Compass Group PLC Proposed acquisition of CH&CO

22 Janeiro 2024 - 4:30AM

RNS Non-Regulatory

TIDMCPG

Compass Group PLC

22 January 2024

Legal Entity Identifier (LEI) No. 2138008M6MH9OZ6U2T68

Compass Group PLC announces proposed acquisition of

CH&CO

22 January 2024: Compass Group PLC (LSE: CPG), a leading global

food service company, has today signed an agreement to acquire

CH&CO, a provider of premium contract and hospitality services

in the UK and Ireland for an initial enterprise value of

GBP475m/$600m(1) .

CH&CO has a highly regarded management team and a long track

record of strong performance delivering a bespoke and high-quality

food offer through several sector brands . The company currently

generates annual revenues of c. GBP450m/$570m(1) and operates

across a range of sectors, including Business & Industry,

Sports & Leisure, Education, and Healthcare. CH&CO has a

diverse client base and broad geographic spread which would

complement Compass Group's existing footprint in the UK and

Ireland.

Dominic Blakemore, Group CEO of Compass Group PLC, said :

"CH&CO is a highly regarded food service business in our

industry. This proposed acquisition combines the best of the two

companies: our shared passion for people, great food, and focus on

sustainability. With CH&CO's strong brand identity and a broad

geographic reach, we would be able to further enhance our customer

proposition, helping us capitalise on the significant growth

potential in the market."

"The proposed acquisition is in line with our longstanding

strategy to create value through disciplined capital allocation.

Our strong cash generation and balance sheet give us the

flexibility to invest in organic growth and to acquire high quality

businesses with exceptional management teams, enabling us to

further accelerate growth and enhance shareholder returns."

Bill Toner, CEO of CH&CO, added :

"We're delighted that Compass wants to acquire CH&CO. The

prospect of joining a leading global provider of food services

offers huge potential for us and our clients. Creativity and

innovation are skills that we share with Compass and food is at the

heart of everything we do."

"Both businesses have strong and complementary brands, and

subject to regulatory approval, there is a great opportunity for us

to learn from each other and to build an even more exciting future

together."

Transaction details

Initial enterprise value is GBP475m/$600m(1) with an additional

earn out over the two years following closing, dependent on the

profit growth of the business. Completion of the proposed

transaction is subject to regulatory approval.

Enquiries

Agatha Donnelly, Helen Javanshiri, Simon

Investors Bielecki +44 1932 573 000

Press Giles Robinson (Compass) +44 1932 963 486

Tim Danaher (Brunswick) +44 207 404 5959

Website www.compass-group.com

Notes: (1) Based on exchange rate of $1.27 as of 19(th) January

2024

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRADBGDBLDDDGSB

(END) Dow Jones Newswires

January 22, 2024 02:30 ET (07:30 GMT)

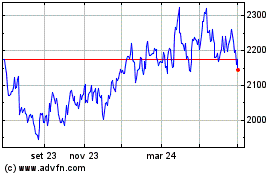

Compass (LSE:CPG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

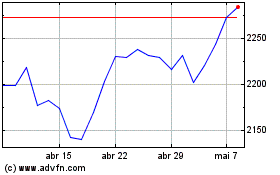

Compass (LSE:CPG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024