Bitcoin Two-Month Rally Slows Down, What’s Next?

27 Fevereiro 2023 - 10:00AM

NEWSBTC

Over the past month, Bitcoin has seen a significant uptrend of

about 40%, starting from the beginning of the year. As a result,

BTC pulled a massive bullish trend carrying the rest of the crypto

market along with it as other altcoins have also surged more than

10% respectively. BTC is starting to bow to a bearish move

following the bullish trend. In January, BTC barely had days with

no bullish moves. However, since the beginning of February, BTC has

had breaks from the continuous rally up by only 1.3% in February as

opposed to the nearly 50% seen last month. Bitcoin Two-Month

Rally Slows Down February has proven to be a month for a BTC

rally break as negative news hit the headline this month more than

positive ones. The SEC began the month with a back-to-back crypto

crackdown. Though at first, BTC and the rest of the crypto market

showed no concern over the headline, however, the aftermath has

started to take effect on the market. In the last 48 hours,

BTC has suffered a toil from higher-for-longer interest rates to

damp inflation that has pushed it below the ranging $24,000 mark.

Besides that, the largest crypto by market cap has also experienced

regulators’ frightening opinions. Related Reading: Bitcoin Whales

Plummets To 2019 lows, What This Means For BTC In a meeting hosted

by India under the G-20 Indian presidency on Friday, US Treasury

Secretary Janet Yellen highlighted some reasons for having to apply

robust regulation on digital assets mentioning that though there

won’t be an outright ban on crypto, there would be a “strong

regulatory framework.” Furthermore, on Sunday, IMF managing

director Kristalina Georgieva voiced a statement expressing that if

crypto could begin to pose higher risks to financial stability, the

idea of banning it shouldn’t be completely ruled out.

Statements such as these including crackdowns from regulators such

as the SEC have impacted BTC’s recent bearish trend. Since the

beginning of the month, BTC has only added about $1,500 to its

value. The asset surged above the $25,000 mark once this month and

didn’t take long before beginning to immediately trade below

it. Overall, the asset has shown fizzling trend indicating a

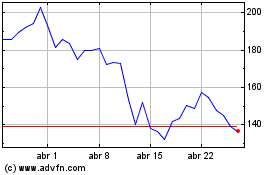

slowdown from its bullish uptick. Looking at the 1-day time frame,

BTC seems to have support at $23,800. Should the asset plummet

below that, we could see a continuous bearish trend from the

largest crypto by market cap. In contrast, the chart also indicates

liquidity to the upside just above $30,000. Should BTC rise above

its previous high of $25,000, the chances of seeing a spike to

above $30,000 are significant. Related Reading: BTC Down 2%

As $1.8 Billion Bitcoin Options Contract Expires Today Crypto

Market Follows Through Bitcoin is not the only asset in the market

experiencing a slowdown from its rally. Ethereum has also

experienced a slowdown after hitting $1,700 for the first time in

four months. Solana has also fallen from its high of $26 seen on

the 9th of this month to trade below $23, down by 6.6% in the past

30 days. This plummet comes after one of several downturns the

Solana blockchain has been facing including the recent network

outage which occurred during the weekend. So far, more than $1

billion has left Solana’s market cap between February 9 and

February 27. Meanwhile, despite the slight bears here and

there, Bitcoin and other altcoins have started to pick up. In the

last 24 hours, Bitcoin has risen 0.8%, Ethereum by 2.3% following

its upcoming Shanghai launch, and Solana is up only 0.1%. Featured

image from Unsplash, Chart from TradingView.

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024