Mohawk Group (NASDAQ: MWK) Appears To Be At

Bargain Prices

April 13, 2020 -- InvestorsHub NewsWire -- via Spotlight Growth --

Investors get very emotional when it comes to their money –

especially losing it. Fear of loss (and not understanding

stock valuation) drives investors to sell down to bargain basement

prices. Evidence of this is the stock market's long history

of going from extreme highs to extreme lows and back again.

Investors will always have news to drive their emotions (and

stock prices) to extremes. In the 1990's, stocks of internet

companies went to the stratosphere. Eventually fear drove

internet stocks, including those with bright futures and those that

didn't, down to very low valuations. Investors who recognized

the quality companies were able to take advange

of excellent prices.

MWK Falls Victim to Overall Global Stock Market Sell-Off

Despite Revenue Growth

A growth company now appearing at bargain prices is Mohawk Group

Holdings, Inc. (NASDAQ:

MWK), a tech-based consumer

goods startup. The Mohawk Group uses artificial

intelligence on their proprietary ecommerce platform to get the

right products in front of the right people. Using

proprietary AI technology, the company can launch new products in

just 6 to 8 months. That is much faster than the typical

release for a new consumer packaged goods product, which still

relies on old methods that take 1 to 2 years.

Source: Mohawk Group

Mohawk's third-party logistics network can reach over 90% of the

U.S. population in one-to-two days with Prime-certified shipping.

In just six years since starting operations, they have become

one of the largest sellers on Amazon.

Mohawk's technical advantage is starting to show. Sales are growing at a blistering pace. Revenue

has tripled over the past three years. The company is a

startup with a market capitalization of just $29 million, so they

are still too small for professional fund managers to invest.

That gives nimble individual investors an advantage, the

opportunity to purchase a great growth stock before professionals

can.

MWK Appears to Be Undervalued Based on Revenue Growth,

Price-to-Sales Ratio at 0.20

On April 9, 2020, Mohawk Group released preliminary first quarter

2020 net revenue between $25.0 million and $26.0 million.

This represents year-over-year growth of over 40%. The Wall Street

average estimate for MWK Q1 net revenues is at $23.4 million,

according to an analyst poll by Capital IQ.

A Price-to-Sales ratio between 1 and 2 is considered good, and

excellent if it's below 1. The Price-to-Sales ratio for MWK

stock is at now at just 0.20. This shows investors can buy an

early stage growth stock at deeply discounted prices.

During the recent fourth quarter earnings conference call,

Co-Founder and CEO Yaniv Sarig discussed quarterly results and

outlook. He said, “We are pleased with our fourth quarter

results and our strong finish to the year. 2019 marked a year of

progress on our strategic priorities that included 32 new products

launched, product category expansion and the growth of our AIMEE

software platform. These activities fueled top-line growth of

over 56% with improved Adjusted EBITDA for the year while we also

continued to invest for the future.

Source: Yahoo Finance

Looking ahead, we believe that our differentiated A.I. driven

business model provides Mohawk with a tremendous amount of

opportunity to grow market share in existing and new categories and

to generate meaningful profitability and increased shareholder

value over the long-term.”

In fiscal 2019, Mohawk reported sales of $114 million, up 35%

year-over-year. They also released 32 new products in

2019. Mohawk is using AI technology to position itself at the cutting

edge of the consumer packaged-goods industry.

Recently, the Financial Times released

its list of the top 500 fastest growing companies in 2020. Mohawk

made the list at #114. This beat out other notable major

companies:

- Uber Technologies, Inc. (NYSE:

UBER) ranked #144

- Tesla, Inc. (NASDAQ:

TSLA) #158

- Twilio, Inc. (NYSE: TWLO) #205

- Grubhub, Inc. (NYSE:

GRUB) #299

- Canada Goose (NYSE: GOOS) #310

- Netflix, Inc. (NASDAQ: NFLX) #371

Mohawk's fast growth shows its use of technology is a

fundamental advantage. Mohawk is in a position

to beat the competition for years to come.

More About Mohawk Group Holdings, Inc.

Mohawk Group Holdings, Inc. and subsidiaries (“Mohawk”) is a

rapidly growing technology-enabled consumer products company that

uses machine learning, natural language processing, and data

analytics to design, develop, market and sell products. Mohawk

predominantly operates through online retail channels such as

Amazon, and Walmart. Mohawk has incubated and grouped four owned

and operated brands: hOme, Vremi, Xtava and RIF6. Mohawk sells

products in multiple categories, including home and kitchen

appliances, kitchenware, environmental appliances (i.e.,

dehumidifiers and air conditioners), beauty-related products and,

to a lesser extent, consumer electronics. Mohawk was founded on the

premise that if a company selling consumer packaged goods was

founded today, it would apply artificial intelligence and machine

learning, the synthesis of massive quantities of data and the use

of social proof to validate high caliber product offerings as

opposed to over-reliance on brand value and other traditional

marketing tactics.

Disclaimer:

Spotlight Growth is compensated, either directly or via a third

party, to provide investor relations services for its

clients. Spotlight Growth creates exposure for companies

through a customized marketing strategy, including design of

promotional material, the drafting and editing of press releases

and media placement.

All information on featured companies is provided by the

companies profiled, or is available from public sources. Spotlight

Growth and its employees are not a Registered Investment Advisor,

Broker Dealer or a member of any association for other research

providers in any jurisdiction whatsoever and we are not qualified

to give financial advice. The information contained herein is based

on external sources that Spotlight Growth believes to be reliable,

but its accuracy is not guaranteed. Spotlight Growth may create

reports and content that has been compensated by a company or

third-parties, or for purposes of self-marketing. Spotlight Growth

was compensated five thousand dollars for the creation and

dissemination of this content by the company.

This material does not represent a solicitation to buy or sell

any securities. Certain statements contained herein constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements may

include, without limitation, statements with respect to the

Company's plans and objectives, projections, expectations and

intentions. These forward-looking statements are based on current

expectations, estimates and projections about the Company's

industry, management's beliefs and certain assumptions made by

management.

The above communication, the attachments and external Internet

links provided are intended for informational purposes only and are

not to be interpreted by the recipient as a solicitation to

participate in securities offerings. Investments referenced

may not be suitable for all investors and may not be permissible in

certain jurisdictions.

Spotlight Growth and its affiliates, officers, directors, and

employees may have bought or sold or may buy or sell shares in the

companies discussed herein, which may be acquired prior, during or

after the publication of these marketing materials. Spotlight

Growth, its affiliates, officers, directors, and employees may sell

the stock of said companies at any time and may profit in the event

those shares rise in value. For more information on our

disclosures, please visit: http://spotlightgrowth.com/index.php/disclosures/

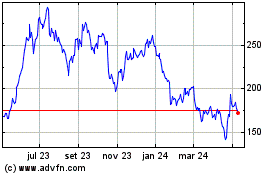

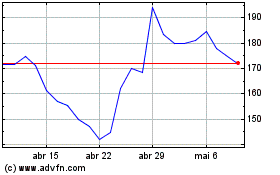

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024