Are Meme Coins Hurting Solana? Rising Selling Pressure Sparks Investor Concerns

17 Fevereiro 2025 - 4:30PM

NEWSBTC

Solana has faced increasing selling pressure and negative sentiment

as the broader meme coin market continues to decline, impacting

overall market performance. Analysts suggest that excessive

speculation on meme coins is a key reason why altcoins, including

Solana, are underperforming compared to Bitcoin. The hype-driven

nature of these tokens has led to extreme volatility, making

investors more cautious about altcoin exposure. Related Reading:

Ethereum Historical Indicator Flashes Long-Term Buy Signal – Is

History Repeating? Meme coins are now seen as a risk factor for

Solana’s ecosystem. A recent rug pull involving LIBRA, a meme coin

endorsed by Argentina’s President Javier Milei, has intensified

concerns among investors. This incident has shaken confidence in

the network, as it highlights the dangers of speculative trading

and potential scams within the Solana ecosystem. As a result, SOL

has dropped 10% over the past week and remains down 40% from its

January peak, signaling a clear trend of declining momentum.

Additionally, trading volumes on decentralized exchanges (DEXs)

have decreased significantly, reflecting growing investor

hesitancy. Solana and the market face a critical moment, with

analysts closely watching whether the network can recover from the

damage caused by meme coin speculation or if further downside is

expected. Solana Enters A CRucial Phase The meme coin euphoria that

fueled Solana’s price surge for months is now unraveling, exposing

the network to increased volatility and uncertainty. While Solana

benefited from the speculative boom of meme coins, it was only a

matter of time before the highly speculative market faced reality

and started creating problems. Crypto analyst Axel Adler shared an

analysis on X, warning that meme coins are actively hurting

Solana’s long-term sustainability. The most recent example is the

LIBRA rug pull, a meme coin that gained traction due to its

association with Argentina’s President Javier Milei, only to

collapse, leaving investors in losses. This event has heightened

investor concerns and accelerated selling pressure on Solana, which

has dropped 10% over the past week and 40% from its January peak.

Beyond price action, Solana’s decentralized exchange (DEX) trading

volumes have also taken a hit, dropping 25% in the last week, while

the Raydium DEX alone saw a 47% decrease. This decline signals

weakening investor confidence in Solana’s DeFi and trading

ecosystem. Adding to the concerns, on March 1, 11.2 million SOL

will be unlocked—these tokens, initially sold off during FTX’s

bankruptcy, were later acquired by major firms like Galaxy,

Pantera, and Figure. This large token unlock could further pressure

the price if these firms decide to offload their holdings. Related

Reading: Dogecoin Pulls Back To ‘The Golden Ratio’ – Analyst

Expects A Bullish Reversal With meme coin speculation cooling off,

Solana now faces a crucial test: can it regain investor trust and

stabilize, or will further downside follow as selling pressure

intensifies? The coming weeks will be critical in determining the

network’s ability to recover from this downturn. SOL Holding

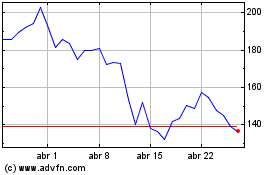

Crucial Demand Solana (SOL) is trading at $184 after losing the

200-day exponential moving average (EMA) around $190, signaling

increased selling pressure. The price is now testing the 200-day

simple moving average (SMA), a crucial long-term support level that

bulls must defend to prevent further downside. If bulls fail to

hold the 200-day SMA, a massive correction could follow,

potentially pushing SOL into lower demand zones around $175 or even

$160. The sentiment around SOL remains fragile as meme coin

speculation continues to fade, dragging Solana’s ecosystem with it.

For bullish momentum to return, SOL must reclaim the $190 level and

push above the psychological $200 mark as soon as possible. A break

and hold above $200 would confirm a short-term reversal, helping

SOL regain strength and potentially target higher supply levels

around $220–$230. Related Reading: Bitcoin Forms Rounding Bottom –

Expert Sees Push To $100K Next Week However, failure to bounce from

current levels would indicate further downside risks, with more

liquidations and selling pressure likely to follow. Given the

negative sentiment surrounding meme coins and upcoming token

unlocks, SOL is at a critical inflection point, where its next move

will determine short-term market direction. Featured image from

Dall-E, chart from TradingView

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025