U.S. Stocks Move Sharply Higher, Dow Reaches One-Month Closing High

17 Janeiro 2025 - 6:44PM

IH Market News

Stocks showed a strong move to the upside during trading on

Friday, with the major averages more than offsetting the losses

posted in the previous session. With the upward move, the Dow ended

the day at its best closing level in a month.

The major averages pulled back off their best levels in the

latter part of the session but remained firmly positive. The Nasdaq

surged 291.91 points or 1.5 percent to 19,630.20, the S&P 500

(SPI:SP500) jumped 59.32 points or 1.0 percent to 5,996.66 and the

Dow climbed 334.70 points or 0.8 percent to 43,487.83.

The major averages also posted strong gains for the week. The

Dow soared by 3.7 percent, while the S&P 500 and the Nasdaq

shot up by 2.9 percent and 2.5 percent, respectively.

Stocks may have benefitted from the recent decrease by treasury

yields even though the yield on the benchmark ten-year note

recovered from an early slump to end the day roughly flat.

The recent retreat by treasury yields came as the U.S. inflation

data released over the past few days led to renewed optimism about

the outlook for interest rates.

Adding to the interest rate optimism, Federal Reserve Governor

Christopher Waller told CNBC the central bank could lower interest

rates multiple times this year if inflation eases as he is

expecting.

“As long as the data comes in good on inflation or continues on

that path, then I can certainly see rate cuts happening sooner than

maybe the markets are pricing in,” Waller said during an interview

with Sara Eisen on CNBC’s “Squawk on the Street” on Thursday.

Waller said the number of rate cuts would be driven by the data,

suggesting the Fed could cut rates three or four times if there is

a lot of progress on inflation or cut rates twice or only once if

inflation remains sticky.

The strength on Wall Street may also have reflected optimism

about the outlook for the markets under President-elect Donald

Trump, who is due to be sworn in for the second time on Monday.

Stocks surged in reaction to Trump’s election in November amid

expectations of more pro-business policies in the new

administration, although there are also concerns about the impact

of proposed tariffs.

In U.S. economic news, the Federal Reserve released a report

showing industrial production increased by much more than expected

in the month of December.

The Fed said industrial production jumped by 0.9 percent in

December after rising by a revised 0.2 percent in November.

Economists had expected industrial production to climb by 0.3

percent compared to the 0.1 percent dip originally reported for the

previous month.

Sector News

Semiconductor stocks turned in some of the market’s best

performances on the day, driving the Philadelphia Semiconductor

Index up by 2.8 percent.

Applied Materials (NASDAQ:AMAT) posted a notable gain after

KeyBanc Capital Markets upgraded its rating on the company’s stock

to Overweight from Sector Weight.

Significant strength was also visible among retail stocks, as

reflected by the 1.5 percent gain posted by the Dow Jones U.S.

Retail Index.

Banking, brokerage and software stocks also saw notable

strength, while pharmaceutical stocks showed a substantial move to

the downside.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in another mixed performance during trading on

Friday. Japan’s Nikkei 225 Index fell by 0.3 percent, while China’s

Shanghai Composite Index crept up by 0.2 percent.

Meanwhile, the major European markets also showed strong moves

to the upside on the day. While the U.K.’s FTSE 100 Index surged by

1.4 percent, the German DAX Index shot up by 1.2 percent and the

French CAC 40 Index jumped by 1.0 percent.

In the bond market, treasuries pulled back near the unchanged

line after seeing early strength. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, inched

up by less than a basis point to 4.609 percent after hitting a low

of 4.568 percent.

Looking Ahead

Following the Martin Luther King Jr. Day on Monday, next week’s

trading may be driven by reaction to the latest earnings news amid

a relatively light U.S. economic calendar.

3M (NYSE:MMM), Netflix (NASDAQ:NFLX), Procter & Gamble (PG),

Johnson & Johnson (NYSE:JNJ), Travelers (TRV), America Express

(NYSE:AXP) and Verizon (VZ) are among the companies due to report

their quarterly results.

Any significant actions in the early days of the new Trump

administration following his inauguration on Monday could also

impact next week’s trading.

SOURCE: RTTNEWS

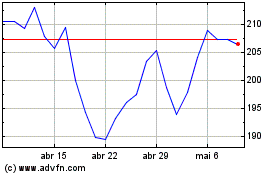

Applied Materials (NASDAQ:AMAT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

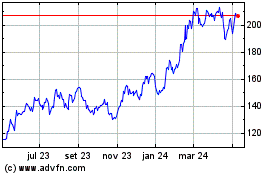

Applied Materials (NASDAQ:AMAT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025