The major U.S. index futures are currently

pointing to a higher open on Friday, with stocks likely to add to

the gains posted during yesterday’s volatile session.

Apple (NASDAQ:AAPL) may help lead an early advance on Wall

Street, as the tech giant is surging by 4.3 percent in pre-market

trading,

The jump by shares of Apple comes after the company reported

fiscal first quarter results that exceeded analyst estimates on

both the top and bottom lines.

Semiconductor giant Intel (NASDAQ:INTC) is also seeing

pre-market strength after reporting fourth quarter earnings that

exceeded analyst estimates.

Early buying interest may also be generated in reaction to a

closely watched Commerce Department report showing consumer prices

in the U.S. increased in line with economist estimates in the month

of December.

The Commerce Department said its personal consumption

expenditures (PCE) price index rose by 0.3 percent in December

after inching up by 0.1 percent in November. The increase matched

expectations.

The annual rate of growth by the PCE price index accelerated to

2.6 percent in December from 2.4 percent in November, which was

also in line with estimates.

Excluding food and energy prices, the core PCE price index crept

up by 0.2 percent in December following a 0.1 percent uptick in

November. The core price growth also matched expectations.

The annual rate of growth by the core PCE price index in

December came in at 2.8 percent, unchanged from the two previous

months and in line with estimates.

The inflation readings, which are preferred by the Federal

Reserve, were included in a report on personal income and

spending.

Stocks saw considerable volatility over the course of the

trading session on Thursday, with the major averages showing wild

swings back and forth across the unchanged line before eventually

closing in positive territory.

The Dow climbed 168.61 points or 0.4 percent to 44,882.13,

ending the day within striking distance of the record closing high

set in early December.

The S&P 500 also advanced 31.86 points or 0.5 percent to

6,071.17, while the Nasdaq rose 49.43 points or 0.3 percent to

19,681.75.

The major averages moved sharply lower late in the session after

President Donald Trump said he would follow through on his threat

to impose 25 percent tariffs on imports from Canada and Mexico on

Saturday, February 1st.

However, the major averages rebounded going into the close,

reflecting the significant volatility seen throughout the

session.

The choppy trading on the day came amid a mixed reaction to

earnings news from several big-name companies.

Shares of IBM Corp. (NYSE:IBM) skyrocketed by 13.0 percent after

the tech giant reported fourth quarter earnings that exceeded

analyst estimates.

Facebook parent Meta Platforms (NASDAQ:META) also posted a

notable gain after reporting fourth quarter results that beat

estimates on both the top and bottom lines.

On the other hand, shares of Microsoft (NASDAQ:MSFT) plunged by

6.2 percent after the software giant reported better than expected

fiscal second quarter results but provided disappointing revenue

guidance for the current quarter.

Delivery giant UPS (NYSE:UPS) also showed a substantial move to

the downside, plummeting by 14.1 percent after reporting fourth

quarter earnings that beat expectations but forecasting full-year

revenue below analyst estimates.

UPS also announced it has reached an agreement with Amazon

(NASDAQ:AMZN) to lower its volume by more than 50 percent by the

second half of 2026.

In U.S. economic news, the Commerce Department released a report

showing U.S. economic growth in the fourth quarter of 2024 slowed

by more than expected.

Gold stocks moved sharply higher as the price

of the precious metal reached highs, driving the NYSE Arca Gold

Bugs Index up by 4.1 percent to its best closing level in well over

a month.

Interest rate-sensitive utilities and housing stocks also saw

considerable strength, with the Dow Jones Utility Average and the

Philadelphia Housing Sector Index surging by 2.4 percent and 2.3

percent, respectively.

Significant strength was also visible among semiconductor

stocks, as reflected by the 2.3 percent jump by the Philadelphia

Semiconductor Index.

Networking, airline and pharmaceutical stocks also saw notable

strength, while the steep drop by Microsoft weighed on the software

sector.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

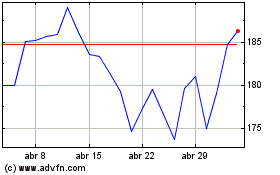

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025