Solana Bullish Pattern Signals Massive Gains Ahead – 2021 Rally Could Repeat

10 Outubro 2024 - 3:00PM

NEWSBTC

Solana (SOL) is currently trading at the lower end of a monthly

range that began in March, positioning the asset at a pivotal level

that will dictate its price action in the coming months. As the

broader crypto market faces uncertainty, analysts and investors

closely monitor whether this range represents an accumulation phase

that could precede a significant rally. Related Reading: XRP Will

Jump 75% If It Holds Current Demand Level – Details Top analyst and

investor Mister Crypto recently shared a technical analysis

comparing Solana’s current price structure to its 2021 performance,

highlighting similarities that suggest a potential bullish

breakout. His analysis reflects optimism amid market anxiety, with

many believing Solana may be on the verge of another strong upward

movement. While caution remains, investors await confirmation that

Solana’s recent range-bound trading is laying the foundation for a

sustained rally. The outcome in the next few weeks could

significantly impact Solana’s trajectory for the rest of the year.

Solana Price Action: Accumulation Or Bull Trap? Solana (SOL) has

been trading within a range of $210 to $110 since mid-March, and

while some investors are starting to believe this could be a bull

trap rather than accumulation, others remain cautiously

optimistic. A growing sentiment suggests that Solana’s

prolonged sideways movement may not lead to the much-anticipated

breakout but could lead to further declines. Despite these

concerns, prominent analyst Mister Crypto provides a more bullish

perspective. In his latest analysis, Mister Crypto compares the

current market sentiment around Solana to that of 2021, just before

the asset soared to new all-time highs. He highlights the

similarities in market fear and uncertainty that preceded Solana’s

previous explosive rally. According to him, such fear-driven

consolidation is often a signal of bullish patterns taking shape,

with the potential for substantial gains once the market recovers.

Mister Crypto refrains from setting a specific price target but

suggests that Solana’s next major move could surpass its all-time

high of $260. While the current mood remains cautious, his analysis

provides hope that Solana may be preparing for another significant

upward move, as historical patterns have shown similar price

behavior before major surges. Related Reading: Cardano (ADA)

Testing $0.34 Support – On-Chain Data Suggests Price Consolidation

The coming weeks will likely be decisive for Solana as traders and

investors wait to see if it will break out of its range or continue

to face downside pressure. SOL Key Levels To Watch Solana (SOL) is

currently trading at $138, following a 9% retrace from its daily

200 moving average (MA) at $152. This drop marks a significant loss

of momentum, as the price also fell below the daily 200 exponential

moving average (EMA) at $140—a crucial support level. Losing the

200 EMA raises concerns for further downside potential in the

coming weeks. For bulls to regain control, the price must reclaim

the 200 MA and EMA, and push above the critical resistance level at

$160. A surge above this threshold would indicate renewed bullish

momentum and the potential for Solana to rally higher. However, if

SOL fails to recover these key indicators, it could signal a deeper

correction. Related Reading: Dogecoin Analyst Expects A ‘Multi-Year

Bullish Breakout’ – 200% Surge Potential If the price continues to

decline, traders may see SOL head toward lower demand zones around

$110, a level that has acted as strong support in previous months.

Investors and analysts are watching closely to see if Solana can

hold its current levels or face more downside pressure in the near

future. The next few days will be pivotal for SOL’s price action

and overall market direction. Featured image from Dall-E, chart

from TradingView

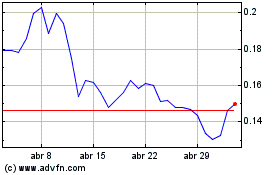

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024