Bitcoin Short-Term Holders Fueling Potential Dip – $90K Support Crucial Level To Hold

24 Dezembro 2024 - 10:00AM

NEWSBTC

Bitcoin experienced a highly volatile trading session yesterday,

with prices swinging between $92,300 and $96,420 throughout the

day. The cryptocurrency now hovers near the $93,000 mark,

struggling to establish a clear direction in the short term. As

market participants await decisive action, uncertainty looms over

whether Bitcoin will sustain its bullish structure or face a deeper

correction. Related Reading: If History Repeats Dogecoin Has

Potential For A Parabolic Rally – Details CryptoQuant analyst Axel

Adler recently shared valuable insights, highlighting a significant

trend among short-term holders (STH). According to Adler, these

investors continue to sell their coins at high-profit margins,

capitalizing on Bitcoin’s recent upward momentum. While

profit-taking is a natural part of market cycles, the lack of

consistent demand to absorb this selling pressure could challenge

Bitcoin’s price stability. If demand fails to match the pace of

active profit-taking, a local correction could occur, potentially

leading to a decline in Bitcoin’s price. This delicate balance

between profit-taking and market demand makes the coming days

critical for determining Bitcoin’s next move. Will buyers step in

to support the price, or will selling pressure lead to a deeper

retrace? Investors and analysts are watching closely as Bitcoin

navigates this pivotal moment. Bitcoin Demand Levels Responding

Bitcoin has faced days of intense volatility as it struggles to

break above the $100,000 psychological barrier while holding firm

above the $92,000 support. The market remains in a state of flux,

with investors and analysts closely monitoring Bitcoin’s next move.

Despite the uncertainty, Bitcoin’s resilience at these key levels

highlights the ongoing tug-of-war between bullish and bearish

forces. Top analyst Axel Adler recently shared an insightful

analysis on X, shedding light on the behavior of short-term holders

(STHs). According to Adler, STHs are actively selling their coins

at high profit margins, taking advantage of the recent price

surges. While profit-taking is a normal part of market cycles, a

lack of consistent demand to counter this selling pressure could

lead to a local correction and a potential price decline. However,

in the event of a price drop, STHs are unlikely to continue selling

their holdings, as selling at a loss in a bull market is often

considered an unwise move. This dynamic could provide Bitcoin with

the breathing room needed to stabilize at its key support levels,

currently around the $90,000 mark. Related Reading: Solana Holds

Weekly Support At $180 – Analyst Expects $330 Mid-Term If Bitcoin

successfully holds above $90,000, a period of consolidation around

this level could create the foundation for the next rally,

potentially propelling BTC to new all-time highs. The coming days

will be critical in determining whether Bitcoin continues its

ascent or faces a temporary setback. BTC Holding Above $90K Bitcoin

is trading at $93,800 after enduring days of selling pressure and

market uncertainty. Despite holding above key support at $92,000,

the loss of both the 4-hour 200 moving average (MA) and exponential

moving average (EMA) is a short-term bearish signal. These

indicators, often viewed as gauges of market momentum, suggest that

Bitcoin may need additional demand to regain upward traction. For

bulls to reclaim control and ignite a fresh rally, Bitcoin must

recover these critical levels. The 4-hour 200 MA at $96,500 and the

4-hour 200 EMA at $98,500 are essential hurdles. Successfully

pushing above these thresholds and securing a decisive close beyond

them would confirm renewed bullish momentum. Related Reading:

Ethereum Whales Bought $1 Billion ETH In The Past 96 Hours –

Details If Bitcoin achieves this feat, the stage could be set for a

massive rally into price discovery, breaking through psychological

barriers like $100,000 and paving the way for new all-time highs.

On the flip side, failing to reclaim these indicators might signal

extended consolidation or a potential retest of lower support

levels. Featured image from Dall-E, chart from TradingView

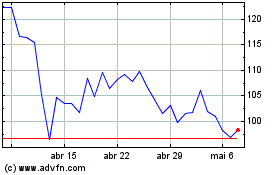

Quant (COIN:QNTUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Quant (COIN:QNTUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024