Bitcoin Korea Premium Index Turns Red, Decline Incoming?

07 Abril 2023 - 1:00PM

NEWSBTC

Data shows the Bitcoin Korea Premium Index has taken a negative

value recently, something that could lead to a drawdown in the

asset’s price. Bitcoin Korea Premium Index Has Declined Into

Negative Values Recently As pointed out by an analyst in a

CryptoQuant post, past instances of this trend have resulted in

pullbacks for the price of the cryptocurrency. The “Korea Premium

Index” is an indicator that measures the difference between the

Bitcoin price listed on South Korean exchanges and that listed on

foreign platforms. This metric helps us know whether Korean

investors are currently buying more or less of the cryptocurrency

compared to the investors residing in other parts of the world.

When the value of the metric is positive, it means the price listed

on the South Korean exchanges is higher than that on the global

exchanges right now. Such a trend implies that Korean holders are

applying a higher buying pressure (or perhaps just a lower selling

pressure) than foreign investors. On the other hand, negative

values of the indicator suggest that users of the South Korean

exchanges are selling more of the cryptocurrency than the global

holders currently. Related Reading: Bitcoin Loss Taking Spikes, Why

This Could Be Bullish Now, here is a chart that shows the trend in

the Bitcoin Korea Premium Index over the past year: The value of

the metric seems to have declined in recent days | Source:

CryptoQuant As shown in the above graph, the Bitcoin Korea Premium

Index has had a positive value for much of the current rally that

started back in January of this year. This would suggest that the

Korean investors have been participating in a heavier amount of

buying than the foreign investors. Recently, however, the indicator

has been gradually going down, implying that the buying pressure

from this segment of the market has been dropping off.

Coincidentally, the price of the cryptocurrency has overall moved

sideways since this trend formed. In the last few days, the metric

has now declined enough to enter into the negative territory, which

is a sign that the buying pressure may now have flipped into

selling pressure instead. In the chart, the quant has marked the

past instances where the Bitcoin Korea Premium Index had assumed

some strong negative values. It looks like whenever such values of

the indicator appeared, the BTC price observed some decline shortly

after. Related Reading: Bitcoin Price Poised To Hit $50,000, This

Crypto Expert Predicts Based on this pattern, the cryptocurrency

may be at risk of another drawdown in the near future. However, the

metric still only has a small negative value so far, while the past

declines have generally come when the values have been much lower.

This may mean that if the Bitcoin Korean Premium Index doesn’t

decrease further from here, the trend that was seen in the past

might not repeat itself. BTC Price At the time of writing, BTC is

trading around $27,900, up 1% in the last week. Looks like BTC

hasn't stopped its consolidation yet | Source: BTCUSD on

TradingView Featured image from Kanchanara on Unsplash.com, charts

from TradingView.com, CryptoQuant.com

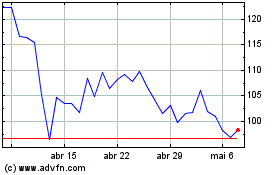

Quant (COIN:QNTUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Quant (COIN:QNTUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024