FTX Seeks Customer Consensus: Multi-Billion Dollar Compensation Plan Goes To Vote

25 Junho 2024 - 11:00PM

NEWSBTC

FTX, the failed crypto exchange, will seek customer approval for

its Chapter 11 plan to compensate victims and resolve government

penalties stemming from the platform’s fraudulent collapse in

November 2022. The decision by Judge John Dorsey marks a

significant step forward in the two-year-long bankruptcy

proceedings, as voting by creditors plays a pivotal role in

restructuring efforts. While FTX’s plan has gained support from key

customer committees, a vocal group remains opposed and demands

substantial revisions. FTX Offers Customers 119% Asset Recovery

According to Bloomberg, under the proposed plan, most FTX customers

are expected to recover 119% of their assets as of the day the

company filed for Chapter 11 in November 2022. Other creditors may

receive up to 143% of their owed amounts. FTX’s legal team

maintains that bankruptcy law necessitates valuing claims based on

their value at the time of filing, despite subsequent increases in

cryptocurrency prices. Related Reading: Bitwise CIO Bullish On Spot

Ethereum ETFs: Envisions $15 Billion Inflows FTX’s decision to

solicit votes from its customer base stems from the desire to

obtain feedback from previously uninvolved parties regarding the

repayment plan. Additionally, the company is still

negotiating with federal authorities and exploring options to

utilize government claims against FTX to compensate affected

customers. Notably, FTX has already settled a $24 billion tax

claim from the US Internal Revenue Service. Under the settlement

terms, the firm will pay the IRS $200 million within 60 days of

implementing the proposed restructuring plan. The settlement

allows FTX to pay a fraction of the amount claimed by the IRS,

clearing the way for the exchange to distribute significant

customer recoveries. The IRS will also receive a lower priority

claim of $685 million, which will be paid on a subordinated basis

to customers and other creditors, depending on the availability of

funds. These details were outlined in a filing made by FTX in the

US Bankruptcy Court for the District of Delaware. SBF’s Fraud

Conviction Shadows Bankruptcy Proceedings FTX is currently

monetizing its assets, as the platform reportedly lacked segregated

digital assets directly connected to claims against the exchange.

Instead, FTX possesses a collection of assets acquired using stolen

customer funds, representing a complex challenge in the

compensation process. Customers have until August 16 to vote on the

Chapter 11 plan. Judge Dorsey will then review and potentially

approve the plan on October 7, considering the outcome of the

customer vote. Related Reading: Crypto Research Firm Says Bitcoin

Crash Below $60,000 May Not Be The End, Here’s Why FTX filed for

bankruptcy after its founder, Sam Bankman-Fried (SBF), shut down

the crypto trading platform in 2022 and relinquished control to

bankruptcy professionals. Bankman-Fried subsequently faced a

25-year fraud conviction, which he recently announced he would

appeal. As of this writing, the exchange’s native token FTT is

trading at $1.43, up 2% in the past 24 hours and just 27%

year-to-date. Featured image from DALL-E, chart from

TradingView.com

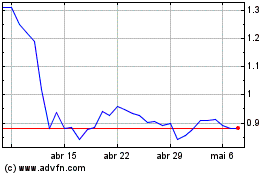

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024