Nvida Stock Plunges Into The Red: $600 Billion Lost On DeepSeek Announcement

28 Janeiro 2025 - 6:59AM

IH Market News

Shares in chip manufacturer Nvidia (NASDAQ:NVDA) fell by 17% on

Monday, its worst daily percentage loss since the start of the

Covid pandemic in March 2020 briefly crashed the markets.

It was the single greatest one-day value wipeout any company has

ever suffered. The previous record of $279 in September 2024 was

also held by Nvidia.

The loss of $589 in market capitalization knocked the company

from its position as the world’s most valuable company. Its

valuation fell from $3.5 trillion to $2.9 trillion, putting it back

below Apple and Microsoft.

Other tech stocks also took a hit. Micron (NASDAQ:MU) tumbled

11.7%, AMD (NASDAQ:AMD) closed down 6.4%, Cisco (NASDAQ:CSCO)

closed lower by 5$. Alphabet (NASDAQ:GOOG), Intel (NASADAQ:INTC),

Tesla (NAASDAQ:TSLA) and Microsoft (NASDAQ:MSFT) also ended sharply

lower.

The fall, which was part of a general sell-off of tech stocks,

was prompted by the announcement by Chinese company DeepSeek that

it had developed a large-language model at a fraction of the cost

of previous AI companies such as OpenAI’s ChatGPT. DeepSeek said it

had spent just $5.6 million on Nvidia technology to develop its

product. This puts the brakes on Nvidia’s meteoric rise, which saw

its profits soar due to demand for its GPUs from tech giants

developing AI such as Meta and OpenAI.

If it turns out that the most powerful hardware is not necessary

to produce the best AI models, then Nvidia’s sales could be hit,

meaning its stock looks badly overpriced.

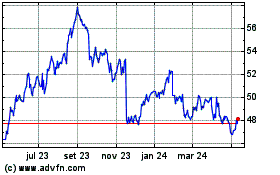

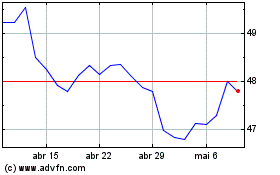

Cisco Systems (NASDAQ:CSCO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Cisco Systems (NASDAQ:CSCO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025