Bitcoin Leads Gains Among Large Cryptos, What Does This Mean?

14 Março 2023 - 10:30AM

NEWSBTC

Since Sunday, Bitcoin has been on an upward rally that has

reinvigorated the market once more. The digital asset went from

trading below $20,000 to reclaiming its spot above $24,000 once

more, all in the span of one day. Naturally, other assets in the

space have followed BTC’s lead and returned to the green territory

but Bitcoin continues to forge ahead of the large caps in terms of

gains. Bitcoin Stays Ahead Of The Pack The vast majority of the

crypto market is back in the green once more, but Bitcoin has

managed to stay ahead of the pack. Usually, cryptocurrencies in the

market, especially the large caps, tend to closely track the

recovery pattern of BTC. But this time around, they have not been

able to maintain gains on the same level as the leading

cryptocurrency. Related Reading: Buy Signal? Bitcoin Investor

Sentiment Falls To Lowest Level In Two Months Bitcoin’s rally saw

it cross $24,000 and in the last day, the digital asset’s gains

have risen above 12%. However, while the large cap cryptocurrencies

have also followed the recovery, they have registered fewer gains

compared to the market leader. An example of this is Ethereum,

which is the only one out of the large caps to maintain a higher

than 50% performance compared to BTC. It the last day, the

second-largest cryptocurrency by market cap is up 6.82% compared to

BTC’s 12.21%. BTC stays ahead of large caps | Source: Coinmarketcap

Going further down the list, BNB is up only 3.52% in the 24-hour

period. Similarly, Cardano (ADA) is seeing 3.32% gains, while

Polygon (MATIC) and Dogecoin (DOGE) are up 5.25% and 5.16%,

respectively. XRP is the worst performer of the pack with only

2.43% gains. Altcoin Season Could Change The Narrative Bitcoin

historically starts moving before the rest of the market but

eventually, the altcoins do catch up. A period when altcoins in the

market are rallying regardless of whether BTC is moving or not is

known as ‘altcoin season’ and it is a period where altcoins begin

the race to catch up with Bitcoin’s gains. BTC clears $25,000

resistance | Source: BTCUSD on TradingView.com This is what

happened in mid-2021 when altcoins began to rally exponentially

right after BTC established support above the $40,000 gains. This

gave altcoins time to catch up and lower market caps allowed for

higher multiples when it came to gains. Related Reading: Bitcoin

Dealt Another Round Of Blows, Is The Bear Market Back? Now, this

could follow the same trend this time around, meaning that the gap

between Bitcoin and the large cap could be merely temporary. If

this is the case, then altcoins could easily stage a catch-up rally

in the next week, which will see double-digit gains among the large

caps, and that liquidity will trickle down all the way to the small

caps. Such a top-down rally can signal the start of the next bull

market. At the time of writing, Bitcoin has cleared the $25,000

level after being rejected in the early hours of Tuesday. $25,000

currently stands as the most important level for the digital asset

for it to secure its short to mid-term bull rally and a comfortable

move above this means that $30,000 becomes the next significant

level. Follow Best Owie on Twitter for market insights, updates,

and the occasional funny tweet… Featured image from Anadolu Agency,

chart from TradingView.com

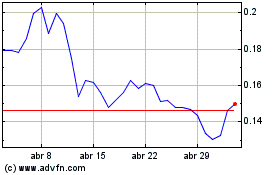

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024