Bitcoin Crashes To $64,000: Will This Historical Support Hold?

26 Julho 2024 - 2:00AM

NEWSBTC

On-chain data shows Bitcoin is retesting a historically significant

support level after the latest plunge in the asset’s price has gone

through. Bitcoin Is Currently Retesting The Short-Term Holder

Realized Price As explained by CryptoQuant community manager

Maartunn in a new post on X, BTC has returned to the Realized Price

of the short-term holders with its drawdown. The “Realized Price”

here refers to an on-chain indicator that, in short, keeps track of

the acquisition price or cost basis of the average investor in the

Bitcoin sector. When the value of this metric is greater than the

cryptocurrency’s spot price, the holders are in a state of net

unrealized loss right now. On the other hand, being below the

asset’s value implies dominance of profits in the market. Related

Reading: Cardano Among Alts Likely To See Price Boosts, Santiment

Says In the context of the current discussion, the Realized Price

of the entire market isn’t of interest, but that of only a segment

of it: the short-term holders (STHs). The STHs include all

investors who bought their BTC within the past 155 days. Now, here

is a chart that shows the trend in the Bitcoin Realized Price

specifically for the STHs over the past month: The above graph

shows that the Bitcoin spot price has declined towards the STH

Realized Price in its latest drawdown. This would mean that the

break-even point of the STHs is now being retested. Historically,

this retest has proven to be quite important for the

cryptocurrency. The line has served as a transition boundary

between bearish and bullish periods. Generally, when the asset is

in the region above the STH Realized Price, retests of the

indicator lead to it reversing back up. Similarly, the line acts as

resistance when the coin is under it. The explanation behind this

curious pattern may lie in investor psychology. Related Reading:

Ethereum Spot ETF Hype: ETH Whale Activity 64% More Than BTC The

STHs are the fickle-minded hands of the market, who easily react to

movements in the asset. As such, they are naturally sensitive to

retests of their cost basis and may make moves when they happen.

When the atmosphere in the sector is bullish, the STHs usually look

at their cost basis as a buying opportunity. This is why the level

acts as support during bullish periods. In times of bearish

sentiment, these investors may panic sell at their break-even

instead, thus providing resistance to the asset. The Bitcoin spot

price had managed to break through this resistance earlier in the

month, but with the plunge, it’s now retesting it again. It remains

to be seen if support holds here, confirming the prevalence of a

bullish mentality, or a dip under it happens, thus suggesting a

transition to a bearish market. BTC Price At the time of writing,

Bitcoin is trading at around $64,800, down more than 2% over the

past 24 hours. Featured image from Dall-E, CryptoQuant.com, chart

from TradingView.com

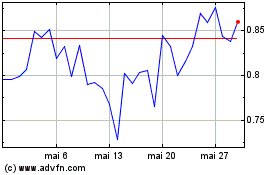

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Mina (COIN:MINAUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024