Positive Reaction To Inflation Data May Spark Early Rally On Wall Street

15 Janeiro 2025 - 11:06AM

IH Market News

The major U.S. index futures are currently

pointing to a sharply higher open on Wednesday, with stocks likely

to show a strong move to the upside following the lackluster

performance seen in the previous session.

Stocks are likely to benefit from a positive reaction to the

Labor Department’s closely watched report on consumer price

inflation in the month of December.

While the report showed consumer prices rose by slightly more

than expected in December, the annual rate of core consumer price

growth unexpectedly slowed.

The Labor Department said its consumer price index climbed by

0.4 percent in December after rising by 0.3 percent in November.

Economists had expected consumer prices to rise by another 0.3

percent.

The report also said the annual rate of growth by consumer

prices accelerated to 2.9 percent in December from 2.7 percent in

November, in line with economist estimates.

Meanwhile, the Labor Department said core consumer prices, which

exclude food and energy prices, edged up by 0.2 percent in December

after increasing by 0.3 percent for four straight months. The

uptick matched expectations.

The annual rate of growth by core consumer prices slowed to 3.2

percent in December from 3.3 percent in November, while economists

had expected yearly growth to remain unchanged.

Positive sentiment is also likely to be generated in reaction to

positive earnings news from financial giants JPMorgan Chase

(NYSE:JPM), Goldman Sachs (NYSE:GS) and Citigroup (NYSE:C).

JPMorgan Chase, Goldman Sachs and Citigroup are all seeing

notable pre-market strength after reporting quarterly earnings that

exceeded analyst estimates.

After failing to sustain an early move to the upside, stocks

showed a lack of direction over the course of the trading session

on Tuesday. The major averages swung back and forth across the

unchanged line before eventually closing narrowly mixed.

While the tech-heavy Nasdaq dipped 43.71 points or 0.2 percent

to 19,044.39, the S&P 500 inched up 6.69 points or 0.1 percent

to 5,842.91 and the Dow climbed 221.16 points or 0.5 percent to

42,518.28.

The initial strength on Wall Street came

following the release of a Labor Department report showing producer

prices rose by slightly less than expected in the month of

December.

The Labor Department said its producer price index for final

demand crept up by 0.2 percent in December after climbing by 0.4

percent in November. Economists had expected producer prices to

rise by 0.3 percent.

Meanwhile, the report said the annual rate of producer price

growth accelerated to 3.3 percent in December from 3.0 percent in

November. The acceleration matched economist estimates.

The smaller than expected monthly increase by producer prices

helped ease recent concerns about the outlook for inflation and

interest rates, although the faster annual growth kept buying

interest somewhat subdued.

Traders may also have been reluctant to make more significant

moves ahead of the release of the more closely watched report on

consumer price inflation.

Gold stocks moved sharply higher on the day, resulting in a 2.8

percent spike by the NYSE Arca Gold Bugs Index. The rally by gold

stocks came amid a modest increase by the price of the precious

metal.

Substantial strength was also visible among housing stocks, as

reflected by the 2.7 percent surge by the Philadelphia Housing

Sector Index.

Airline stocks also showed a significant move to the upside,

driving the NYSE Arca Airline Index up by 2.4 percent.

Networking, natural gas and banking stocks also saw notable

strength, while pharmaceutical stocks showed a considerable move to

the downside.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

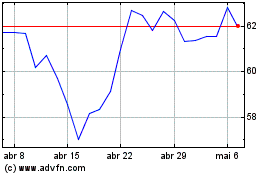

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

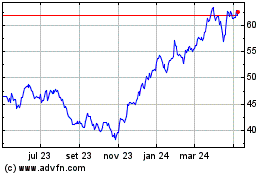

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025