Bitcoin Crossroads: Analyst Identifies Level Set To Determine Next Move

04 Março 2024 - 8:30AM

NEWSBTC

Bitcoin has been on an upward trajectory for a while now,

witnessing a significant rally within the broader crypto market and

reaching the $64,000 threshold on Sunday, as analysts have

identified trends that could decide the asset’s next direction.

Bitcoin Poised To Witneesed A Rally Or Dip In Short Term

Cryptocurrency analyst and trader Ali Martinez has taken to the

social media platform X (formerly Twitter) to share his insights on

Bitcoin’s price action in the short term with the crypto community.

Related Reading: JPMorgan Analysts Predict Bitcoin Crash To $42,000

Post-Halving – What You Need To Know Martinez has spotted an area

that could either lead to an uptick or a correction. Ali Martinez

highlighted that more than half a million Bitcoins have been

transacted within the range of $61,100 and $61,800, and as a

result, the crypto asset has formed a “substantial support area.”

According to the analyst, BTC is expected to rise towards $65,900,

if it manages to hold above this level. However, the experts expect

this to happen considering the lack of obstacles that lie ahead.

Furthermore, Martinez has also pointed out the potential for

Bitcoin to undergo a correction if it falls below the support

level. The crypto analyst stated that if this happens, BTC could

decline to “$56,970 or even deeper to $51,500.” The Post read: Over

500,000 BTC have been transacted in the range of $61,100 to

$61,800, which has created a substantial support area. If Bitcoin

remains above this threshold, it could climb towards $65,900, given

the minimal resistance ahead. Conversely, should BTC dip below

support, a correction could lead it down to $56,970 or even

$51,500. Ali Martinez’s predictions came in light of the broader

crypto market experiencing a significant rally. Presently, the

entire crypto market is seeing a substantial capital inflow not

recorded in over 2 years. Martinez noted in another X post that

approximately $48.54 billion is entering the crypto market,

indicating a rise in investors’ interest in crypto. He further

underscored that the development marks the “largest inflow of

capital since October 2021.” So far, experts forecast that in the

upcoming months, there will be bigger financial inflows due to more

lucid cryptocurrency regulatory frameworks. BTC ETFs To Control 10%

Of The Crypto Asset’s Supply Bitcoin Spot Exchange-Traded Funds

(ETFs) continue to gain traction as BTC maintains its upward

momentum. Due to this, SkyBridge founder Anthony Scaramucci has

predicted that the products could “take control of 10% of BTC’s

supply.” Related Reading: Bitcoin ETFs Threaten Gold’s Dominance As

Digitalization Trends Gain Momentum Scaramucci noted that a lot of

BTCs have been “lost since the ETFs were introduced.” Consequently,

ETFs now boast about 776,000 BTC since the products began

trading. However, he expects the products to take control of

the aforementioned percent “when it hits 1.7 million BTC.” Anthony

Scaramucci is confident that when this happens, there will be a

swift rise in Bitcoin’s price. Currently, the price of Bitcoin is

trading at $65,184, demonstrating an increase of over 5% in the

last 24 hours. Meanwhile, its market cap and trading volume are

both up by 5% and 79% respectively in the past day. Featured image

from iStock, chart from Tradingview.com

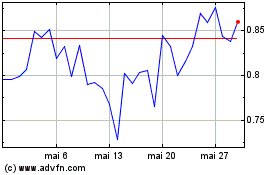

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024