Positive Reaction To Inflation Data, Bank Earnings Leads To Rally On Wall Street

15 Janeiro 2025 - 6:44PM

IH Market News

Stocks moved sharply higher early in the session on Wednesday

and continued to turn in a strong performance throughout the

trading day. The major averages all surged after ending Tuesday’s

trading narrowly mixed.

The tech-heavy Nasdaq posted a standout gain, soaring 466.84

points or 2.5 percent to 19,511.23 after ending the previous

session at its lowest closing level in almost two months.

The Dow also jumped 703.27 points or 1.7 percent to 43,221.55,

while the S&P 500 (SPI:SP500) shot up 107.00 points or 1.8

percent to 5,949.91.

The rally on Wall Street reflected a positive reaction to the

Labor Department’s closely watched report on consumer price

inflation in the month of December.

While the report showed consumer prices rose by slightly more

than expected in December, the annual rate of core consumer price

growth unexpectedly slowed.

The Labor Department said its consumer price index climbed by

0.4 percent in December after rising by 0.3 percent in November.

Economists had expected consumer prices to rise by another 0.3

percent.

The report also said the annual rate of growth by consumer

prices accelerated to 2.9 percent in December from 2.7 percent in

November, in line with economist estimates.

Meanwhile, the Labor Department said core consumer prices, which

exclude food and energy prices, edged up by 0.2 percent in December

after increasing by 0.3 percent for four straight months. The

uptick matched expectations.

The annual rate of growth by core consumer prices slowed to 3.2

percent in December from 3.3 percent in November, while economists

had expected yearly growth to remain unchanged.

“Core Inflation isn’t accelerating and that’s the story,” said

Jamie Cox, Managing Partner for Harris Financial Group. “The market

may have had its hair on fire about inflation running away again,

but the data do not support that conclusion.”

Positive sentiment was also generated in reaction to upbeat

earnings news from financial giants JPMorgan Chase (NYSE:JPM),

Goldman Sachs (NYSE:GS) and Citigroup (NYSE:C).

Sector News

Financial stocks moved sharply higher in reaction to the upbeat

earnings news, with the KBW Bank Index and the NYSE Arca

Broker/Dealer Index spiking by 4.1 percent and 3.1 percent,

respectively.

Substantial strength was also visible among interest

rate-sensitive housing stocks, resulting in a 2.3 percent surge by

the Philadelphia Housing Sector Index.

Computer hardware, semiconductor and software stocks also saw

considerable strength, contributing to the strong upward move by

the tech-heavy Nasdaq.

Retail, steel and energy stocks also showed notable moves to the

upside on the day, moving higher along with most of the other major

sectors.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance during trading on Wednesday.

Japan’s Nikkei 225 Index edged down by 0.1 percent, while Hong

Kong’s Hang Seng Index rose by 0.3 percent.

Meanwhile, the major European markets all moved to the upside on

the day. While the German DAX Index surged by 1.5 percent, the

U.K.’s FTSE 100 Index jumped by 1.2 percent and the French CAC 40

Index climbed by 0.7 percent.

In the bond market, treasuries moved sharply higher in reaction

to the consumer price inflation data. Subsequently, the yield on

the benchmark ten-year note, which moves opposite of its price,

plunged by 13.5 basis points to 4.653 percent.

Looking Ahead

Trading on Thursday may be impacted by reaction to a slew of

U.S. economic data, including reports on weekly jobless claims and

retail sales.

On the earnings front, Bank of America (NYSE:BAC), Morgan

Stanley (NYSE:MS) and UnitedHealth (NYSE:UNH) are among the

companies due to report their quarterly results before the start of

trading.

SOURCE: RTTNEWS

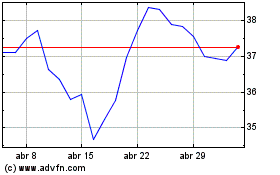

Bank of America (NYSE:BAC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Bank of America (NYSE:BAC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025