Cardano Faces 30% Correction Risk After Drop In Large Holders’ Netflow – Details

12 Outubro 2024 - 10:00AM

NEWSBTC

Cardano (ADA) is currently trading near its yearly lows after

months of underwhelming price action. Since early August, the price

has struggled to hold above the crucial $0.36 level. This shift has

left ADA in a precarious position, with investors and traders

watching for signs of a potential recovery. Related Reading:

Dogecoin Could Break Yearly Highs ‘Any Moment Now’ – Crypto Analyst

Data from IntoTheBlock highlights a significant drop in whale

activity over the past month, raising concerns about further

downside pressure. The decrease in large transactions suggests that

major holders may be stepping back, adding to the likelihood of a

deeper correction for the altcoin. If ADA fails to break above the

$0.36 resistance in the coming days, a 30% retrace to lower demand

levels seems inevitable. Market participants are awaiting

confirmation of either a breakout or further declines as the

broader market remains uncertain. The next few days will be crucial

for determining Cardano’s short-term direction. Cardano Whales

Leaving Early? Cardano is at a crucial liquidity level, with

on-chain metrics indicating a potential for further decline,

especially given the significant decrease in whale activity. Recent

data from IntoTheBlock highlights a concerning trend: ADA whales,

or large investors, have increasingly sold their holdings over the

past month. This trend is evident in the 100% fall in ADA’s large

holders’ netflow, which refers to the balance between the amount of

the coin these addresses buy and the amount they sell. Large

holders are addresses with over 0.1% of Cardano’s circulating

supply. When the flow declines, these investors sell more coins

than they buy, signaling a potential loss of confidence in Cardano.

This lack of confidence often trickles down to retail investors,

leading them to sell their holdings. The drop in ADA’s whale

concentration over the past month confirms this selling activity,

raising concerns about ‘Smart Money’ potentially exiting the

Cardano ecosystem. If this trend continues, it could push ADA below

its current liquidity level, resulting in a deeper correction.

Related Reading: Solana Bullish Pattern Signals Massive Gains Ahead

– 2021 Rally Could Repeat Market participants are closely

monitoring these developments, as the exit of large holders could

signal a bearish sentiment that may lead to a significant price

decline. As Cardano navigates this critical phase, investors will

watch for signs of recovery or further weakness in the coming days.

Key Levels To Watch Cardano (ADA) is currently trading at

$0.35 after experiencing days of choppy price action below the

critical $0.36 resistance level. The price is 15% below the 1D 200

exponential moving average (EMA) at $0.40, a key area of resistance

that bulls must overcome to reverse the prevailing downtrend. This

crucial level was lost in April, and since then, ADA has failed to

close above it four times. If the price continues to struggle, a

deeper correction to fresh yearly lows at $0.25 could be in store.

Such a move would represent a significant 30% retracement from

current levels, further intensifying bearish sentiment in the

market. Investors are aware of these critical price points, as a

failure to reclaim the EMA and break through the $0.36 resistance

may lead to increased selling pressure. Related Reading: Can SUI

Fall To $1.40? On-Chain Data Exposes Declining Demand Traders will

look for signs of strength or weakness in ADA’s price action to

determine the likelihood of a potential breakout or a more profound

decline in the coming days. Featured image from Dall-E, chart from

TradingView

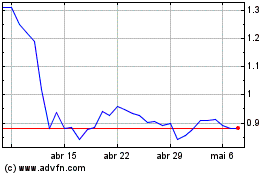

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024