Bitcoin Miners Move 85,503 BTC, Price Unaffected – Here’s Why

07 Dezembro 2024 - 11:00PM

NEWSBTC

From attaining a six-figure market price to a sudden market crash,

Bitcoin has remained the major headliner in the crypto market over

the past week. Among these rapid developments on the largest

digital asset, blockchain analytics company Santiment has observed

a massive decline in mining balance. Related Reading: Bitcoin Sets

New ATH Above $104,000, Yet Investors Don’t Want To Sell Bitcoin

Miners Offload 85,503 BTC In 48 Hours On Friday, Santiment shared a

report on Bitcoin mining wallets activity in correlation to the

asset’s price. According to the analytics firm, there has been a

consistent decrease in the Bitcoin collective mining balances since

April 2024 indicating that miners have been gradually selling their

BTC or moving funds to another wallet. However, Santiment states

these mining wallets have now transferred out 85,503 BTC, valued at

$8.56 billion, over the last 48 hours, which represents the largest

drop in miner balances since late February prior to Bitcoin’s surge

to $73,000. Generally, increased outflows from miners could

indicate a bearish shift in price momentum. However, the team at

Santiment postulates the recent BTC offload should be considered a

net-neutral signal with no inking on Bitcoin’s price

movement. This notion is based on Bitcoin miner balances

showing a weak correlation with price for the majority of 2024.

Moreover, non-mining whales and sharks continue to accumulate

Bitcoin signaling confidence among investors in the asset’s

profitability despite miner activity. Interestingly, popular crypto

analyst Ali Martinez recently provided some update on this

accumulation trend stating that BTC whales have acquired 20,000

BTC, valued at $2 billion, over the past 24 hours.

Nevertheless, the constant decline in miner balances remains an

important concern for Bitcoin investors. Aside from an ability to

induce a bearish sentiment, miners transferring out BTC may draw

speculations over mining profitability, which is critical to

sustaining the Bitcoin network. Related Reading: As Bitcoin Trades

Above $100K—Analysts Reveal What Could Be Next Bitcoin Price

Overview At the time of writing, Bitcoin trades at $100,119

following a 3.67% price increase in the past 24 hours. On larger

time frames, Bitcoin is equally in profit as evidenced by gains of

2.92% and 32.60% in the last seven days and 30 days,

respectively. The largest digital asset is preparing to face

minor resistance at $102,000 following an earlier rejection. If the

market bulls are able to produce a breakout, Bitcoin maintains a

prolonged price rally that began in early October. Based on

previous bull cycles, the premier cryptocurrency is touted to gain

by an average of 38.86% in December, with the potential to trade as

high as $140,000 before 2024 runs out. Featured image from

Britannica, chart from Tradingview

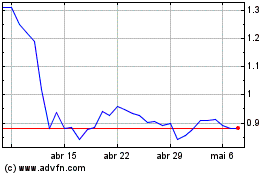

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024