Quant (QNT) Gains Over 34% In A Turbulent Week For Others

17 Outubro 2022 - 9:39PM

NEWSBTC

Quant (QNT) is the first blockchain OS that enjoyed continued gains

in the last week despite other coins facing turbulent times. The

top-30 coin has enjoyed a five-day upswing, gaining over 34%. As of

writing, Quant’s price is trading at $198, although it broke its

$206 resistance during the day. The token is experiencing a

resurgence that has seen it beat Bitcoin (BTC) and Ethereum (ETH)

over the same period. However, it’s still trading at about 50%

below its all-time high of $427.42. Related Reading: Crypto Won’t

See Bull-Run Anytime Soon, This Expert Explains Why Why Is Quant

Gaining So Much? Santiment, a blockchain analytics startup,

attributes QNT’s increase to “Volume, daily active addresses, and

whale accumulation.” The company also said that whales had amassed

15% of the currency in just 5 months. Intotheblock data reveals

that around sixty percent of coin holders acquired their coins

between one and twelve months ago. However, it appears that the

network’s recent changes are what piqued the interest of a new

generation of holders. The network introduced the Tokenise

mechanism in June, enabling the production of QRC20 tokens

compatible with ERC20 tokens. The network also supported the QRC721

standard, allowing users to build and deploy safe, interoperable

non-fungible tokens on its blockchain. Lunar Crush’s data also

suggests that social media generally has positive attitudes toward

the currency. Quant’s social mentions and interactions increased by

43.24% and 64.57% in the last week, respectively. What The Charts

Say About Quant Quant coin price is increasing with the help of a

rounding bottom pattern on the daily time frame chart. This bullish

pattern is common at market lows. In principle, its U shape

indicates a turnaround in investor confidence following a decline.

Furthermore, the current upswing began when the price reversed from

$42.7 on June 18. As a result, the value of one Quant coin

increased by 430% in just four short months. Quant, however, has

been on a five-day winning streak while most of the leading

cryptocurrencies battle with uncertainty. In addition, the rising

amount of trades shows that buyers and sellers are becoming

increasingly enthusiastic. Additionally, the altcoin jumped by 12%

today and decisively broke through the previously mentioned

resistance level of $206. This breakthrough provides buyers solid

ground to stand on, which could keep this rally going for another

10.84% to $240. However, Quant’s price saw extreme buying in a

short period, which is unsustainable for longer bull runs. As a

result, a correction in pricing is anticipated to happen soon.

TradingView Expert Says Quant Is Overbought Meanwhile, a

Tradingview expert remarked that Quant had entered the overbought

region. The asset’s Relative Strength Index (RSI) was greater than

75. Typically, a score on the RSI of more than 70 suggests an asset

is overbought. Then, a score of less than 30 indicates that the

asset is oversold. Related Reading: A Bullish Week In Bitcoin On

The Way? BTCUSD Analysis October 17, 2022 Overbought conditions on

the daily RSI indicate excessive purchasing, and a correction phase

is needed to stabilize prices. The rising EMAs (20, 50, 100, and

200) may provide sufficient support to restart the current uptrend

after a likely correction. Featured image from Pixabay and chart

from TradingView.com

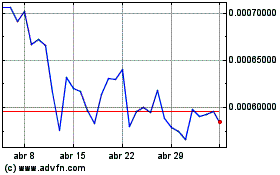

OMI Token (COIN:OMIUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

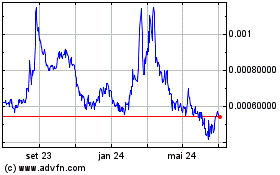

OMI Token (COIN:OMIUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024

Notícias em tempo-real sobre OMI Token da Criptomoeda bolsa de valores: 0 artigos recentes

Mais Notícias de ECOMI