Solana (SOL) Funding Rate Signals A Decline: Investors Expect $130

30 Agosto 2024 - 11:00AM

NEWSBTC

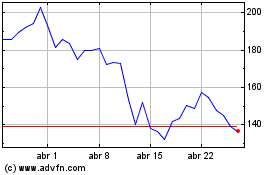

Solana is now trading around a critical support level after

experiencing a 15% decline from its local highs at $162.36. While

Solana has shown relative strength compared to other altcoins, the

recent price action has introduced heightened volatility and

potential risks for investors. Related Reading: Solana Price

(SOL) Slips: Will a Break Below $140 Trigger More Downside? Fear

and uncertainty currently dominate the market, with key data from

Coinglass revealing a bearish sentiment among traders. This

sentiment shift reflects the broader market concerns as Solana

approaches this crucial support level. The coming days will

be pivotal in determining whether Solana can stabilize or face

additional downside pressure. Notably, some top investors are

waiting for a decline to the $130 area, a shy 7% drop from current

prices, as a potential entry point. Given the current market

environment, traders and investors are closely monitoring Solana’s

performance at this level to gauge its next move. If Solana holds

its ground, it could indicate resilience and potential for

recovery; however, a failure to maintain this support could lead to

further declines. Solana’s Funding Rate Turns Negative Solana’s

recent decline has turned traders bearish, at least in the short

term. Crucial data from Coinglass reveals that the funding rate for

SOL has turned negative for the first time since August 23. A

negative funding rate indicates that short positions now outweigh

long positions, meaning traders are paying to maintain their short

bets against SOL. This shift in sentiment suggests that traders are

increasingly expecting further declines in Solana’s price. Adding

to the bearish sentiment, several traders and analysts are

anticipating a drop towards key support levels. Top trader

AlienOvich on X shared an analysis suggesting that Solana could

fall further, targeting the $135-$128 area. If Solana fails to hold

its current levels, this bearish scenario could materialize,

bringing Solana closer to AlienOvich’s predicted range. Such a

decline would not only validate the bearish sentiment currently

driving the market but also challenge Solana’s ability to maintain

its recent gains. Related Reading: Chainlink (LINK) Could Drop To

$8 If It Loses Current Support: On-Chain Data Reveals The next few

days will be crucial for Solana as it tests these lower levels.

Traders will be closely watching to see if Solana can find support

or if the negative sentiment will push the price down further. As

the market reacts to this pressure, Solana’s ability to recover and

potentially bounce back will be key to determining its short-term

trajectory. Solana Price Action Solana (SOL) is currently

trading at $139.87, significantly below its daily 200 moving

average (MA) of $152.28, and is now testing the daily 200

exponential moving average (EMA) after briefly dipping below it.

The primary distinction between these two indicators is that an EMA

is a weighted average, giving more importance to recent data

points, while an MA treats all data points equally. For SOL to hold

this critical support level, it needs to reclaim the EMA and

consolidate around the $140 mark. Failing to do so could lead to a

further decline toward the lows seen on August 5. This price

level is crucial for determining whether SOL can maintain its

current uptrend or if it will continue to face downward pressure.

Traders are closely watching this level, as losing it might

indicate a deeper correction is imminent. Cover image from Dall-E,

Charts from Tradingview

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024