U.S. Stocks Give Back Ground Following Early Rebound

26 Fevereiro 2025 - 6:42PM

IH Market News

Stocks showed a strong move to the upside early in the session

on Wednesday but have given back ground since then. The major

averages have pulled back well off their highs of the session, with

the Dow sliding firmly into negative territory.

Currently, the major averages are turning in a mixed

performance. While the Dow is down 213.78 points or 0.5 percent at

43,407.38, the S&P 500 (SPI:SP500) is 3.48 points or 0.1

percent at 5,958.73 and the Nasdaq is up 68.46 points or 0.4

percent at 19,094.84.

The early strength on Wall Street partly reflected bargain

hunting following weakness, which saw the Nasdaq and the S&P

500 close lower for four straight sessions.

The tech-heavy Nasdaq tumbled to its lowest closing level in

three months on Tuesday, while the S&P 500 fell to a one-month

closing low.

Buying interest has waned over the course of the session,

however, as traders express caution ahead of earnings news from

Nvidia (NASDAQ:NVDA).

The AI darling and market leader has pulled back off its best

levels but remains up by 3.6 percent ahead of the release of its

fourth quarter financial results after the close of today’s

trading.

“Nvidia is due to report its fourth-quarter and full-year

results on Wednesday and investors will be looking forward to the

usual demolition of forecasts and also positive guidance for the

next quarter from chief executive Jensen Huang,” said AJ Bell

investment director Russ Mould.

“Failure to deliver the customary upside surprise might not sit

well,” he added. “Nvidia’s shares are no higher than they were last

summer, despite strong earnings and ongoing investor enthusiasm for

all things related to artificial intelligence, so any unexpected

disappointment could cause some share price turbulence.”

The pullback by stocks also comes after President Donald Trump

reiterated he is “not stopping” previously delayed tariffs on

Canada and Mexico, saying they would go into effect with “no

exceptions.”

“We’ve been taken advantage of as a country for a long period of

time,” Trump said. “We’ve been tariffed, but we didn’t tariff.”

In U.S. economic news, the Commerce Department released a report

showing a substantial pullback by new home sales in the U.S. in the

month of January.

The Commerce Department said new home sales plunged by 10.5

percent to an annual rate of 657,000 in January after spiking by

8.1 percent to an upwardly revised rate of 734,000 in December.

Economists had expected new home sales to slump by 2.6 percent

to an annual rate of 680,000 from the 698,000 originally reported

for the previous month.

Sector News

Networking stocks continue to see substantial strength on the

day, with the NYSE Arca Networking Index surging by 2.8 percent

after ending the previous session at its lowest closing level in

over a month.

Considerable strength also remains visible among computer

hardware stocks, as reflected by the 2.3 percent jump by the NYSE

Arca Computer Hardware Index.

Gold, semiconductor and brokerage stocks are also turning in

strong performances, while housing and oil stocks have moved to the

downside over the course of the session.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance on Wednesday. Japan’s Nikkei

225 Index fell by 0.3 percent, while China’s Shanghai Composite

Index jumped by 1.0 percent and Hong Kong’s Hang Seng Index spiked

by 3.3 percent.

Meanwhile, the major European markets all moved to the upside on

the day. While the German DAX Index shot up by 1.6 percent, the

French CAC 40 Index surged by 1.2 percent and the U.K.’s FTSE 100

Index climbed by 0.7 percent.

In the bond market, treasuries have moved higher over the course

of the session, adding to recent gains. Subsequently, the yield on

the benchmark ten-year note, which moves opposite of its price, is

down by 3.4 basis points at 4.264 percent.

SOURCE: RTTNEWS

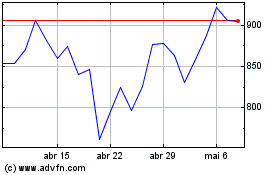

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025