Upbeat Nvidia Earnings May Lead To Initial Strength On Wall Street

27 Fevereiro 2025 - 11:15AM

IH Market News

The major U.S. index futures are currently

pointing to initial strength on Wall Street on Thursday, with

stocks likely to see further upside after ending the previous

session mostly higher but well off their best levels

The markets are likely to benefit from a positive reaction to

earnings news from Nvidia (NASDAQ:NVDA), as the AI darling and

market leader is jumping by 1.7 percent in pre-market trading.

The advance by Nvidia comes after the company reported better than

expected fourth quarter results and provided upbeat revenue

guidance for the current quarter.

Buying interest may be somewhat subdued, however, as concerns about

President Donald Trump’s threatened tariffs continue to weigh on

sentiment.

Traders are also digesting the latest batch of U.S. economic data,

including a Labor Department report showing first-time claims for

U.S. unemployment benefits climbed much more than expected in the

week ended February 22nd.

The report said initial jobless claims rose to 242,000, an increase

of 22,000 from the previous week’s revised level of 220,000.

Economists had expected initial jobless claims to inch up to

221,000 from the 219,000 originally reported for the previous

month.

While the report could add to recent concerns about the economic

outlook, the data may also generate renewed optimism about

potential interest rate cuts.

A separate report released by the Commerce Department showed

durable goods orders surged by much more than expected in January,

although the growth was largely due to a spike in volatile orders

for transportation equipment.

Stocks showed a strong move to the upside early in the session on

Wednesday but gave back ground over the course of the trading day.

The major averages pulled back well off their highs of the session,

although the Nasdaq and the S&P 500 managed to close in

positive territory.

After surging by as much as 1.3 percent, the tech-heavy Nasdaq

ended the day up 48.88 points or 0.3 percent to 19,075.26. The

S&P 500 eked out a more modest gain, inching up 0.81 points or

less than a tenth of a percent to 5,956.06, while the narrower Dow

bucked the uptrend and slid 188.04 points or 0.4 percent to

43,433.12.

The early strength on Wall Street partly reflected

bargain hunting following recent weakness, which saw the Nasdaq and

the S&P 500 close lower for four straight sessions.

The tech-heavy Nasdaq tumbled to its lowest closing level in three

months on Tuesday, while the S&P 500 fell to a one-month

closing low.

Buying interest waned over the course of the session, however, as

traders expressed caution ahead of the earnings news from

Nvidia.

The pullback by stocks also came after President Donald Trump

reiterated he is “not stopping” previously delayed tariffs on

Canada and Mexico.

While a 30-day pause on those tariffs is set to expire on March

4th, Trump indicated the tariffs would take effect on April 2nd,

the same day he purportedly plans to announce reciprocal tariffs on

other U.S. trade partners.

In U.S. economic news, the Commerce Department released a report

showing a substantial pullback by new home sales in the U.S. in the

month of January.

The Commerce Department said new home sales plunged by 10.5 percent

to an annual rate of 657,000 in January after spiking by 8.1

percent to an upwardly revised rate of 734,000 in December.

Economists had expected new home sales to slump by 2.6 percent to

an annual rate of 680,000 from the 698,000 originally reported for

the previous month.

Networking stocks saw substantial strength on the day, with the

NYSE Arca Networking Index surging by 2.8 percent after ending the

previous session at its lowest closing level in over a month.

Significant strength was also visible among semiconductor stocks,

as reflected by the 2.1 percent jump by the Philadelphia

Semiconductor Index.

Computer hardware, gold and brokerage stocks also saw notable

strength, while housing stocks came under pressure over the course

of the session.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

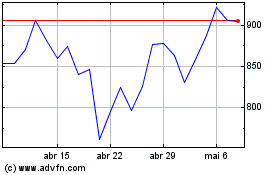

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025