Bitcoin ETF By BlackRock Registers First Daily Net Inflow In 3 Weeks: What To Know

17 Setembro 2024 - 8:00PM

NEWSBTC

BlackRock’s iShare Bitcoin Trust (IBIT) registered its first daily

net inflow in three weeks, leading to US spot Bitcoin

exchange-traded-funds (ETFs) witnessing a combined net inflow of

$12.8 million, data from Farside Investors confirms. BlackRock’s

Spot Bitcoin ETF Attracts Net Inflows, How About Other ETFs?

BlackRock forayed into the Bitcoin ETF space when the US Securities

and Exchange Commission (SEC) approved IBIT in January 2024. Dubbed

the world’s largest asset manager with a total

asset-under-management (AUM) of $9 trillion, BlackRock’s entry into

the nascent crypto ETF ecosystem was met with much enthusiasm by

investors as it not only brought a degree of sophistication but

also exhibited institutional approval toward the industry. Related

Reading: BlackRock Calls Bitcoin ‘Hedge Against Global Disorder’,

Analyst Sets $600,000 Target Yesterday, the asset manager’s

regulated financial product pulled $15.8 million in daily net

inflows, a first since August 26, 2024. The net inflow of funds

into IBIT was strong enough to push the wider US spot Bitcoin ETF

market into green territory, with a combined net inflow of $12.8

million. IBIT’s three weeks of no net daily inflows consisted of 11

days with zero flows, while two days – August 29, and September 9 –

saw net daily outflows to $13.5 million and $9.1 million,

respectively. Looking at the performance of other spot Bitcoin

ETFs, Grayscale’s GBTC product witnessed a net daily outflow of

$20.8 million. At the same time, Fidelity’s FBTC, Franklin

Templeton’s EZBC, and VanEck’s HODL experienced a net daily inflow

of $5.1 million, $5 million, and $4.9 million, respectively.

According to data from cryptocurrency ETF tracker SoSoValue,

BlackRock’s IBIT reigns supreme among US-based spot Bitcoin ETFs,

with an enviable cumulative net inflow of $20.9 billion since the

product’s inception early this year. FBTC follows this with $10.1

billion, Ark and 21Shares’ ARKB with $2.6 billion, and Bitwise’s

BITB with $2.2 billion. In contrast, GBTC has witnessed a

cumulative net outflow of $20 billion. Analysts blame the product’s

exorbitant fee of 1.5% as a major reason for GBTC’s performance to

date. For comparison, IBIT has a fee of 0.21%. Spot Ethereum ETFs

Continue Their Lackluster Performance While spot Bitcoin ETFs ended

the day with a combined net inflow of $12.8 million, spot Ethereum

ETFs experienced a combined net outflow of $9.4 million. Akin to

its Bitcoin ETF, Grayscale’s Ethereum ETF (ETHE) witnessed a net

daily outflow of $13.8 million, followed by Bitwise’s ETHW with a

$2.1 million net outflow. Only Grayscale’s mini Ethereum ETF (ETH)

successfully attracted net inflows worth $2.3 million. Related

Reading: Ether Liquidity Plummets 40% On Exchanges After ETF Debut

Since their approval in May 2024, Ethereum ETFs haven’t performed

as well as Bitcoin ETFs when attracting significant inflows. The

tepid performance of Ethereum ETFs is reflected in the digital

asset’s price as it continues to underperform against Bitcoin.

Ethereum trades at $2,307 at press time, slightly up by 0.6% in the

past 24 hours. Featured image from Unsplash, Chart from

Tradingview.com

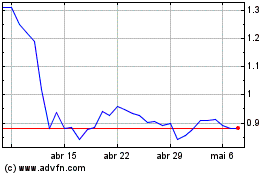

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024