U.S. Dollar Rises As Traders' Bet On Fed Rate Hike

14 Março 2017 - 12:58AM

RTTF2

The U.S. dollar strengthened against other major currencies in

the early European session on Tuesday, as traders bet that the

Federal Reserve is likely to raise its interest rate in the policy

meeting, due later in the day.

The Federal Open Market Committee will hold a two-day monetary

policy meeting, which starts on Tuesday. The economists expect the

federal funds rate to raise its rate by 0.25 percent from 0.75

percent to 1.00 percent.

Meanwhile, Friday's robust U.S. jobs report also triggered the

investors to expect a rate hike by a quarter percentage point.

In the Asian trading, the U.S. dollar held steady against its

major rivals.

In the early European trading, the U.S. dollar rose to nearly a

2-month high of 1.2124 against the pound, from an early low of

1.2222. The greenback may test resistance near the 1.20 region.

Against the euro and the yen, the greenback advanced to 4-day

highs of 1.0637 and 115.11 from early lows of 1.0662 and 114.76,

respectively. If the greenback extends its uptrend, it is likely to

find resistance around 1.05 against the euro and 117.00 against the

yen.

The greenback edged up to 1.0096 against the Swiss franc, from

an early low of 1.0070. On the upside, 1.01 is seen as the next

resistance level for the greenback.

Looking ahead, Eurozone industrial production for January and

German ZEW survey's economic sentiment index for March are due to

be released later in the day.

In the New York session, U.S. NFIB small business index and U.S.

PPI, both for February, are slated for release.

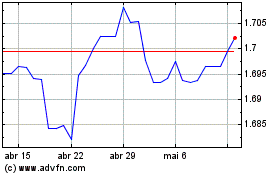

Sterling vs SGD (FX:GBPSGD)

Gráfico Histórico de Câmbio

De Jan 2025 até Fev 2025

Sterling vs SGD (FX:GBPSGD)

Gráfico Histórico de Câmbio

De Fev 2024 até Fev 2025

Notícias em tempo-real sobre Pound Sterling vs Singapore Dollar da Forex bolsa de valores: 0 artigos recentes

Mais Notícias de Pound Sterling (B) VS Singapore Dollar Spot (GBP/Sgd)