Green Bitcoin: Sustainable Energy Usage Surges To Record 55% High

22 Fevereiro 2024 - 12:00PM

NEWSBTC

Bitcoin, the enigmatic cryptocurrency known for its volatile price

swings and digital gold status, is making a surprising play for a

new title: sustainability champion. A recent analysis by Bitcoin

environmental impact expert Daniel Batten reveals a remarkable

surge in renewable energy use for mining, reaching a staggering

55%. This marks a significant shift from just four years ago, when

the figure languished below 40%, and paints a picture of an

industry undergoing a green metamorphosis. Related Reading: Apecoin

Climbs To 6-Month High Amidst Whales’ Strategic Moves From Carbon

Culprit To Clean Crusader? Bitcoin’s mining process, essential for

creating new coins, has historically been a lightning rod for

environmental criticism. The sheer computing power required gulps

up massive amounts of electricity, often sourced from fossil fuels.

This led to accusations of Bitcoin being a climate villain, spewing

greenhouse gases and contributing to global warming. However, the

narrative is evolving. Companies like Luxor Technology are

harnessing Ethiopia’s hydroelectric bounty, while Argentina’s

Unblock Global repurposes wasted natural gas from oil reserves.

Source: Daniel Batten Even domestic players like CleanSpark are

upping their game with low-carbon solutions. These efforts, coupled

with an overall decline in mining emissions intensity, suggest a

genuine commitment to going green. The Green Rush: Challenges And

Cautions Despite the positive strides, the sustainability of

Bitcoin is far from over. The ever-growing network demands more

energy, and ensuring enough renewable sources to keep pace is

critical. Bitcoin market cap currently at $1.014 trillion. Chart:

TradingView.com Furthermore, the environmental impact extends

beyond energy consumption. The mountains of discarded mining

hardware raise concerns about e-waste, another hurdle on the path

to true sustainability. The Future: Doubling Down On Green The

success of Bitcoin’s green gamble hinges on several factors.

Continued investment in renewable energy infrastructure is

paramount, and regulatory frameworks that incentivize sustainable

practices could play a vital role. Ultimately, the industry needs

to demonstrate a long-term commitment to environmental

responsibility, moving beyond individual success stories to ensure

widespread adoption of green solutions. Related Reading: Ethereum

Bullish Run: Analyst Eyes $4,500 After ETH Breached $3K While the

jury is still out on whether Bitcoin can truly shed its

carbon-intensive past, the recent surge in renewable energy use is

a promising sign. This green gamble, if played with transparency,

scalability, and a holistic approach to sustainability, could pave

the way for a future where Bitcoin and the environment coexist in

harmony. The question remains: will Bitcoin’s green hand win the

game, or will it fold under the weight of its own growth and

environmental concerns? Only time, and the industry’s commitment,

will tell. Featured image from Karolina Grabowska/Pexels, chart

from TradingView

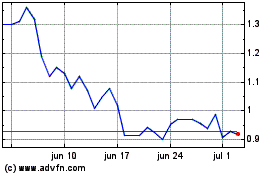

ApeCoin (COIN:APEUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

ApeCoin (COIN:APEUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025