Tech Stocks May Lead Early Pullback On Wall Street

05 Fevereiro 2025 - 11:00AM

IH Market News

The major U.S. index futures are currently

pointing to a lower open on Wednesday, with stocks likely to give

back ground after ending the previous session mostly higher.

Tech stocks may lead an early pullback on Wall Street amid a

negative reaction to earnings news from Alphabet (NASDAQ:GOOGL) and

Advanced Micro Devices (NASDAQ:AMD).

Shares of Alphabet are tumbling by 7.6 percent in pre-market

trading after the Google parent reported better than expected

fourth quarter earnings but its cloud revenues missed

estimates.

Chip maker AMD is also plunging by 9.9 percent in pre-market

trading after reporting fourth quarter earnings and revenues that

beat estimates but its data center sales fell short of

expectations.

Shares of Disney (NYSE:DIS) are also seeing pre-market weakness

after the entertainment giant reported better than expected fiscal

first quarter earnings but warned it expects a “modest decline” in

Disney+ subscribers in the current quarter.

Worries about the Federal Reserve leaving interest rates on hold

for a prolonged period may also weigh on stocks after payroll

processor ADP released a report showing private sector employment

in the U.S. increased by more than expected in the month of

January.

ADP said private sector employment climbed by 183,000 jobs in

January after rising by an upwardly revised 176,000 jobs in

December.

Economists had expected private sector employment to rise by

150,000 jobs compared to the addition of 122,000 jobs originally

reported for the previous month.

Stocks moved mostly higher during trading on Tuesday, largely

offsetting the weakness seen in the previous session. The major

averages all moved to the upside on the day, with the tech-heavy

Nasdaq leading the charge.

The major averages finished the session just off their best

levels of the day. The Nasdaq jumped 262.06 points or 1.4 percent

to 19,654.02, the S&P 500 climbed 43.31 points or 0.7 percent

to 6,037.88 and the Dow rose 134.13 points or 0.3 percent to

44,556.04.

The strength on Wall Street partly reflected

easing concerns about a global trade war after President Donald

Trump agreed to pause 25 percent tariffs on imports from Mexico and

Canada for a month.

Positive sentiment may also have been regenerated in reaction to

a report from the Labor Department showing job openings in the U.S.

fell by much more than expected in the month of December.

The report said job openings tumbled to 7.6 million in December

after climbing to an upwardly revised 8.2 million in November.

Economists had expected job openings to dip to 8.0 million from

the 8.1 million originally reported for the previous month.

The data led to some optimism about the outlook for interest

rates ahead of the release of the Labor Department’s more closely

watched monthly jobs report on Friday.

Meanwhile, traders largely shrugged off news that China has

slapped retaliatory tariffs on U.S. imports in response to a 10

percent trade duty imposed on Chinese goods.

China’s Finance Ministry said it will impose a 15 percent duty

on imports of coal and liquefied natural gas from the U.S.

In addition, there will be a 10 percent tariff on imports from

the U.S. of crude oil, agricultural equipment and automobiles

beginning February 10.

Oil stocks moved sharply higher despite a decrease by the price

of crude oil, resulting in a 3.0 percent surge by the NYSE Arca Oil

Index.

Considerable strength was also visible among computer hardware

stocks, as reflected by the 2.5 percent jump by the NYSE Arca

Computer Hardware Index.

Steel, retail and networking stocks also saw significant

strength on the day, moving higher along with most of the other

major sectors.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

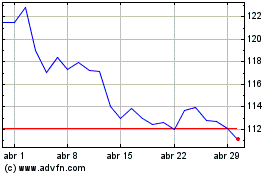

Walt Disney (NYSE:DIS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Walt Disney (NYSE:DIS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025