Ethereum-Bitcoin Ratio Breaks 0.04 Barrier: Could Altcoins Be At Risk?

17 Setembro 2024 - 5:00AM

NEWSBTC

Today’s Ethereum-Bitcoin (ETH/BTC) trading pair slid below 0.04, a

level last seen in April 2021. The declining ETH/BTC ratio could

have multiple implications for the wider altcoin market. Altcoins

Might Suffer Due To Weak Ethereum One of the key indicators to

gauge the resiliency of the altcoin market is the ETH/BTC ratio.

The ratio essentially tracks the relative price strength of

Ethereum against Bitcoin and is widely considered a metric that

could indicate the future potential price action of altcoins. As of

September 16, 2024, the ETH/BTC ratio sits at 0.039, a level it

last touched 3 years ago in April 2021. In fact, after hitting a

high of 0.088 in December 2021, the ETH/BTC ratio has been on a

long-lasting decline, barring the occasional dead cat bounce,

before further eroding in value. Related Reading: Ethereum Price

Nosedives Over 5%, Pressure Mounts on Bulls Regarding altcoin price

action, a surging ETH/BTC ratio indicates that Ethereum is

performing well against Bitcoin. Conversely, a declining ratio

suggests that Bitcoin outperforms Ethereum and other altcoins,

which could trigger a shift in confidence away from Ethereum toward

Bitcoin. As a result, the wider crypto market might witness a

sell-off in altcoins as capital seeks more stable and

better-performing assets. Currently, Bitcoin dominance (BTC.D) sits

at 57.78%, and it can be observed that the metric has been on a

steady uptrend since November 2022. An increase in BTC.D further

solidifies a weakening altcoin market, hinting that liquidity is

exiting small-cap tokens, which might lead to volatile price action

and quick price drawdowns. It’s worth highlighting that the US

Securities and Exchange Commission’s (SEC) approval of Ethereum

exchange-traded-funds (ETFs) didn’t quite turn out to be as

significant an event for ETH price as it did for BTC. Data from

crypto ETF tracker SoSoValue shows that the cumulative net outflow

for US Ethereum ETFs is $581 million, while the net inflow for US

Bitcoin ETFs is $17.3 billion. Can Ethereum Price Change Its

Momentum? Ethereum is exchanging hands at $2,282, a price level it

last touched in January 2024. Notably, the second-largest

cryptocurrency by market cap briefly touched the $3,900 mark,

before losing all its gains. Most recently, it was reported

that 112,000 ETH was moved to crypto exchanges in one day,

suggesting that investors might not be too keen on holding ETH

while its price relative to Bitcoin weakens. Related Reading:

Ethereum (ETH) Triangle Formation Hints At A Double Bottom:

Breakout and New ATH? Some experts opine that now might be a good

time to convert BTC holdings to ETH as they see a potential 180%

surge in the battered ETH/BTC ratio. The continual selling pressure

on Ethereum has also moved ETH to oversold territory, giving hope

to ETH holders that the digital asset has likely bottomed and might

soon see a strong price recovery. Featured image from Unsplash,

Charts from Tradingview.com

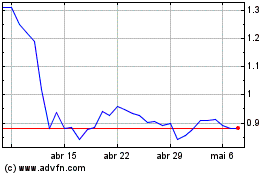

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024