, respectively, while Australia’s

S&P/ASX 200 Index climbed by 0.5 percent.

Meanwhile, the major European markets all moved to the upside on

the day. While the U.K.’s FTSE 100 Index jumped by 1.1 percent, the

German DAX Index advanced by 0.6 percent and the French CAC 40

Index rose by 0.2 percent.

In the bond market, treasuries pulled back near the unchanged

line after seeing early strength. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, inched

up by less than a basis point to 4.575 percent after hitting a low

of 4.517 percent.

Looking Ahead

Trading on Friday may be impacted by reaction to a report on

U.S. manufacturing sector activity in the month of December.

SOURCE: RTTNEWS

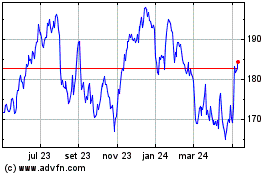

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

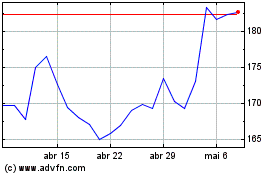

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025