Binance Coin Breaks $600! Is There More Upside Ahead For BNB?

07 Novembro 2024 - 8:00AM

NEWSBTC

In the past 24 hours, the price of Binance Coin (BNB) increased by

5%, which is indicative of a consistent upward motion. BNB, which

just broke the vaunted $600 barrier, is attracting the market’s

focus due to indications of bullish momentum. Related Reading:

Solana Rockets Past BNB To Claim Coveted 4th Spot In Crypto Ranks

However, the data at CoinCheckup suggests that BNB is trading about

20% below its expected price for the next month. This

undervaluation might thus be a sign of potential for near-term

profits if this trend does not change anytime soon. Binance Coin:

Mixed Sentiment & Cautious Optimism BNB’s technical figures

indicate a cautious optimism regarding market sentiment. The

Relative Strength Index (RSI) is consistently around 50, indicating

a balanced sentiment that is not subject to significant pressure

from either purchasers or sellers. This neutrality in itself says

that the market is not overheating and, by extension, BNB could

surge either way without a clear, outstanding trend. Another very

important indicator to monitor is the Chaikin Oscillator, and it’s

currently at -35K. Thus, there’s virtually no buying accumulation.

Meanwhile, in the absence of a change in market sentiment that may

attract more buyers into the fray, the lack of capital inflow might

be the thing that keeps BNB from further rallies. The trading

volume of BNB rises by 31% within 24 hours, therefore the market

activity and interest are rising. Investor interest is observable

via the figure for volume-to-market capitalization ratio, which is

at 2.46% currently, and based on this increase, but what is being

tested is whether interest supports the upward move of prices.

Short-Term Pressures And Trading Volatility The liquidation map of

BNB demonstrates concentration zones that may jeopardize price

stability in the immediate term. The potential for price volatility

exists if BNB surpasses $590; short positions are highly

concentrated at the $583 level. This can push these short

positions, and subsequently, act like a domino effect that might

push prices up higher. Long liquidations are triggered when the

price falls below $570. This means if the BNB price drops, sells

can be accelerated as the positions near their end. These levels

are the critical points a short-term trader should be watching.

Depending on the behavior of the market, the price fluctuations

around these levels can either have risks or present opportunities.

Related Reading: Grab Ethereum Now? Expert Says Next Stop Could Be

$10,000 After ‘Final Drop’ Long-Term Forecast With projections

indicating a potential rise of 60% over the next three months and a

subsequent increase of 30% over six months, BNB’s outlook remains

optimistic (although it is important to remain cautious).

Furthermore, the anticipated growth rate of 53% suggests that the

12-month forecast is robust, which is promising for investors. The

recent token burn activity of BNB—leading to the definite

elimination of 1.77 million tokens (which are estimated to be worth

about $1 billion)—has emerged as the main reason for this positive

sentiment. This supply reduction is crucial for price stability and

BNB growth for long-term investors. Each burn increases the value

of the remaining tokens, but the volatile market makes it uncertain

how these dynamics will play out. Featured image from DALL-E, chart

from TradingView

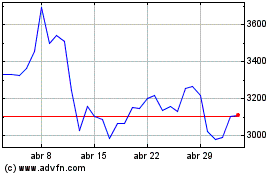

Ethereum (COIN:ETHUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Ethereum (COIN:ETHUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025